Groupe Guillin's (EPA:ALGIL) Shareholders Will Receive A Bigger Dividend Than Last Year

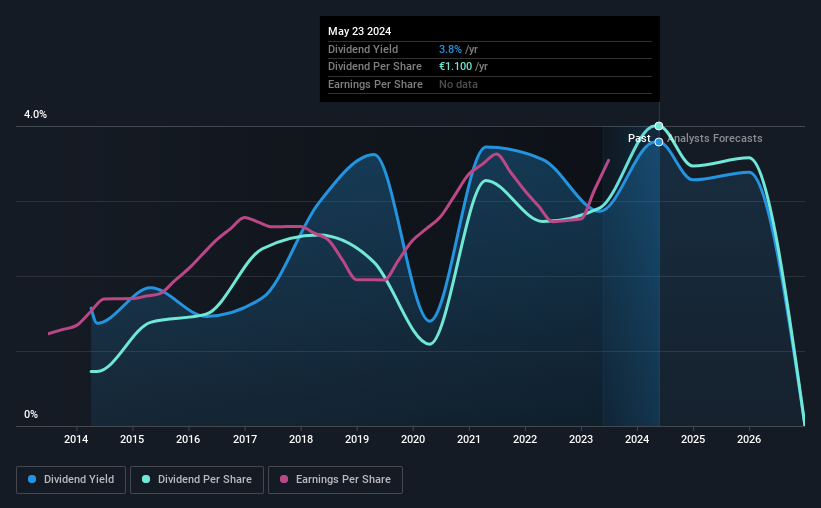

The board of Groupe Guillin S.A. (EPA:ALGIL) has announced that it will be paying its dividend of €1.10 on the 27th of June, an increased payment from last year's comparable dividend. This takes the dividend yield to 3.8%, which shareholders will be pleased with.

See our latest analysis for Groupe Guillin

Groupe Guillin's Dividend Is Well Covered By Earnings

If the payments aren't sustainable, a high yield for a few years won't matter that much. Before making this announcement, Groupe Guillin was easily earning enough to cover the dividend. This means that most of its earnings are being retained to grow the business.

Looking forward, earnings per share is forecast to rise by 20.4% over the next year. If the dividend continues along recent trends, we estimate the payout ratio will be 29%, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2014, the annual payment back then was €0.20, compared to the most recent full-year payment of €1.10. This works out to be a compound annual growth rate (CAGR) of approximately 19% a year over that time. It is great to see strong growth in the dividend payments, but cuts are concerning as it may indicate the payout policy is too ambitious.

The Dividend Has Growth Potential

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Groupe Guillin has impressed us by growing EPS at 7.4% per year over the past five years. A low payout ratio and decent growth suggests that the company is reinvesting well, and it also has plenty of room to increase the dividend over time.

Our Thoughts On Groupe Guillin's Dividend

Overall, this is a reasonable dividend, and it being raised is an added bonus. While the payout ratios are a good sign, we are less enthusiastic about the company's dividend record. This looks like it could be a good dividend stock going forward, but we would note that the payout ratio has been at higher levels in the past so it could happen again.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. However, there are other things to consider for investors when analysing stock performance. For instance, we've picked out 1 warning sign for Groupe Guillin that investors should take into consideration. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALGIL

Groupe Guillin

Produces and sells food packaging products in France, the United Kingdom, Italy, and internationally.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)