- France

- /

- Oil and Gas

- /

- ENXTPA:FDE

The one-year shareholder returns and company earnings persist lower as La Française de l'Energie (EPA:FDE) stock falls a further 12% in past week

Investing in stocks comes with the risk that the share price will fall. Unfortunately, shareholders of La Française de l'Energie S.A. (EPA:FDE) have suffered share price declines over the last year. The share price has slid 56% in that time. Even if you look out three years, the returns are still disappointing, with the share price down32% in that time. Furthermore, it's down 23% in about a quarter. That's not much fun for holders.

Since La Française de l'Energie has shed €16m from its value in the past 7 days, let's see if the longer term decline has been driven by the business' economics.

Check out our latest analysis for La Française de l'Energie

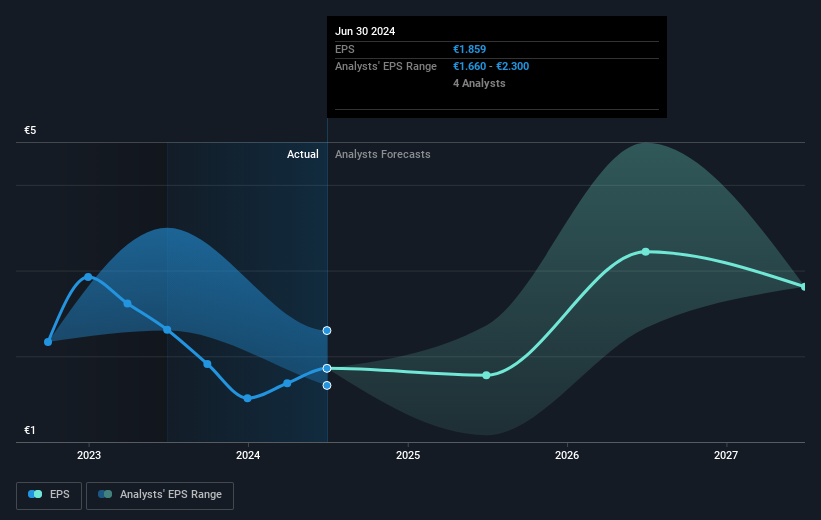

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

Unhappily, La Française de l'Energie had to report a 20% decline in EPS over the last year. This reduction in EPS is not as bad as the 56% share price fall. Unsurprisingly, given the lack of EPS growth, the market seems to be more cautious about the stock.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how La Française de l'Energie has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at La Française de l'Energie's financial health with this free report on its balance sheet.

A Different Perspective

Investors in La Française de l'Energie had a tough year, with a total loss of 56%, against a market gain of about 2.5%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. On the bright side, long term shareholders have made money, with a gain of 6% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. It's always interesting to track share price performance over the longer term. But to understand La Française de l'Energie better, we need to consider many other factors. For example, we've discovered 1 warning sign for La Française de l'Energie that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FDE

La Française de l'Energie

Operates as a carbon-negative energy production company in France and internationally.

High growth potential with questionable track record.

Similar Companies

Market Insights

Community Narratives