- France

- /

- Capital Markets

- /

- ENXTPA:ALBON

News Flash: One Analyst Just Made An Incredible Upgrade To Their Compagnie Lebon (EPA:LBON) Forecasts

Celebrations may be in order for Compagnie Lebon (EPA:LBON) shareholders, with the covering analyst delivering a significant upgrade to their statutory estimates for the company. The revenue forecast for this year has experienced a facelift, with the analyst now much more optimistic on its sales pipeline.

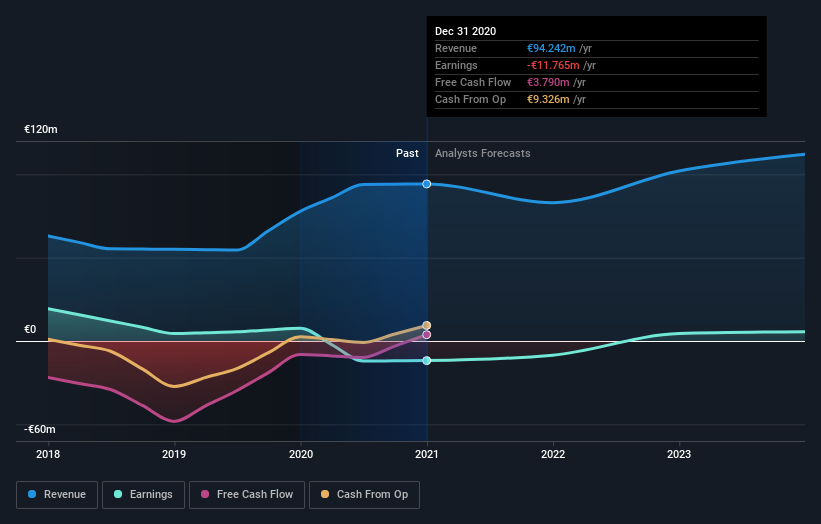

Following the latest upgrade, the current consensus, from the lone analyst covering Compagnie Lebon, is for revenues of €83m in 2021, which would reflect a definite 12% reduction in Compagnie Lebon's sales over the past 12 months. The loss per share is anticipated to greatly reduce in the near future, narrowing 30% to €7.25. Yet before this consensus update, the analyst had been forecasting revenues of €55m and losses of €7.25 per share in 2021. So there's definitely been a change in sentiment in this update, with the analyst upgrading this year's revenue estimates, while at the same time holding losses per share steady.

View our latest analysis for Compagnie Lebon

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. Over the past five years, revenues have declined around 2.8% annually. Worse, forecasts are essentially predicting the decline to accelerate, with the estimate for an annualised 12% decline in revenue until the end of 2021. Compare this against analyst estimates for companies in the broader industry, which suggest that revenues (in aggregate) are expected to grow 3.5% annually. So while a broad number of companies are forecast to grow, unfortunately Compagnie Lebon is expected to see its sales affected worse than other companies in the industry.

The Bottom Line

The highlight for us was that the consensus reduced its estimated losses this year, perhaps suggesting Compagnie Lebon is moving incrementally towards profitability. Pleasantly, the analyst also upgraded their revenue estimates, and their forecasts suggest the business is expected to grow slower than the wider market. Given that the analyst appears to be expecting substantial improvement in the sales pipeline, now could be the right time to take another look at Compagnie Lebon.

Still, the long-term prospects of the business are much more relevant than next year's earnings. We have analyst estimates for Compagnie Lebon going out as far as 2023, and you can see them free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are upgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

If you’re looking to trade Compagnie Lebon, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTPA:ALBON

Compagnie Lebon

Engages in the hotel, private equity, real estate, and thermal bath businesses in France.

Reasonable growth potential and fair value.

Market Insights

Community Narratives