- France

- /

- Metals and Mining

- /

- ENXTPA:ERA

ERAMET (EPA:ERA) Has Announced That It Will Be Increasing Its Dividend To €3.50

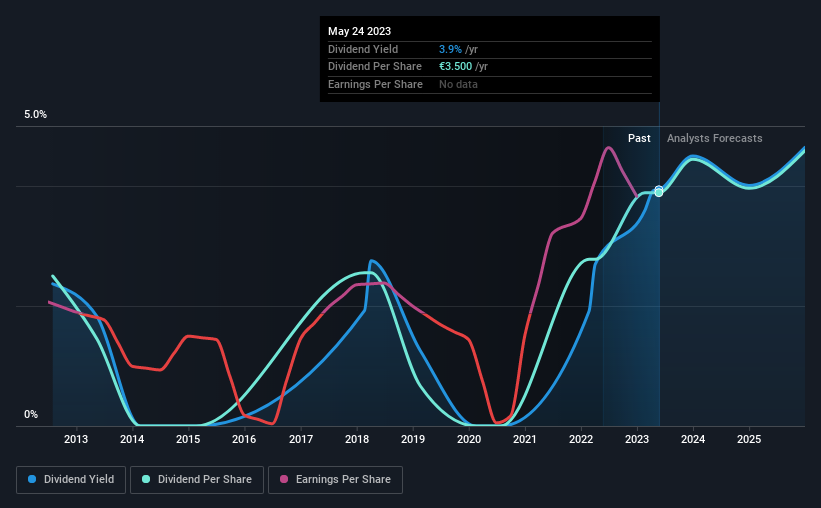

ERAMET S.A. (EPA:ERA) will increase its dividend from last year's comparable payment on the 30th of May to €3.50. The payment will take the dividend yield to 3.9%, which is in line with the average for the industry.

View our latest analysis for ERAMET

ERAMET's Earnings Easily Cover The Distributions

Unless the payments are sustainable, the dividend yield doesn't mean too much. However, prior to this announcement, ERAMET's dividend was comfortably covered by both cash flow and earnings. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share is forecast to fall by 29.5% over the next year. Assuming the dividend continues along recent trends, we believe the payout ratio could be 15%, which we are pretty comfortable with and we think is feasible on an earnings basis.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2013, the annual payment back then was €2.25, compared to the most recent full-year payment of €3.50. This implies that the company grew its distributions at a yearly rate of about 4.5% over that duration. The dividend has seen some fluctuations in the past, so even though the dividend was raised this year, we should remember that it has been cut in the past.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. We are encouraged to see that ERAMET has grown earnings per share at 34% per year over the past five years. Earnings have been growing rapidly, and with a low payout ratio we think that the company could turn out to be a great dividend stock.

ERAMET Looks Like A Great Dividend Stock

Overall, a dividend increase is always good, and we think that ERAMET is a strong income stock thanks to its track record and growing earnings. The distributions are easily covered by earnings, and there is plenty of cash being generated as well. We should point out that the earnings are expected to fall over the next 12 months, which won't be a problem if this doesn't become a trend, but could cause some turbulence in the next year. All of these factors considered, we think this has solid potential as a dividend stock.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. To that end, ERAMET has 3 warning signs (and 1 which is significant) we think you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if ERAMET might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ERA

ERAMET

Produces and sells manganese and nickel metals in Asia, Europe, North America, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026