- France

- /

- Retail REITs

- /

- ENXTPA:CARM

The Bull Case For Carmila (ENXTPA:CARM) Could Change Following Its €300M Oversubscribed Green Bond Issue

Reviewed by Sasha Jovanovic

- Carmila recently completed a highly oversubscribed €300 million green bond issue maturing in January 2033 with a 3.75% annual coupon, alongside a tender offer for four existing bonds as part of its balance sheet optimization strategy.

- This move attracted significant demand from both French and international investors, underlining market confidence in Carmila's sustainability initiatives and proactive debt management approach.

- We'll explore how Carmila's refinancing and focus on green finance could reinforce its investment thesis and financial flexibility.

We've found 18 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Carmila Investment Narrative Recap

Carmila's investment case centers on the long-term resilience of prime retail centers in France, Spain, and Italy, supported by adaptability to new retail trends. The recent €300 million green bond issue has no material impact on the immediate catalyst of sustained leasing momentum but may help alleviate refinancing risk, which remains the principal concern given Carmila's current leverage and regional focus.

Among recent news, Carmila’s tender offer on €1.775 billion of existing notes stands out. This action, pairing with the green bond issue, targets extension and optimization of the debt profile, an important step for resolving short-term balance sheet pressure as leasing and occupancy trends evolve.

In contrast, it’s essential for investors to keep a close watch on refinancing risk given that...

Read the full narrative on Carmila (it's free!)

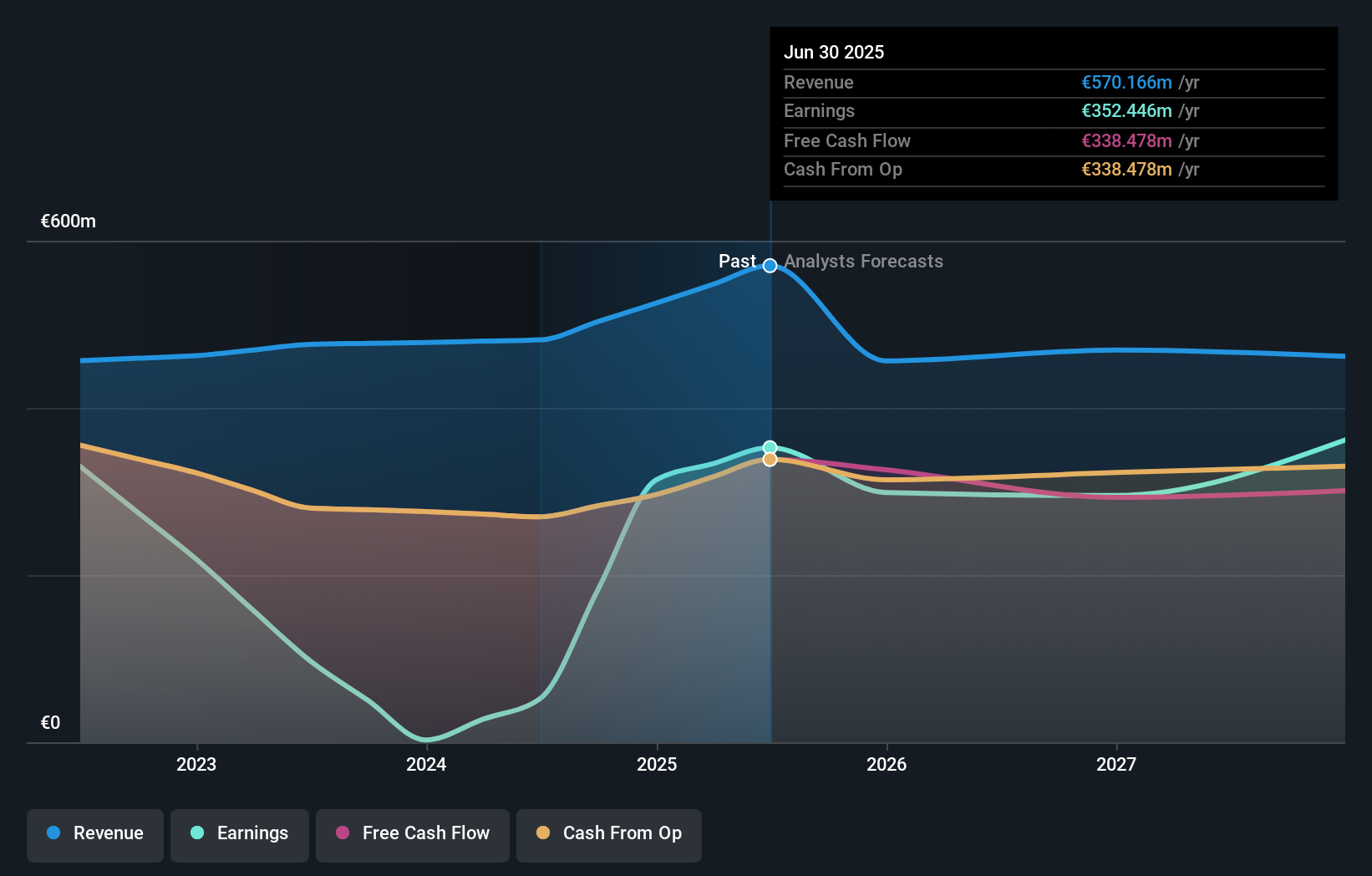

Carmila's narrative projects €431.7 million in revenue and €332.5 million in earnings by 2028. This requires an annual revenue decline of 8.9% and an earnings decrease of €19.9 million from current earnings of €352.4 million.

Uncover how Carmila's forecasts yield a €20.70 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Two members of the Simply Wall St Community estimate Carmila’s fair value between €20.70 and €27.93 per share. Community outlooks vary, while refinancing risk remains prominent and could influence financial flexibility and future growth. Consider several viewpoints to broaden your understanding.

Explore 2 other fair value estimates on Carmila - why the stock might be worth just €20.70!

Build Your Own Carmila Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Carmila research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Carmila research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Carmila's overall financial health at a glance.

Curious About Other Options?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CARM

Carmila

As the third-largest listed owner of commercial property in Europe, Carmila was founded by Carrefour and large institutional investors in order to enhance the value of shopping centres adjoining Carrefour hypermarkets in France, Spain and Italy.

Very undervalued with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives