- France

- /

- Capital Markets

- /

- ENXTPA:ROTH

The Rothschild & Co (EPA:ROTH) Share Price Has Gained 34% And Shareholders Are Hoping For More

If you buy and hold a stock for many years, you'd hope to be making a profit. Better yet, you'd like to see the share price move up more than the market average. Unfortunately for shareholders, while the Rothschild & Co SCA (EPA:ROTH) share price is up 34% in the last five years, that's less than the market return. Looking at the last year alone, the stock is up 11%.

Check out our latest analysis for Rothschild & Co

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

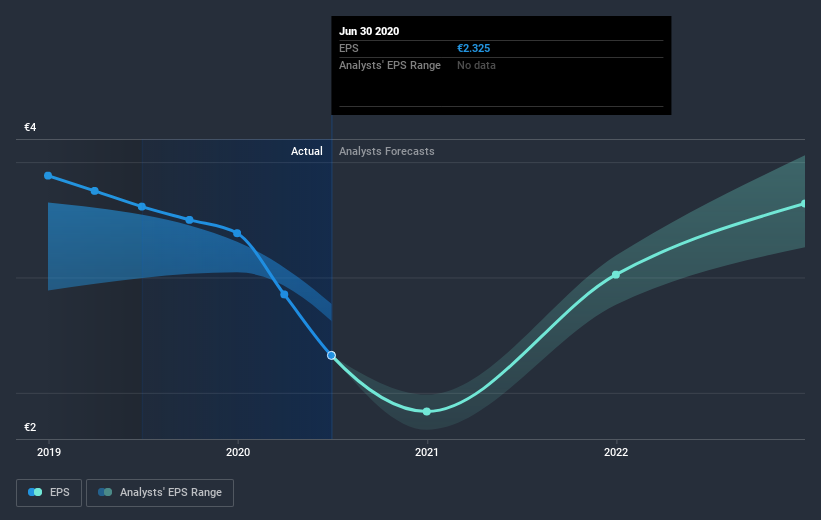

Over half a decade, Rothschild & Co managed to grow its earnings per share at 5.4% a year. So the EPS growth rate is rather close to the annualized share price gain of 6% per year. Therefore one could conclude that sentiment towards the shares hasn't morphed very much. In fact, the share price seems to largely reflect the EPS growth.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. This free interactive report on Rothschild & Co's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What about the Total Shareholder Return (TSR)?

Investors should note that there's a difference between Rothschild & Co's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Rothschild & Co's TSR of 48% for the 5 years exceeded its share price return, because it has paid dividends.

A Different Perspective

It's nice to see that Rothschild & Co shareholders have received a total shareholder return of 11% over the last year. That gain is better than the annual TSR over five years, which is 8%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Rothschild & Co , and understanding them should be part of your investment process.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on FR exchanges.

If you decide to trade Rothschild & Co, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ROTH

Rothschild & Co

Rothschild & Co SCA provides global advisory, wealth and asset management, and merchant banking services in France, the United Kingdom, the Channel Islands, the Americas, rest of Europe, Switzerland, Australia, Asia, and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives