Is Atos (ENXTPA:ATO) Using Sports-Tech Partnerships To Quietly Rewrite Its Digital Strategy?

Reviewed by Sasha Jovanovic

- Earlier this month, CONMEBOL announced Atos as its first Official Innovation Partner for major South American club competitions, tasking the company with building new digital platforms to deepen fan engagement, while Atos also unveiled a joint research program to strengthen AI security and expanded its sports-technology push in Saudi Arabia.

- Together, these moves highlight how Atos is leaning on sports technology and secure AI capabilities to reposition its business mix toward higher-value digital services.

- We’ll now examine how Atos’s new CONMEBOL innovation role and broader sports-tech push could influence its existing investment narrative.

Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Atos Investment Narrative Recap

To own Atos today, you need to believe its turnaround can offset pressure on legacy IT services and a stretched balance sheet. The CONMEBOL innovation deal and broader sports-tech wins modestly support the near term revenue stabilization catalyst, but do not directly address the biggest risk around high debt and negative equity, which still hinges on execution of the Genesis restructuring and consistent cash generation.

The most relevant recent announcement is Atos’s launch of its Agentic AI solution on the Polaris AI Platform with Azure, which reinforces its push into higher value, AI driven services. Together with the CONMEBOL role, this helps frame a clearer catalyst: shifting the mix toward digital and AI offerings that could matter more if they scale meaningfully against the drag from traditional outsourcing and restructuring costs.

Yet beneath these promising AI and sports-tech headlines, investors still need to be aware of the strain from high debt and...

Read the full narrative on Atos (it's free!)

Atos’ narrative projects €8.5 billion revenue and €527.4 million earnings by 2028.

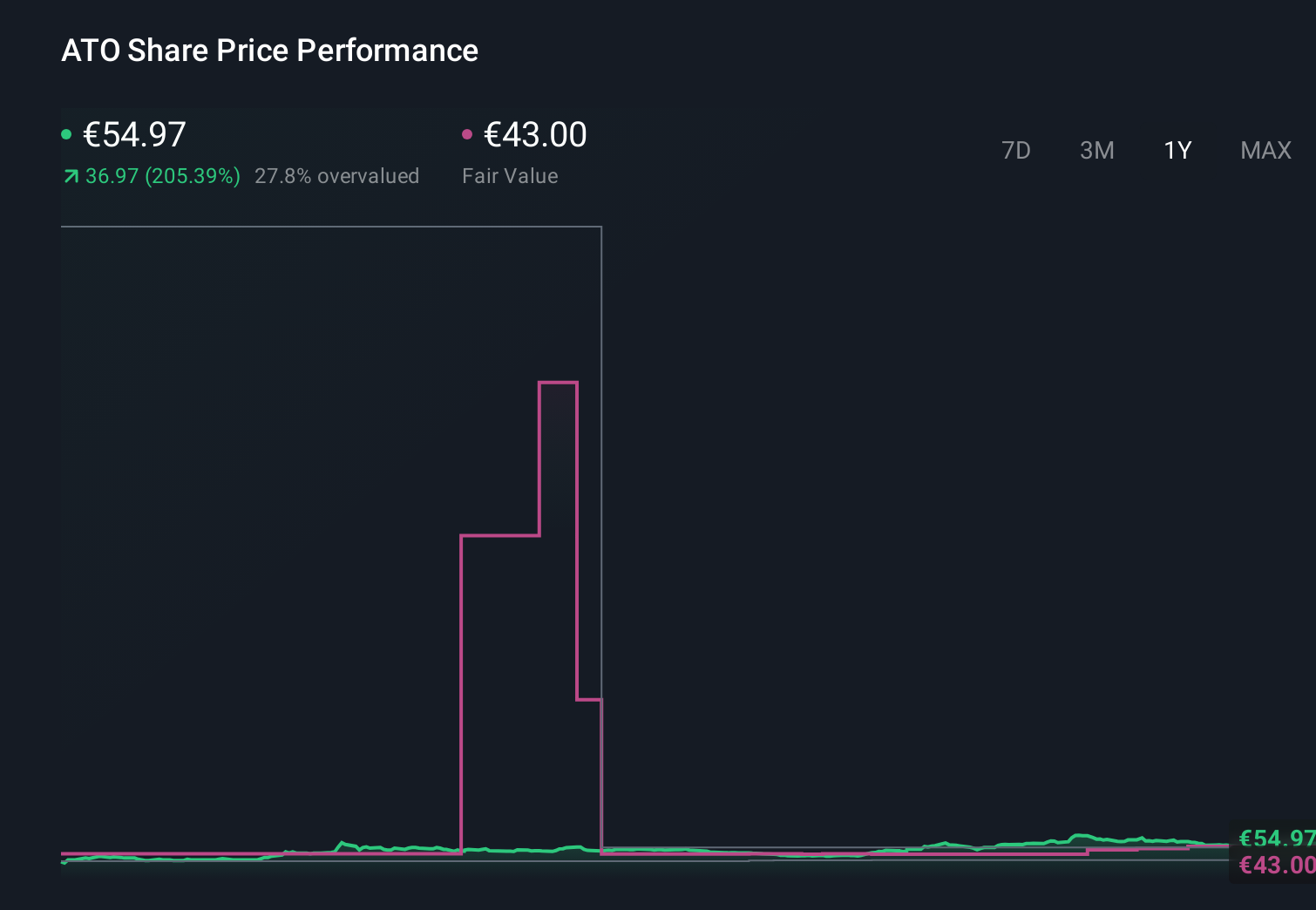

Uncover how Atos' forecasts yield a €43.00 fair value, a 11% downside to its current price.

Exploring Other Perspectives

Twenty one Simply Wall St Community fair value estimates span roughly €0.04 to about €253 per share, reflecting very different expectations. Against this wide range, the central concern remains Atos’s high debt and negative equity position, which could weigh on any benefits from its new sports and AI contracts over time.

Explore 21 other fair value estimates on Atos - why the stock might be worth less than half the current price!

Build Your Own Atos Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Atos research is our analysis highlighting 3 key rewards and 6 important warning signs that could impact your investment decision.

- Our free Atos research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Atos' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ATO

Atos

Provides digital transformation solutions and services in France and internationally.

Medium-low risk and undervalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026