- France

- /

- Capital Markets

- /

- ENXTPA:AMUN

Amundi (ENXTPA:AMUN): Has Recent Share Price Strength Left the Stock Undervalued or Fairly Priced?

Reviewed by Simply Wall St

Amundi (ENXTPA:AMUN) has quietly outperformed over the past 3 years, even as its latest annual revenue and net income slipped. This makes the stock an interesting case of resilience versus slowing growth.

See our latest analysis for Amundi.

Over the past year, Amundi’s share price return has been steadily positive, and its three year total shareholder return of around 54% underlines that the recent 11.8% one year total shareholder return is part of a longer stretch of solid, if moderating, momentum.

If Amundi’s track record has you thinking about where else capital is quietly compounding, it could be worth exploring fast growing stocks with high insider ownership.

With earnings under gentle pressure, a solid multi year share price run, and only a modest gap to analyst targets, the key question now is simple: is Amundi still undervalued, or has the market already priced in future growth?

Most Popular Narrative: 7.5% Undervalued

With Amundi last closing at €68.30 against a narrative fair value of €73.80, the valuation story hinges on resilient margins despite shrinking revenues.

The analysts have a consensus price target of €76.521 for Amundi based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the more bullish ones expecting earnings as high as €1.6 billion and the most bearish reporting a price target of just €68.0.

Want to see why a business facing falling revenues can still command a richer earnings multiple in a few years? The narrative leans heavily on widening margins, disciplined capital assumptions and a future valuation profile that looks more like a quality growth compounder than a shrinking asset manager. Curious which specific profit and discount rate assumptions need to hold for that gap to close? Dive in to see the numbers behind this call.

Result: Fair Value of €73.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this optimism could be challenged if France’s exceptional tax hits profitability harder than expected, and if Asian outflows persist despite Amundi’s joint ventures.

Find out about the key risks to this Amundi narrative.

Another Angle On Value

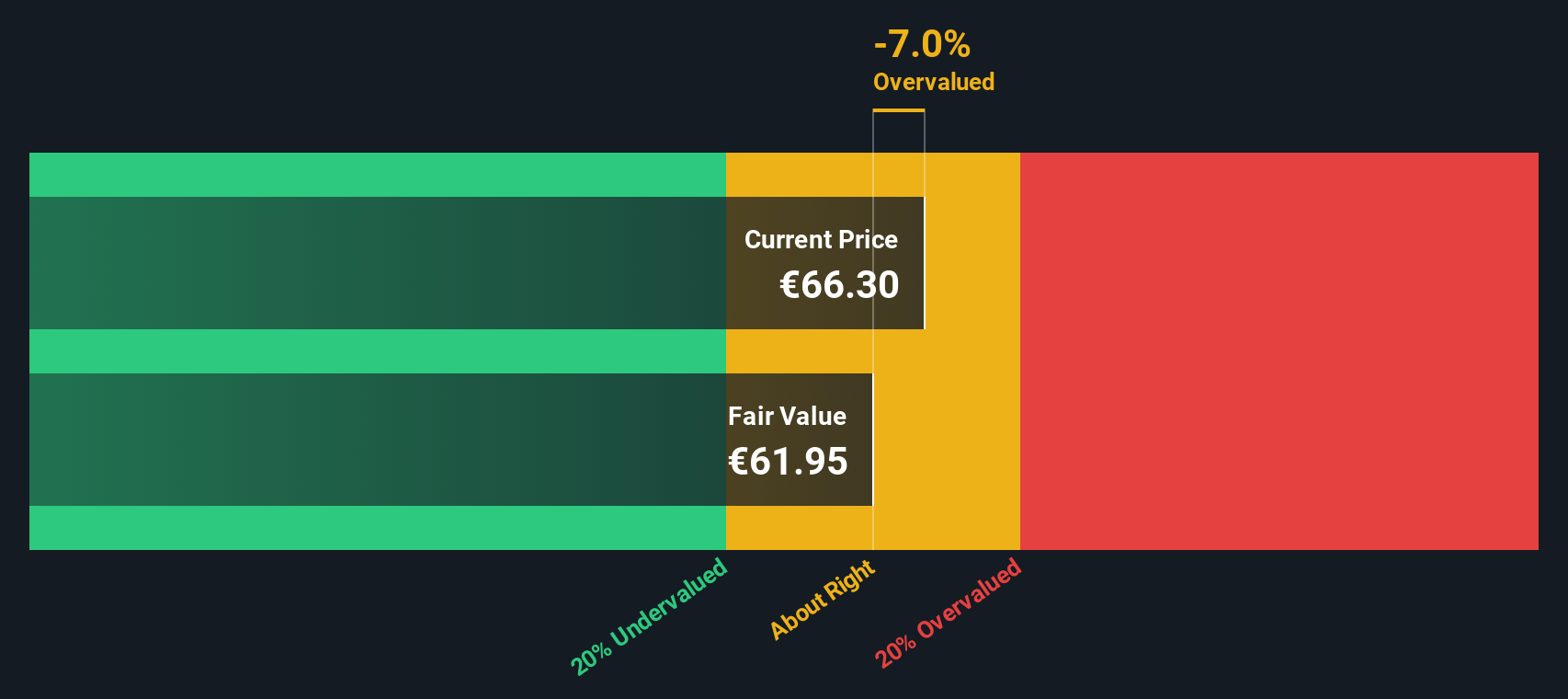

Our SWS DCF model paints a cooler picture, with Amundi’s fair value closer to €62.61, implying the current €68.30 price is a touch rich. If cash flows do fade as forecast, today’s apparent margin driven upside could be pulling future returns forward.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Amundi for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 901 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Amundi Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can build a personalized view of Amundi in minutes: Do it your way.

A great starting point for your Amundi research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing edge?

If Amundi interests you, do not stop here. Use the Simply Wall St Screener to uncover fresh, actionable opportunities before other investors catch on.

- Capture mispriced potential by reviewing these 901 undervalued stocks based on cash flows that may offer stronger upside than mature blue chips.

- Ride structural growth themes by assessing these 30 healthcare AI stocks transforming diagnostics, treatment pathways and hospital efficiency.

- Tap into innovation at the frontier by scanning these 81 cryptocurrency and blockchain stocks reshaping payments, infrastructure and digital asset ecosystems.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AMUN

Solid track record established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion