- France

- /

- Capital Markets

- /

- ENXTPA:ENX

Euronext (ENXTPA:ENX): Assessing Valuation Following Its Addition to the CAC 40 Index

Reviewed by Kshitija Bhandaru

Euronext (ENXTPA:ENX) has just caught investors’ eyes after being added to the Paris CAC 40 Index, one of the market’s most followed benchmarks. This move is more than just a change in nameplates; inclusion in the CAC 40 can have real effects, with institutional funds and index trackers potentially allocating new capital to Euronext. For many watching from the sidelines, the news could mark a turning point in the company’s visibility and liquidity on the French market.

Looking back, Euronext’s performance has offered plenty to think about. The stock is up 31% over the past year, although recent months have seen a dip, with an 11% slide in the past month and a 13% drop over the past 3 months, even as its year-to-date return remains positive. The boost from index inclusion comes on the heels of annual revenue and net income growth, alongside earlier periods of stronger returns for long-term holders. Altogether, momentum seems to be in flux.

With Euronext now a part of the CAC 40, the big question is whether the stock’s current price reflects its future potential or if this is a genuine buying opportunity sparked by the latest catalyst?

Most Popular Narrative: 15.9% Undervalued

According to the most widely followed narrative among market analysts, Euronext's shares are trading below their calculated fair value, currently offering what is seen as a notable discount given expectations for growth and future profitability.

Ongoing integration of recent pan-European acquisitions (for example, Admincontrol, ATHEX, and ongoing progress on Borsa Italiana) creates a powerful catalyst for cost and revenue synergies, leading to margin expansion and higher operational leverage. This is reinforced by a track record of realizing synergies and disciplined capital allocation, positively impacting EBITDA and net income.

Curious how heavy-hitting mergers and disciplined strategy power the valuation? There is a hidden financial engine revving under Euronext’s future price target. The most popular narrative relies on ambitious forecasts about revenue gains and margin improvements. Find out what key projections are pushing fair value beyond the current market price.

Result: Fair Value of €150.59 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, slowing market activity or challenges integrating acquisitions could undercut growth expectations and keep Euronext’s future profits below current forecasts.

Find out about the key risks to this Euronext narrative.Another View: Market Comparisons Tell a Different Story

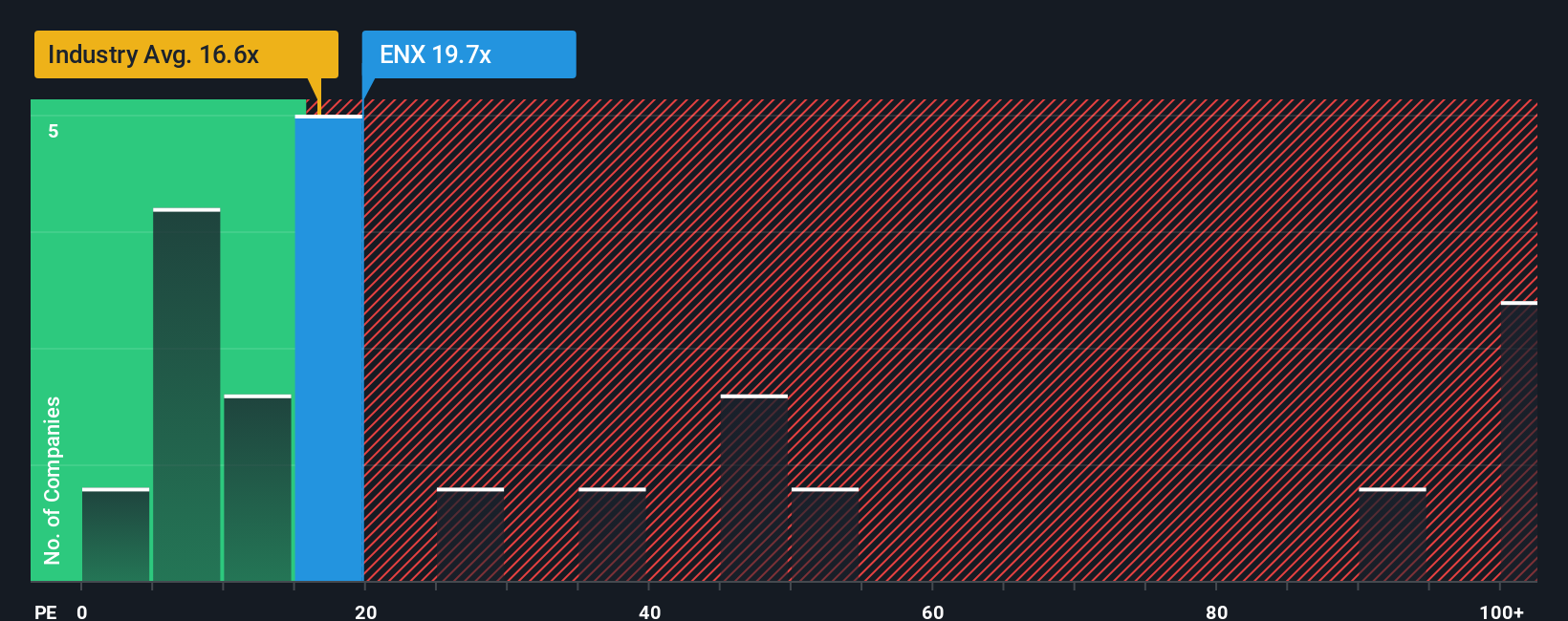

Looking beyond future earnings forecasts, a quick glance at how Euronext is priced compared to others in its industry raises new questions. On this market yardstick, Euronext comes out looking a bit expensive. Should investors trust this warning sign, or is the market missing a bigger picture?

See what the numbers say about this price — find out in our valuation breakdown.

Stay updated when valuation signals shift by adding Euronext to your watchlist or portfolio. Alternatively, explore our screener to discover other companies that fit your criteria.

Build Your Own Euronext Narrative

If you see the numbers differently, or want to test your own ideas, you can shape your personal narrative using the same data and insights. Do it your way.

A great starting point for your Euronext research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Smart Investment Ideas?

These hand-picked stock ideas could help you spot the next opportunity. Don’t let today’s market winners pass you by. Stay ahead by exploring what’s working right now.

- Unlock income with market leaders offering yields above 3% when you browse our dividend stocks with yields > 3%. See which solid payers stand strong in all climates.

- Catch the AI revolution early by checking out the fast-rising innovators powering tomorrow’s breakthroughs through our AI penny stocks.

- Find hidden value in companies that are primed for a rebound with our handpicked undervalued stocks based on cash flows list. Don’t miss stocks flying under the radar.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Euronext might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ENX

Euronext

Operates securities and derivatives exchanges in the Netherlands, France, Italy, Belgium, Portugal, Ireland, the United States, Norway, Denmark, and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)