- France

- /

- Hospitality

- /

- ENXTPA:AC

Accor (ENXTPA:AC) Valuation Check as Trading Surges and New Regional CEO Signals Strategic Shift

Reviewed by Simply Wall St

Accor (ENXTPA:AC) is drawing extra attention after promoting long time executive Karelle Lamouche to CEO for Europe and North Africa, just as trading volumes climb ahead of the group’s February 2026 earnings.

See our latest analysis for Accor.

That leadership change is landing as momentum builds, with a roughly 15 percent 90 day share price return and a standout three year total shareholder return north of 115 percent, suggesting investors are leaning into Accor’s recovery story.

If Karelle Lamouche’s promotion has you thinking about where else leadership and growth could surprise the market, now is a smart moment to explore fast growing stocks with high insider ownership.

With shares up strongly over three years and the price still sitting near a 10 percent discount to both intrinsic value estimates and analyst targets, is Accor quietly undervalued, or is the market already banking on its next leg of growth?

Most Popular Narrative: 12.1% Undervalued

With Accor last closing at €47.06 against a narrative fair value near €53.51, the current pricing implies the market is not fully crediting the company’s medium term earnings power.

Continued shift toward an asset light model, with disciplined focus on higher fee per room contracts and quality churn, is expected to improve net margins and enhance stability/recurrence of earnings by reducing capital expenditure and exposure to owned hotel volatility.

Curious how moderate growth assumptions can still justify a premium earnings multiple for a hotel group, and why cash flow visibility becomes the backbone of this valuation story, not the headline revenue line.

Result: Fair Value of €53.51 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent FX headwinds and overreliance on mature European markets could quickly erode margin gains and challenge the current undervaluation narrative.

Find out about the key risks to this Accor narrative.

Another Lens on Value

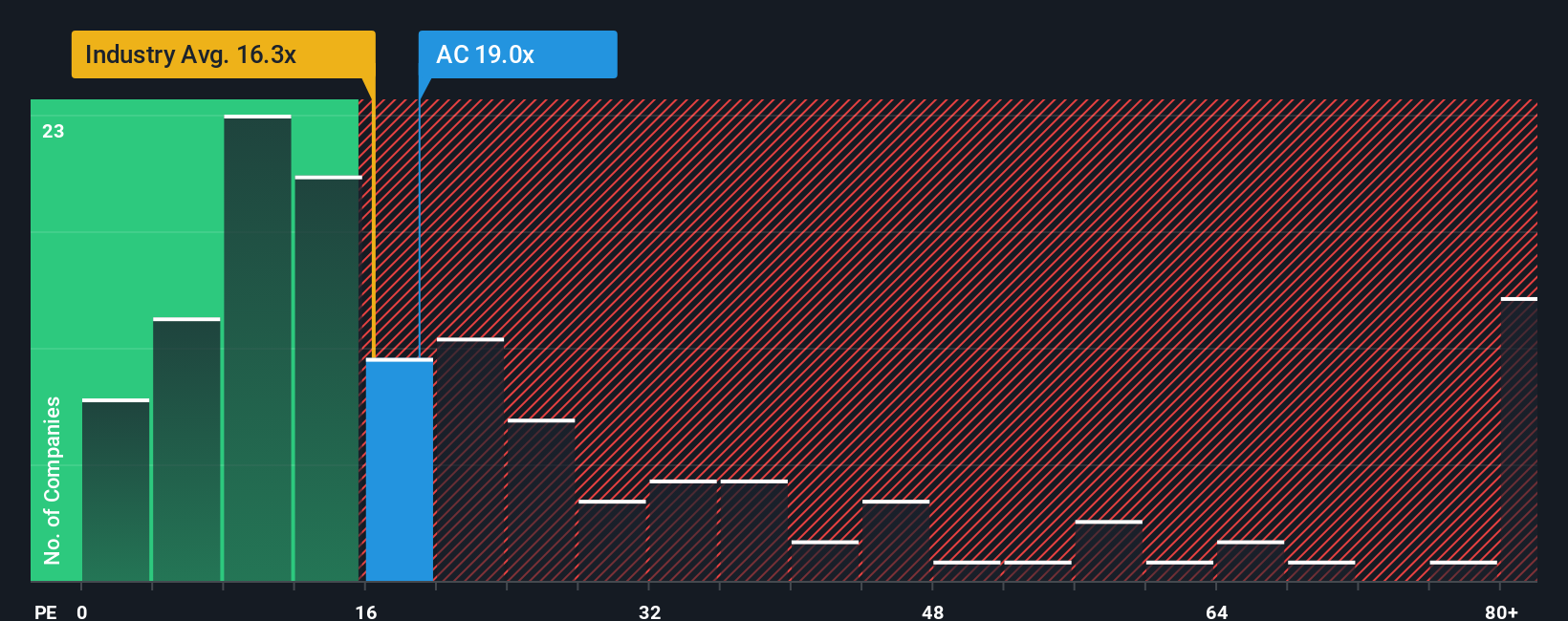

While the narrative fair value frames Accor as about 12 percent undervalued, its 18.8x earnings multiple tells a more cautious story. That is richer than the 16.2x sector average, but cheaper than peers at 24.6x and below a fair ratio of 21.2x. This leaves investors to question whether this is a margin of safety or a value trap in disguise.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Accor Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a custom narrative in just a few minutes: Do it your way.

A great starting point for your Accor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investment move?

Do not stop at a single stock. Use the Simply Wall Street Screener to uncover fresh opportunities before the crowd spots them and position your portfolio ahead.

- Target future market leaders by reviewing these 26 AI penny stocks that harness powerful trends reshaping how businesses operate and compete globally.

- Secure potential bargains early with these 903 undervalued stocks based on cash flows that trade below their estimated cash flow value, before sentiment and prices catch up.

- Tap into cutting edge disruption through these 28 quantum computing stocks poised to transform computing power, security, and complex problem solving across industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:AC

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)