- France

- /

- Specialty Stores

- /

- ENXTPA:FNAC

Fnac Darty's (EPA:FNAC three-year decrease in earnings delivers investors with a 17% loss

For many investors, the main point of stock picking is to generate higher returns than the overall market. But the risk of stock picking is that you will likely buy under-performing companies. Unfortunately, that's been the case for longer term Fnac Darty SA (EPA:FNAC) shareholders, since the share price is down 24% in the last three years, falling well short of the market return of around 25%. The last week also saw the share price slip down another 13%. This could be related to the recent financial results - you can catch up on the most recent data by reading our company report.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

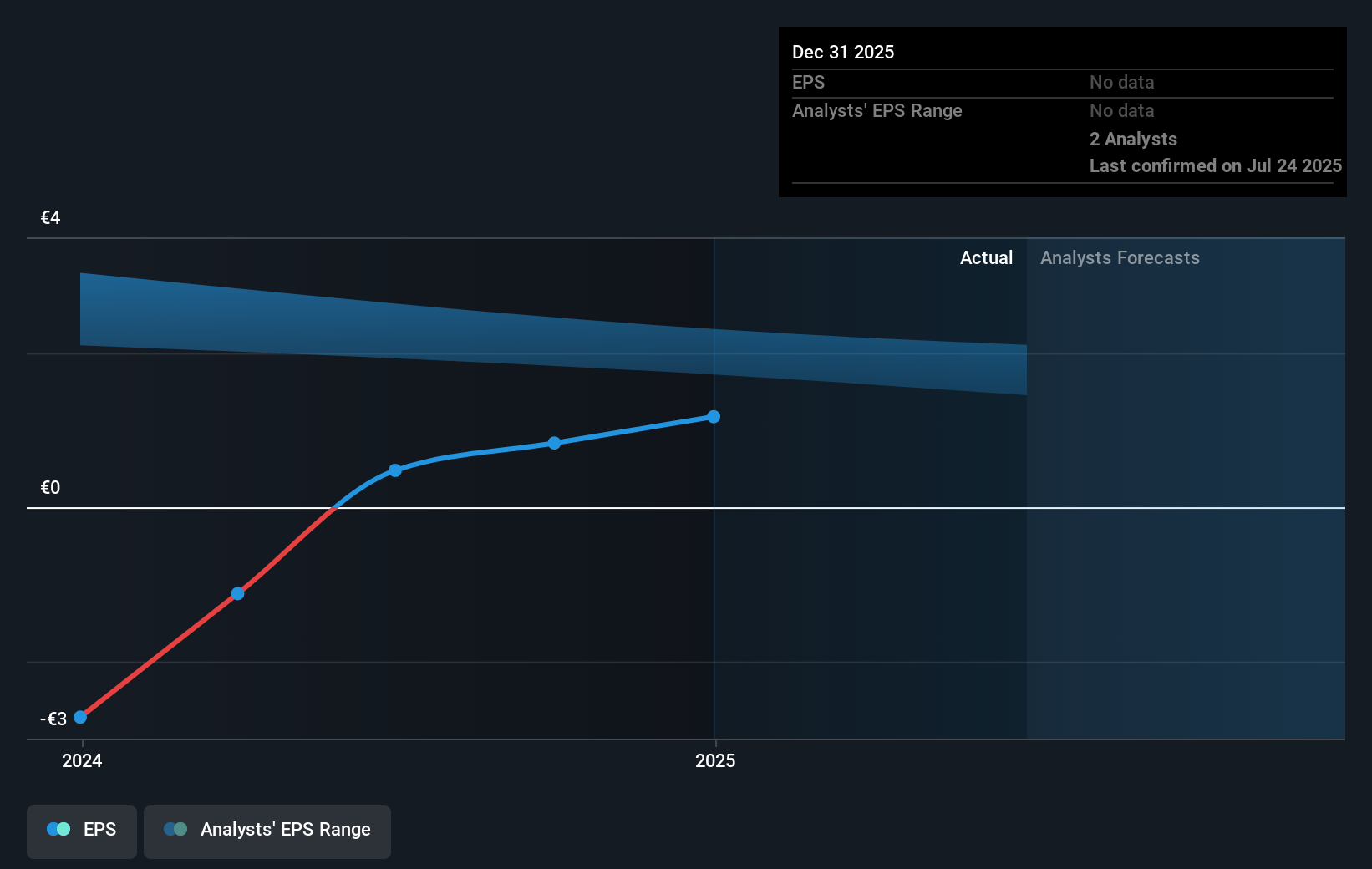

During the three years that the share price fell, Fnac Darty's earnings per share (EPS) dropped by 45% each year. In comparison the 9% compound annual share price decline isn't as bad as the EPS drop-off. This suggests that the market retains some optimism around long term earnings stability, despite past EPS declines.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It might be well worthwhile taking a look at our free report on Fnac Darty's earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Fnac Darty the TSR over the last 3 years was -17%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

Fnac Darty shareholders are up 1.5% for the year (even including dividends). Unfortunately this falls short of the market return. On the bright side, that's still a gain, and it's actually better than the average return of 0.6% over half a decade It is possible that returns will improve along with the business fundamentals. It's always interesting to track share price performance over the longer term. But to understand Fnac Darty better, we need to consider many other factors. For example, we've discovered 3 warning signs for Fnac Darty (1 is significant!) that you should be aware of before investing here.

For those who like to find winning investments this free list of undervalued companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FNAC

Fnac Darty

Engages in the retail of entertainment and leisure products, consumer electronics, and domestic appliances in France, Switzerland, Belgium, Luxembourg, and the Iberian Peninsula.

Moderate growth potential with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

The Future of Social Sharing Is Private and People Are Ready

EU#3 - From Philips Management Buyout to Europe’s Biggest Company

Booking Holdings: Why Ground-Level Travel Trends Still Favor the Platform Giants

A fully integrated LNG business seems to be ignored by the market.

Recently Updated Narratives

Sunny Returns with On the Beach

High Quality Business and a true compounding machine

Roche Holding AG To Benefit From Strong Drug Pipeline In 2027 And Beyond

Popular Narratives

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

AMZN: Acceleration In Cloud And AI Will Drive Margin Expansion Ahead

Trending Discussion