- France

- /

- Entertainment

- /

- ENXTPA:BLV

Exploring High Growth Tech Stocks In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets have shown mixed signals with the S&P 500 and Nasdaq Composite marking significant gains over the past two years, despite recent economic challenges such as a decline in the Chicago PMI and a downward revision of GDP forecasts by the Atlanta Fed. In this environment, identifying high-growth tech stocks requires careful consideration of factors like innovation potential, market adaptability, and resilience to economic fluctuations.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Shanghai Baosight SoftwareLtd | 21.82% | 25.22% | ★★★★★★ |

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.18% | 27.00% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1253 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Believe (ENXTPA:BLV)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Believe S.A. is a company that offers digital music services to independent labels and local artists across various regions including France, Germany, the rest of Europe, the Americas, Asia, Oceania, and the Pacific with a market cap of approximately €1.42 billion.

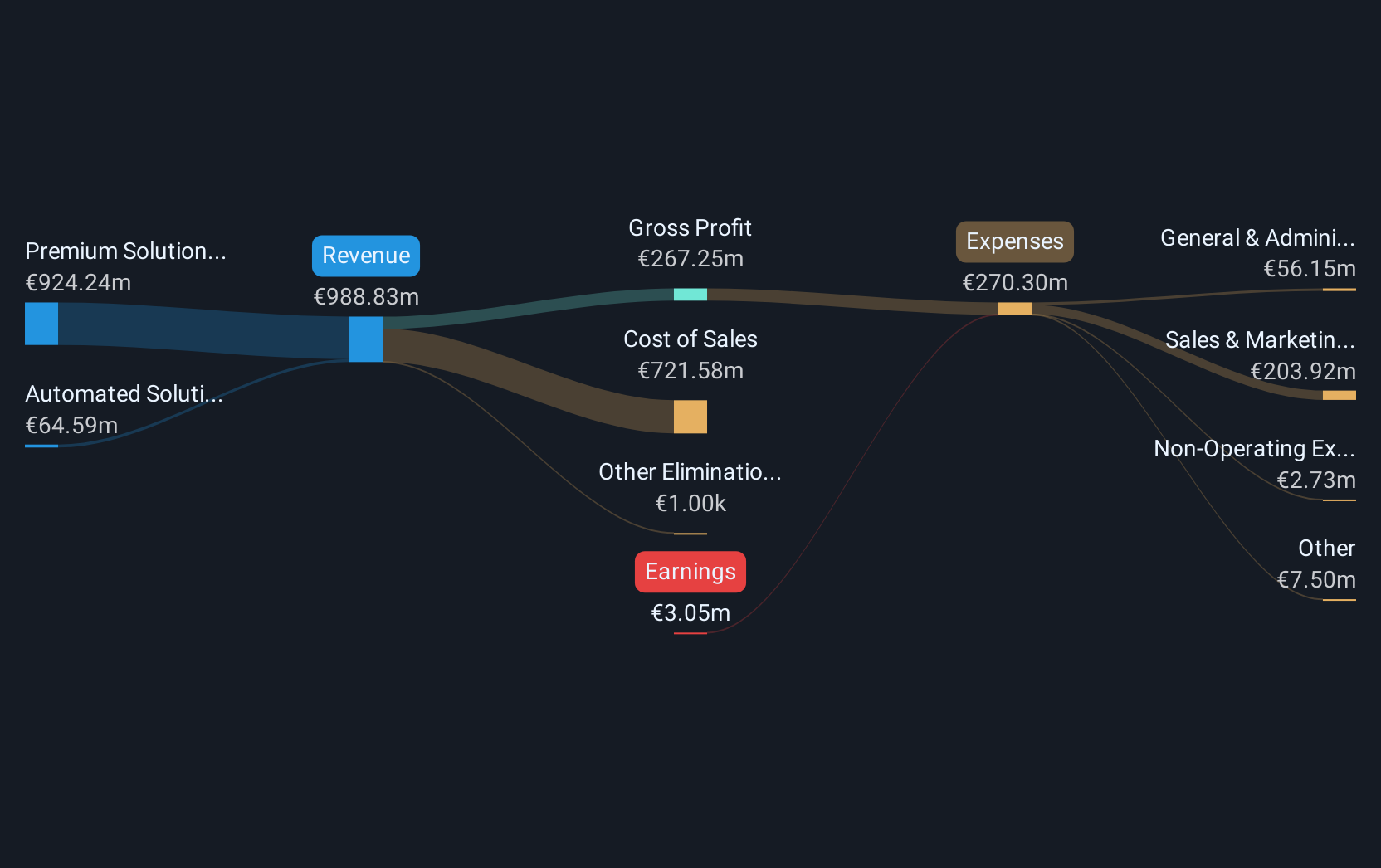

Operations: The company generates revenue primarily through Premium Solutions (€877.53 million) and Automated Solutions (€61.50 million). The focus is on delivering digital music services tailored for independent labels and local artists across multiple regions.

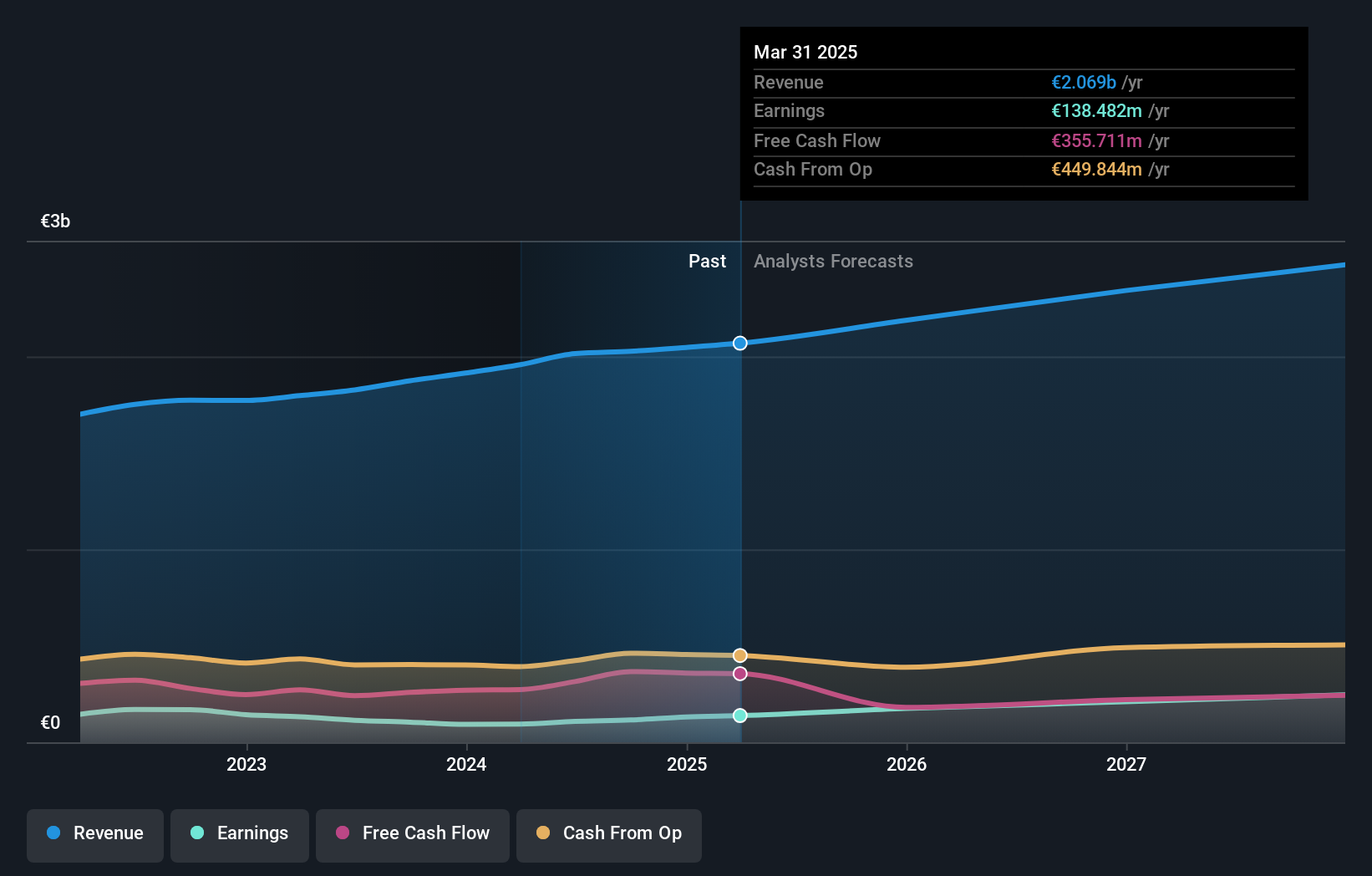

Believe, navigating through a challenging tech landscape, demonstrates a promising trajectory with its revenue set to grow by 12.9% annually, outpacing the French market's 5.4%. Despite current unprofitability, Believe is not just staying afloat but is poised for significant earnings expansion at an anticipated rate of 56.72% per year. This growth is underpinned by strategic R&D investments aimed at refining its entertainment technology offerings—a sector where innovation directly translates to competitive advantage and market share gains. While shareholder dilution has occurred over the past year, the focus on becoming profitable within three years highlights a forward-looking approach that could reshape its financial contours and bolster investor confidence in its operational strategy.

