- France

- /

- Healthtech

- /

- ENXTPA:EQS

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets experience broad-based gains with U.S. indexes approaching record highs, investors are navigating a landscape marked by strong labor market data and stabilizing economic indicators. In this environment, dividend stocks can offer a compelling opportunity for those seeking to enhance their portfolios with steady income streams and potential growth, particularly as interest rates show signs of easing.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.98% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.54% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.27% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.60% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| James Latham (AIM:LTHM) | 6.73% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.45% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.93% | ★★★★★★ |

Click here to see the full list of 1970 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

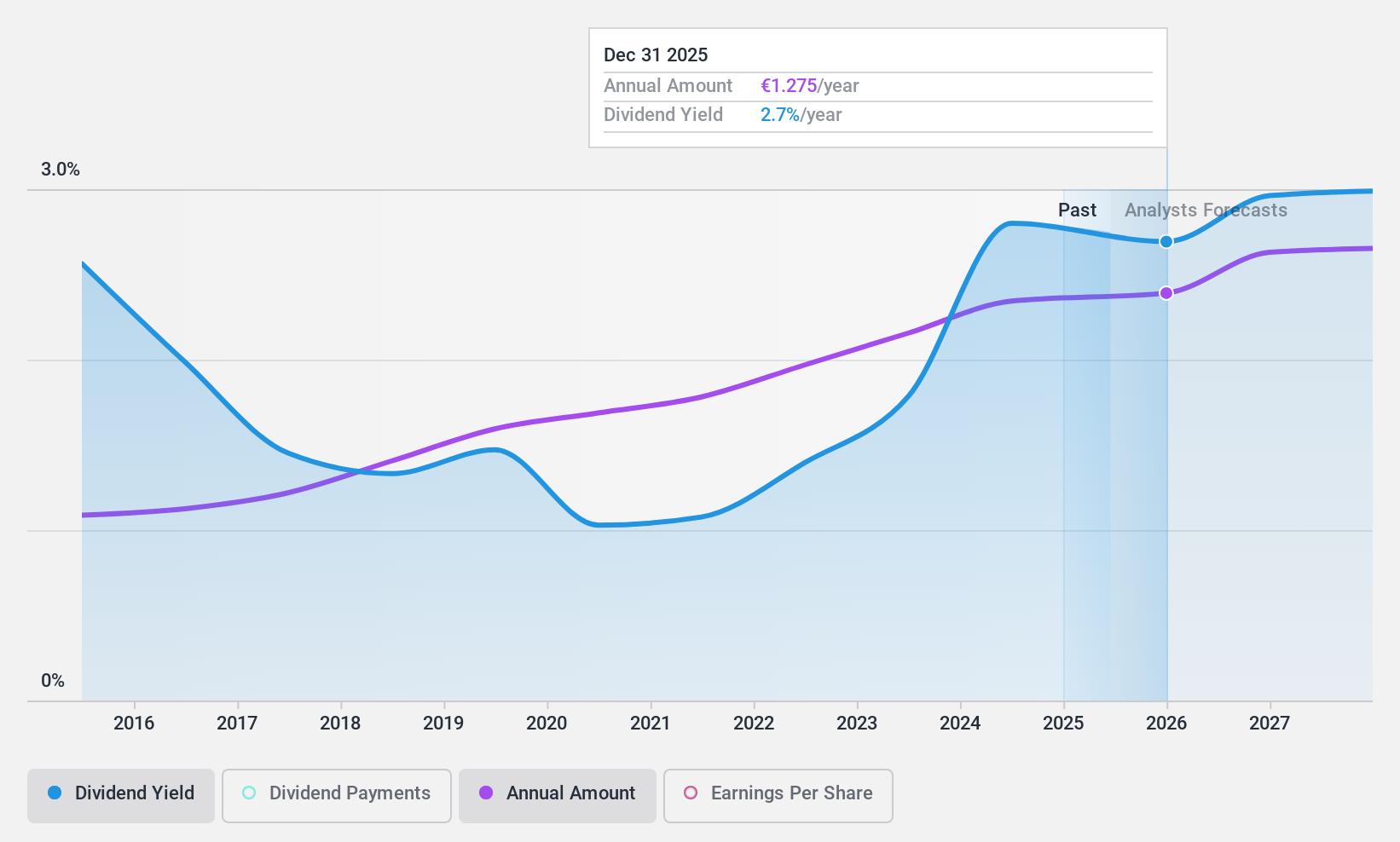

Equasens Société anonyme (ENXTPA:EQS)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Equasens Société anonyme offers healthcare IT solutions across Europe and has a market capitalization of €623.04 million.

