- France

- /

- Food and Staples Retail

- /

- ENXTPA:FNTS

Finatis Société Anonyme (EPA:FNTS) Is Experiencing Growth In Returns On Capital

Did you know there are some financial metrics that can provide clues of a potential multi-bagger? Firstly, we'd want to identify a growing return on capital employed (ROCE) and then alongside that, an ever-increasing base of capital employed. If you see this, it typically means it's a company with a great business model and plenty of profitable reinvestment opportunities. Speaking of which, we noticed some great changes in Finatis Société Anonyme's (EPA:FNTS) returns on capital, so let's have a look.

What is Return On Capital Employed (ROCE)?

For those that aren't sure what ROCE is, it measures the amount of pre-tax profits a company can generate from the capital employed in its business. To calculate this metric for Finatis Société Anonyme, this is the formula:

Return on Capital Employed = Earnings Before Interest and Tax (EBIT) ÷ (Total Assets - Current Liabilities)

0.057 = €1.1b ÷ (€32b - €12b) (Based on the trailing twelve months to December 2021).

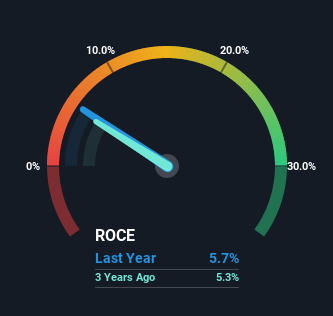

Thus, Finatis Société Anonyme has an ROCE of 5.7%. In absolute terms, that's a low return and it also under-performs the Consumer Retailing industry average of 11%.

View our latest analysis for Finatis Société Anonyme

Historical performance is a great place to start when researching a stock so above you can see the gauge for Finatis Société Anonyme's ROCE against it's prior returns. If you'd like to look at how Finatis Société Anonyme has performed in the past in other metrics, you can view this free graph of past earnings, revenue and cash flow.

What Can We Tell From Finatis Société Anonyme's ROCE Trend?

You'd find it hard not to be impressed with the ROCE trend at Finatis Société Anonyme. The figures show that over the last five years, returns on capital have grown by 72%. That's a very favorable trend because this means that the company is earning more per dollar of capital that's being employed. Interestingly, the business may be becoming more efficient because it's applying 22% less capital than it was five years ago. If this trend continues, the business might be getting more efficient but it's shrinking in terms of total assets.

In Conclusion...

From what we've seen above, Finatis Société Anonyme has managed to increase it's returns on capital all the while reducing it's capital base. Given the stock has declined 57% in the last five years, this could be a good investment if the valuation and other metrics are also appealing. That being the case, research into the company's current valuation metrics and future prospects seems fitting.

If you want to know some of the risks facing Finatis Société Anonyme we've found 2 warning signs (1 is concerning!) that you should be aware of before investing here.

While Finatis Société Anonyme isn't earning the highest return, check out this free list of companies that are earning high returns on equity with solid balance sheets.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:FNTS

Finatis Société Anonyme

Operates in the food distribution business in France and Latin America.

Very low with weak fundamentals.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)