With EPS Growth And More, Verallia Société Anonyme (EPA:VRLA) Is Interesting

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it completely lacks a track record of revenue and profit. But as Warren Buffett has mused, 'If you've been playing poker for half an hour and you still don't know who the patsy is, you're the patsy.' When they buy such story stocks, investors are all too often the patsy.

In contrast to all that, I prefer to spend time on companies like Verallia Société Anonyme (EPA:VRLA), which has not only revenues, but also profits. While that doesn't make the shares worth buying at any price, you can't deny that successful capitalism requires profit, eventually. In comparison, loss making companies act like a sponge for capital - but unlike such a sponge they do not always produce something when squeezed.

Check out our latest analysis for Verallia Société Anonyme

Verallia Société Anonyme's Improving Profits

In the last three years Verallia Société Anonyme's earnings per share took off like a rocket; fast, and from a low base. So the actual rate of growth doesn't tell us much. Thus, it makes sense to focus on more recent growth rates, instead. Like a firecracker arcing through the night sky, Verallia Société Anonyme's EPS shot from €1.06 to €2.21, over the last year. Year on year growth of 109% is certainly a sight to behold.

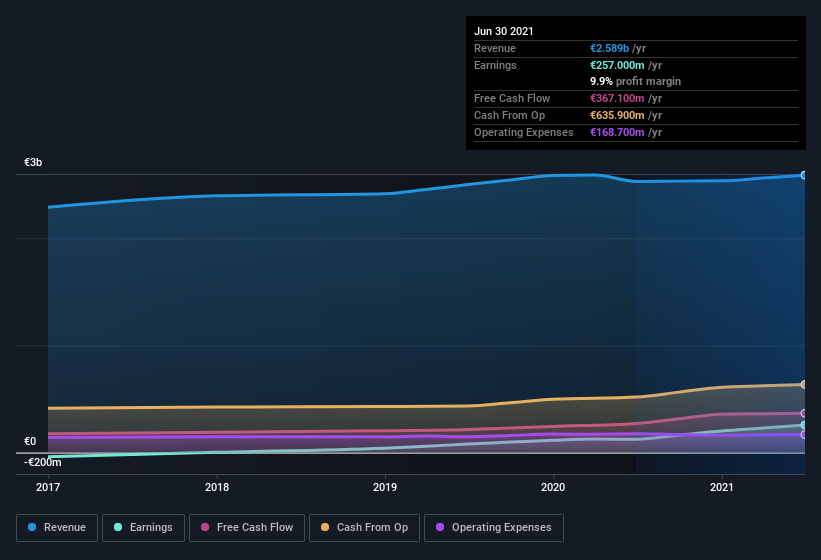

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Verallia Société Anonyme shareholders can take confidence from the fact that EBIT margins are up from 14% to 18%, and revenue is growing. That's great to see, on both counts.

In the chart below, you can see how the company has grown earnings, and revenue, over time. Click on the chart to see the exact numbers.

Fortunately, we've got access to analyst forecasts of Verallia Société Anonyme's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Verallia Société Anonyme Insiders Aligned With All Shareholders?

It makes me feel more secure owning shares in a company if insiders also own shares, thusly more closely aligning our interests. So it is good to see that Verallia Société Anonyme insiders have a significant amount of capital invested in the stock. With a whopping €74m worth of shares as a group, insiders have plenty riding on the company's success. That's certainly enough to make me think that management will be very focussed on long term growth.

Is Verallia Société Anonyme Worth Keeping An Eye On?

Verallia Société Anonyme's earnings per share have taken off like a rocket aimed right at the moon. That sort of growth is nothing short of eye-catching, and the large investment held by insiders certainly brightens my view of the company. At times fast EPS growth is a sign the business has reached an inflection point; and I do like those. So yes, on this short analysis I do think it's worth considering Verallia Société Anonyme for a spot on your watchlist. You should always think about risks though. Case in point, we've spotted 2 warning signs for Verallia Société Anonyme you should be aware of.

You can invest in any company you want. But if you prefer to focus on stocks that have demonstrated insider buying, here is a list of companies with insider buying in the last three months.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:VRLA

Verallia Société Anonyme

Manufactures and sells glass packaging products for beverages and food products worldwide.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives