- France

- /

- Diversified Financial

- /

- ENXTPA:WLN

Improved Revenues Required Before Worldline SA (EPA:WLN) Stock's 26% Jump Looks Justified

Those holding Worldline SA (EPA:WLN) shares would be relieved that the share price has rebounded 26% in the last thirty days, but it needs to keep going to repair the recent damage it has caused to investor portfolios. Unfortunately, the gains of the last month did little to right the losses of the last year with the stock still down 48% over that time.

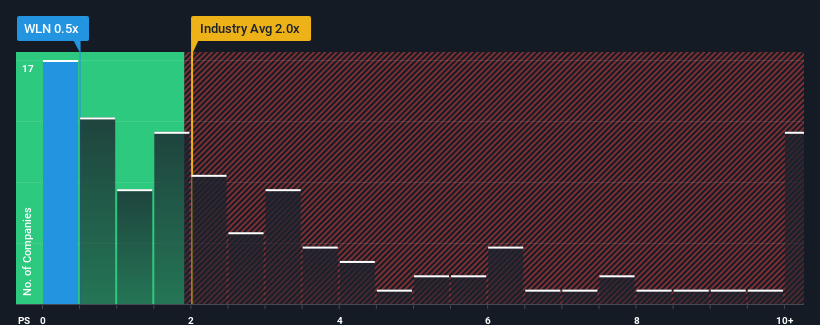

Even after such a large jump in price, Worldline's price-to-sales (or "P/S") ratio of 0.5x might still make it look like a strong buy right now compared to the wider Diversified Financial industry in France, where around half of the companies have P/S ratios above 3x and even P/S above 8x are quite common. However, the P/S might be quite low for a reason and it requires further investigation to determine if it's justified.

See our latest analysis for Worldline

What Does Worldline's Recent Performance Look Like?

Worldline certainly has been doing a good job lately as its revenue growth has been positive while most other companies have been seeing their revenue go backwards. It might be that many expect the strong revenue performance to degrade substantially, possibly more than the industry, which has repressed the P/S. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Worldline.How Is Worldline's Revenue Growth Trending?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Worldline's to be considered reasonable.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Although pleasingly revenue has lifted 52% in aggregate from three years ago, notwithstanding the last 12 months. Therefore, it's fair to say the revenue growth recently has been great for the company, but investors will want to ask why it has slowed to such an extent.

Turning to the outlook, the next three years should generate growth of 2.9% per year as estimated by the analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 15% per year, which is noticeably more attractive.

In light of this, it's understandable that Worldline's P/S sits below the majority of other companies. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Bottom Line On Worldline's P/S

Even after such a strong price move, Worldline's P/S still trails the rest of the industry. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As expected, our analysis of Worldline's analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

Don't forget that there may be other risks. For instance, we've identified 1 warning sign for Worldline that you should be aware of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Worldline might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:WLN

Worldline

Provides payments and transactional services for financial institutions, merchants, corporations, and government agencies in Northern Europe, Central and Eastern Europe, Southern Europe, the Asia Pacific, the Americas, and internationally.

Undervalued with adequate balance sheet.