- France

- /

- Healthcare Services

- /

- ENXTPA:CLARI

Market Participants Recognise Clariane SE's (EPA:CLARI) Revenues Pushing Shares 187% Higher

The Clariane SE (EPA:CLARI) share price has done very well over the last month, posting an excellent gain of 187%. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 38% in the last twelve months.

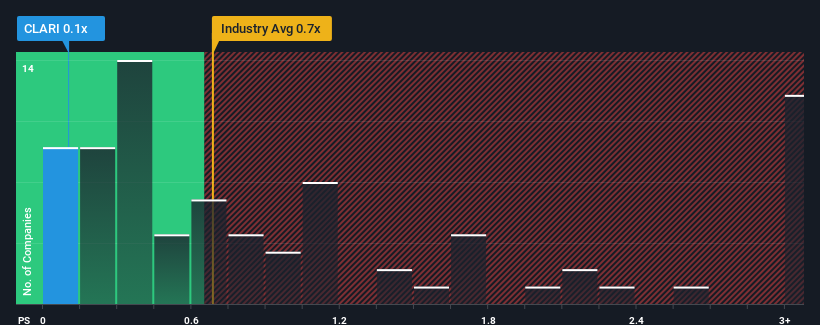

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Clariane's P/S ratio of 0.1x, since the median price-to-sales (or "P/S") ratio for the Healthcare industry in France is also close to 0.3x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for Clariane

How Clariane Has Been Performing

Recent times have been advantageous for Clariane as its revenues have been rising faster than most other companies. Perhaps the market is expecting this level of performance to taper off, keeping the P/S from soaring. If not, then existing shareholders have reason to be feeling optimistic about the future direction of the share price.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Clariane.How Is Clariane's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Clariane's is when the company's growth is tracking the industry closely.

Taking a look back first, we see that the company managed to grow revenues by a handy 13% last year. Pleasingly, revenue has also lifted 32% in aggregate from three years ago, partly thanks to the last 12 months of growth. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 5.6% each year over the next three years. That's shaping up to be similar to the 6.0% each year growth forecast for the broader industry.

With this information, we can see why Clariane is trading at a fairly similar P/S to the industry. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

What We Can Learn From Clariane's P/S?

Its shares have lifted substantially and now Clariane's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

A Clariane's P/S seems about right to us given the knowledge that analysts are forecasting a revenue outlook that is similar to the Healthcare industry. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

There are also other vital risk factors to consider before investing and we've discovered 2 warning signs for Clariane that you should be aware of.

If these risks are making you reconsider your opinion on Clariane, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CLARI

Clariane

Provides care home, healthcare facilities and services, and shared living solutions in France, Germany, Benelux, Italy, Spain, and the United Kingdom.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives