- France

- /

- Oil and Gas

- /

- ENXTPA:ALEO2

Positive Sentiment Still Eludes Eo2 Société Anonyme (EPA:ALEO2) Following 28% Share Price Slump

The Eo2 Société Anonyme (EPA:ALEO2) share price has fared very poorly over the last month, falling by a substantial 28%. Instead of being rewarded, shareholders who have already held through the last twelve months are now sitting on a 43% share price drop.

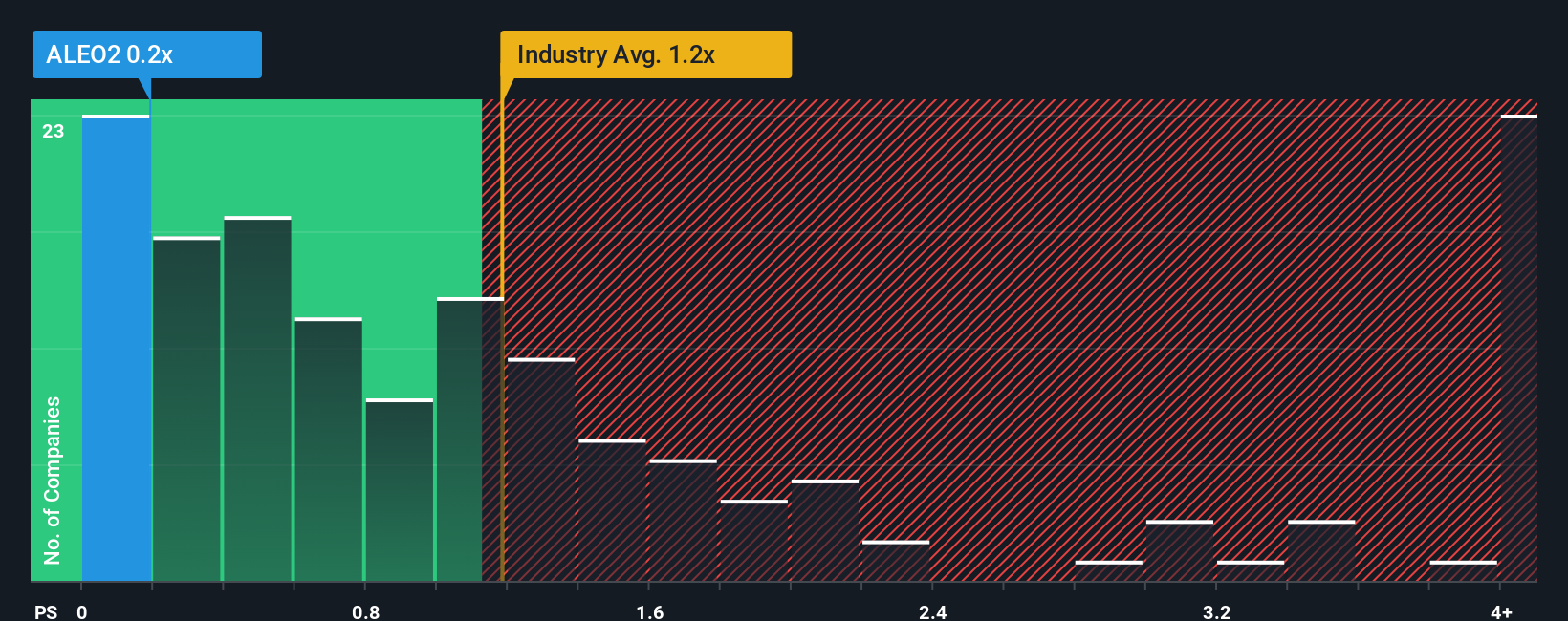

After such a large drop in price, Eo2 Société Anonyme's price-to-sales (or "P/S") ratio of 0.2x might make it look like a strong buy right now compared to the wider Oil and Gas industry in France, where around half of the companies have P/S ratios above 4x and even P/S above 10x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Eo2 Société Anonyme

What Does Eo2 Société Anonyme's P/S Mean For Shareholders?

As an illustration, revenue has deteriorated at Eo2 Société Anonyme over the last year, which is not ideal at all. One possibility is that the P/S is low because investors think the company won't do enough to avoid underperforming the broader industry in the near future. However, if this doesn't eventuate then existing shareholders may be feeling optimistic about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Eo2 Société Anonyme's earnings, revenue and cash flow.Do Revenue Forecasts Match The Low P/S Ratio?

In order to justify its P/S ratio, Eo2 Société Anonyme would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. The last three years don't look nice either as the company has shrunk revenue by 1.6% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Comparing that to the industry, which is predicted to shrink 2.9% in the next 12 months, the company's downward momentum is still superior based on recent medium-term annualised revenue results.

In light of this, the fact Eo2 Société Anonyme's P/S sits below the majority of other companies is peculiar but certainly not shocking. Even if the company's recent growth rates continue outperforming the industry, shrinking revenues are unlikely to lead to a stable P/S long-term. Even just maintaining these prices will be difficult to achieve as recent revenue trends are already weighing down the shares excessively.

The Final Word

Shares in Eo2 Société Anonyme have plummeted and its P/S has followed suit. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Eo2 Société Anonyme revealed its narrower three-year contraction in revenue isn't contributing to its P/S anywhere near as much as we would have predicted, given the industry is set to shrink even more. There could be some major unobserved threats to revenue preventing the P/S ratio from matching this comparatively more attractive revenue performance. We'd hazard a guess that some investors are concerned about the company's revenue performance tailing off amidst these tough industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see a lot of volatility.

It's always necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Eo2 Société Anonyme, and understanding should be part of your investment process.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if Eo2 Société Anonyme might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:ALEO2

Eo2 Société Anonyme

Designs, produces, and distributes wood heating products under the EO2 and PIKS brands in France.

Excellent balance sheet and slightly overvalued.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Mastersystem Infotama will achieve 18.9% revenue growth as fair value hits IDR1,650

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026