- Click here and access our complete health analysis report to understand the dynamics of Believe.

Explore historical data to track Believe's performance over time in our Past section.

Hunan Kylinsec Technology (SHSE:688152)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Hunan Kylinsec Technology Co., Ltd. specializes in supplying software products and has a market capitalization of CN¥3.69 billion.

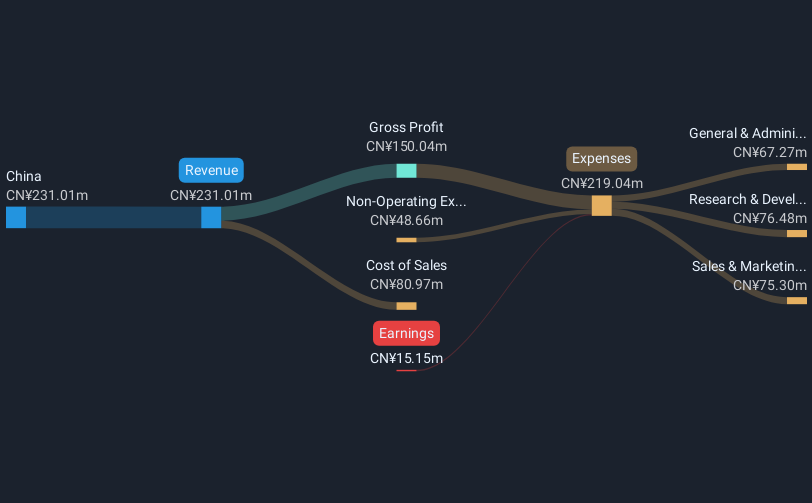

Operations: The company generates revenue primarily through its software products. With a market capitalization of CN¥3.69 billion, it focuses on providing specialized software solutions.

Hunan Kylinsec Technology, despite a recent drop from the S&P Global BMI Index, showcases resilience with a robust 44.9% annual revenue growth rate and an anticipated earnings surge of 117.0% per year. This growth is fueled by significant R&D investments which totaled CNY 10 million last quarter, accounting for approximately 6.7% of their total revenue—a clear indicator of their commitment to innovation in cybersecurity solutions. With these aggressive expansions and improvements in technology offerings, Hunan Kylinsec not only addresses current market demands but also sets itself up as a contender in the evolving tech landscape despite its current unprofitability and recent market setbacks.

Ströer SE KGaA (XTRA:SAX)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Ströer SE & Co. KGaA is a company that offers out-of-home media and online advertising solutions both in Germany and internationally, with a market capitalization of approximately €2.55 billion.

Operations: The company's primary revenue streams include Out-Of-Home Media, generating €942 million, and Digital & Dialog Media, contributing €867.49 million. Additionally, its Daas & E-Commerce segment adds €352.26 million to the total revenue.

Ströer SE & Co. KGaA, a company immersed in the competitive landscape of digital and outdoor advertising, is demonstrating robust growth dynamics, with revenue climbing at 6.4% annually and earnings forecasted to surge by 26.9% per year. This financial trajectory is underpinned by substantial investment in innovation, as evidenced by its R&D spending aligned closely with industry demands for evolving advertising solutions. Recent presentations at key financial forums underscore Ströer's strategic initiatives to capitalize on market opportunities and enhance shareholder value through focused business segments like online advertising which significantly contributes to its revenue stream. With a forward-looking approach marked by high Return on Equity projections of 40%, the company is well-positioned to navigate the complexities of digital market trends effectively.

- Navigate through the intricacies of Ströer SE KGaA with our comprehensive health report here.

Examine Ströer SE KGaA's past performance report to understand how it has performed in the past.

Key Takeaways

- Click through to start exploring the rest of the 1250 High Growth Tech and AI Stocks now.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Believe, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Believe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:BLV

Believe

Provides digital music services for independent labels and local artists in France, Germany, rest of Europe, the Americas, Asia, Oceania, and Pacific.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives