Undiscovered Gems And 2 Other Promising Small Caps With Strong Potential

Reviewed by Simply Wall St

In a week marked by volatility and mixed performances across major indices, the U.S. markets saw fluctuations driven by AI competition fears and ongoing tariff discussions, while European stocks benefited from strong earnings and an ECB rate cut. Amid these broader market dynamics, small-cap stocks often present unique opportunities for investors seeking growth potential in less conspicuous corners of the market. Identifying promising small-cap companies involves looking for those with robust fundamentals that can thrive despite economic uncertainties or competitive pressures.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| All E Technologies | NA | 18.60% | 31.35% | ★★★★★★ |

| Hermes Transportes Blindados | 50.88% | 4.57% | 3.33% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| La Positiva Seguros y Reaseguros | 0.04% | 8.78% | 27.31% | ★★★★☆☆ |

| Sociedad Eléctrica del Sur Oeste | 42.67% | 8.52% | 4.10% | ★★★★☆☆ |

| Practic | NA | 3.63% | 6.85% | ★★★★☆☆ |

| Jiangsu Aisen Semiconductor MaterialLtd | 12.19% | 14.60% | 12.10% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

74Software (ENXTPA:74SW)

Simply Wall St Value Rating: ★★★★★☆

Overview: 74Software operates as an infrastructure software publisher across France, the rest of Europe, the Americas, and the Asia Pacific with a market capitalization of €791.13 million.

Operations: The company's revenue streams are primarily driven by subscriptions (€201.19 million) and maintenance services (€77.04 million), with additional contributions from licenses and non-subscription services.

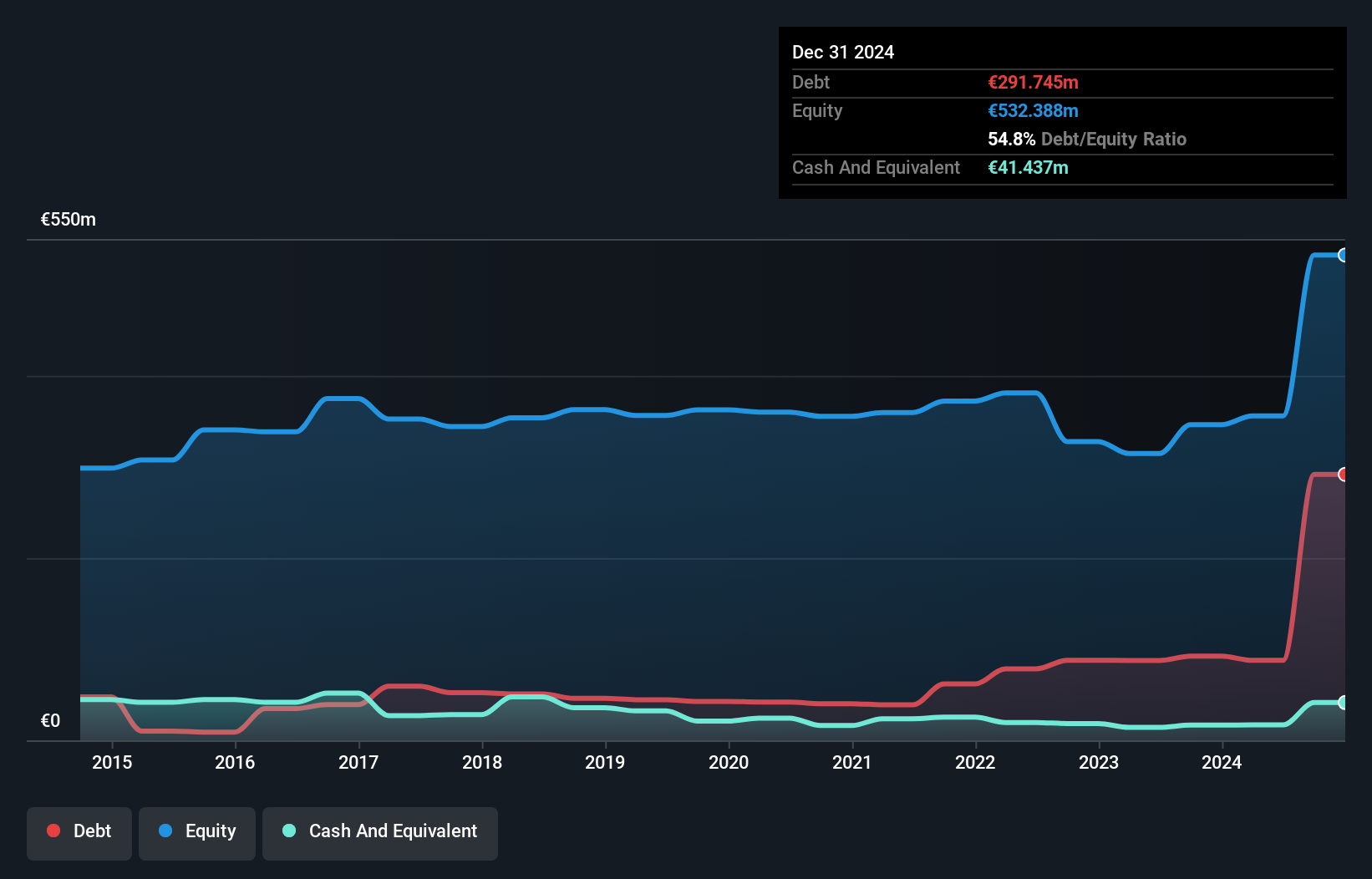

74Software, recently rebranded from Axway Software SA, stands out with its strong financial footing and attractive valuation. Trading at 48.4% below its estimated fair value, it offers potential upside for investors. The company's net debt to equity ratio sits comfortably at 19.9%, indicating a satisfactory debt level within industry norms. Despite past shareholder dilution, 74Software's interest payments are well covered by EBIT (10.1x), showcasing robust earnings quality and profitability achieved this year. Looking ahead, earnings are forecasted to grow annually by about 20%, suggesting promising growth prospects in the software sector.

- Click here and access our complete health analysis report to understand the dynamics of 74Software.

Gain insights into 74Software's past trends and performance with our Past report.

Çelebi Hava Servisi (IBSE:CLEBI)

Simply Wall St Value Rating: ★★★★★★

Overview: Çelebi Hava Servisi A.S. offers ground handling, cargo, and warehouse services to both domestic and international airlines as well as private air cargo companies, primarily operating in Turkey with a market capitalization of TRY46.73 billion.

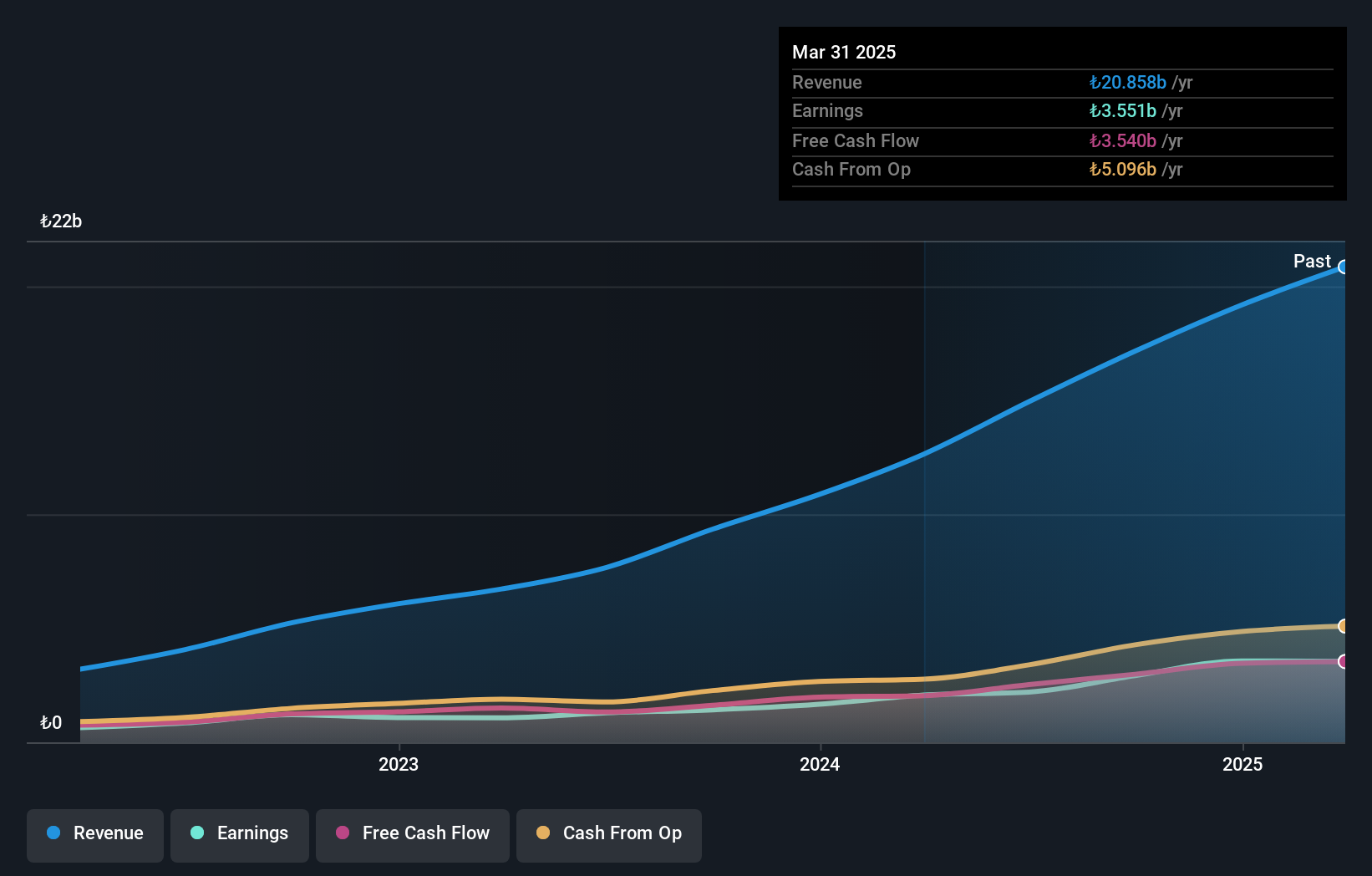

Operations: Çelebi Hava Servisi A.S. generates revenue primarily from airport ground services, including ground handling, which accounts for TRY11.33 billion, and cargo and warehouse services contributing TRY5.90 billion. The company's financial data indicates a focus on these segments as key revenue drivers without detailing specific cost breakdowns or profit margins in the provided text.

Çelebi Hava Servisi has demonstrated impressive financial performance recently. The company's earnings have surged by 105% over the past year, significantly outpacing the infrastructure industry's growth rate of 6.7%. Its debt-to-equity ratio has improved dramatically, dropping from 157.6% to 46.4% over five years, indicating better financial health and stability. For the third quarter of 2024, sales reached TRY 5,806 million compared to TRY 3,590 million a year prior; net income was TRY 1,395 million versus TRY 673 million previously. With high-quality earnings and positive free cash flow, Çelebi seems well-positioned in its sector.

Intermestic (TSE:262A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Intermestic Inc. operates as a retailer of eyeglasses and sunglasses through physical stores and online platforms in Japan, with a market cap of ¥54.60 billion.

Operations: Intermestic generates revenue primarily from its domestic business, contributing ¥38.17 billion, while the overseas segment adds ¥2.09 billion.

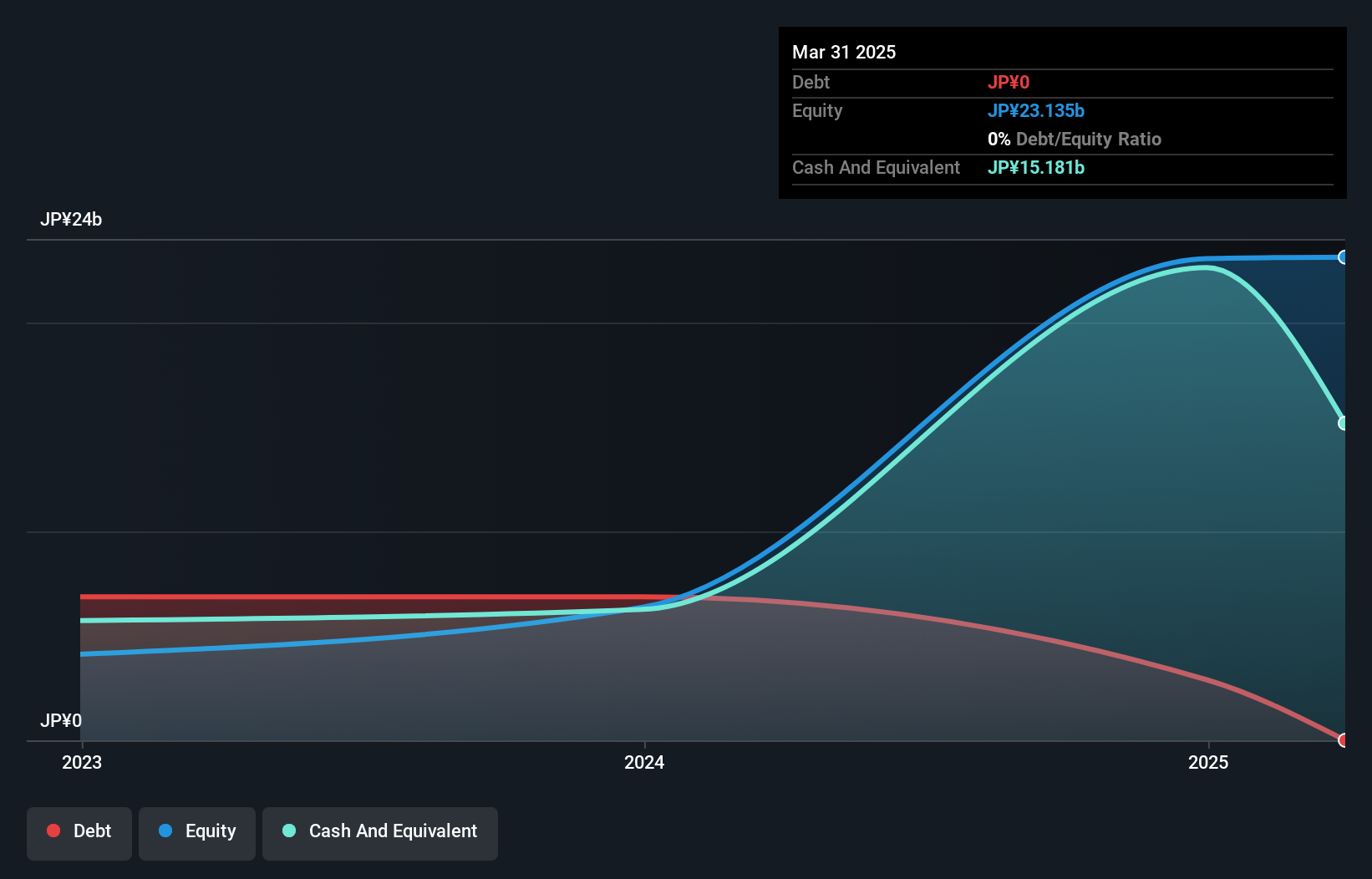

Intermestic's recent performance highlights its potential as a promising investment. Earnings surged by 102% over the past year, significantly outpacing the Specialty Retail industry’s 6.6% growth rate. The company maintains a satisfactory net debt to equity ratio of 9.5%, indicating robust financial health, while its interest payments are well covered with EBIT providing 113x coverage. Despite share price volatility in recent months, Intermestic is trading at over half below estimated fair value, suggesting potential upside. For fiscal year-end December 2024, projected net sales stand at JPY 43 billion and operating profit at JPY 4 billion with dividends expected at JPY 27 per share.

- Click to explore a detailed breakdown of our findings in Intermestic's health report.

Assess Intermestic's past performance with our detailed historical performance reports.

Taking Advantage

- Take a closer look at our Undiscovered Gems With Strong Fundamentals list of 4682 companies by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:74SW

Excellent balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)