Operations: Equasens Société anonyme generates its revenue through the provision of healthcare IT solutions across various European markets.

Dividend Yield: 3%

Equasens Société anonyme offers a reliable dividend history with consistent growth over the past decade. Despite a lower yield of 2.98% compared to top French market payers, its dividends are well-covered by earnings and cash flows, with payout ratios of 44.5% and 64.9%, respectively. Recent earnings showed a decline, but management maintains revenue growth forecasts for late 2024 and beyond, suggesting potential stability in future payouts amidst improving economic conditions for French pharmacies.

- Delve into the full analysis dividend report here for a deeper understanding of Equasens Société anonyme.

- Upon reviewing our latest valuation report, Equasens Société anonyme's share price might be too pessimistic.

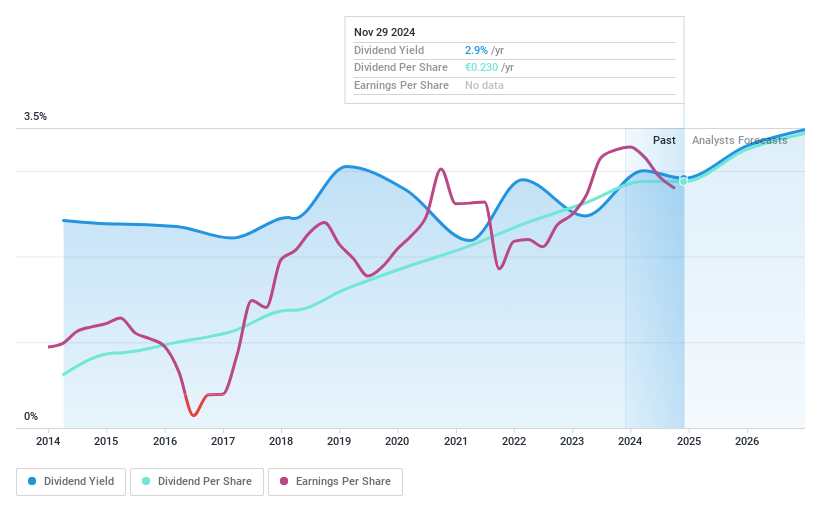

Scanfil Oyj (HLSE:SCANFL)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Scanfil Oyj is a global contract manufacturer and system supplier for the electronics industry with a market cap of €487.63 million.

Operations: Scanfil Oyj generates its revenue from several key segments, including Industrial (€132.70 million), Energy & Cleantech (€253.50 million), and Medtec, Life Science, Environmental Measurements (€142.10 million).

Dividend Yield: 3.1%

Scanfil Oyj's dividend yield of 3.07% is modest compared to leading Finnish market payers, yet it offers a stable and growing dividend history over the past decade. The company's dividends are well-covered by earnings and cash flows, with payout ratios of 37% and 17.1%, respectively, indicating sustainability. Despite recent declines in sales and net income for Q3 2024, strategic partnerships like the one with Skytree may bolster future growth prospects, supporting long-term dividend reliability.

- Dive into the specifics of Scanfil Oyj here with our thorough dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Scanfil Oyj shares in the market.

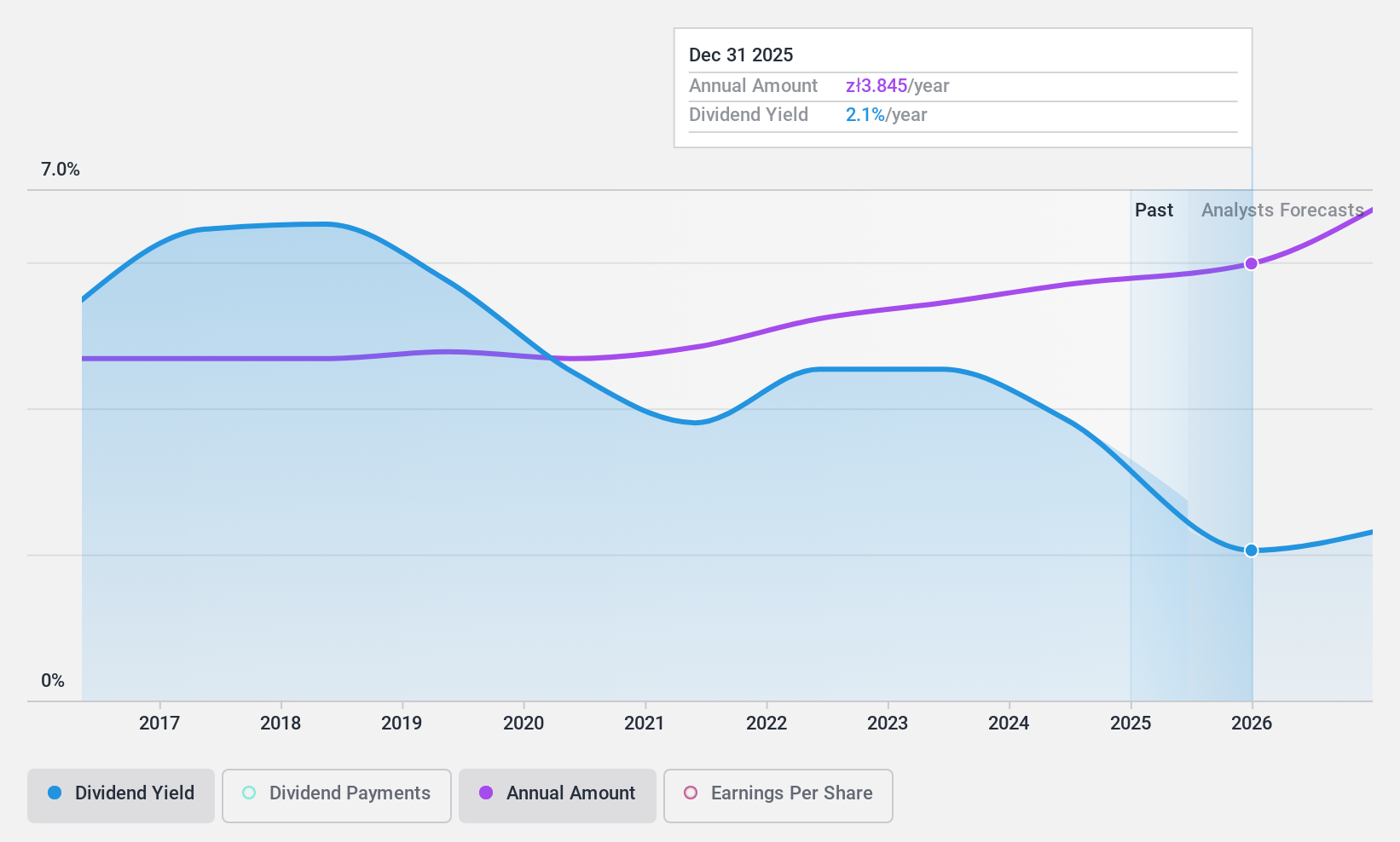

Asseco Poland (WSE:ACP)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asseco Poland S.A. is a software development and sales company operating primarily in Poland and internationally, with a market cap of PLN5.87 billion.

Operations: Asseco Poland S.A. generates its revenue through the development and sale of software products across various regions including Poland, Europe, the United States, Israel, and Africa.

Dividend Yield: 4.1%

Asseco Poland's dividend yield of 4.07% is modest compared to top Polish market payers but remains reliable and stable over the past decade. Recent earnings growth, with Q3 net income rising to PLN 134 million, supports dividend sustainability. The payout ratio of 49.1% and cash payout ratio of 12% indicate strong coverage by earnings and cash flows. Trading at a significant discount to estimated fair value enhances its appeal for value-focused investors seeking steady dividends.

- Click to explore a detailed breakdown of our findings in Asseco Poland's dividend report.

- In light of our recent valuation report, it seems possible that Asseco Poland is trading behind its estimated value.

Make It Happen

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1967 more companies for you to explore.Click here to unveil our expertly curated list of 1970 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Equasens Société anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:EQS

Flawless balance sheet, good value and pays a dividend.

Market Insights

Community Narratives