LVMH (ENXTPA:MC): Exploring Valuation Following Recent Share Price Rebound

Reviewed by Simply Wall St

LVMH Moët Hennessy, Louis Vuitton Société Européenne (ENXTPA:MC), has seen moderate stock moves in recent weeks, sparking questions about how its latest financial results and long-term performance stack up for investors weighing luxury sector exposure.

See our latest analysis for LVMH Moët Hennessy - Louis Vuitton Société Européenne.

LVMH’s share price enjoyed a sharp rebound this past month, jumping over 20 percent after a quieter start to the year. While its 1-year total shareholder return sits nearly flat, the recent momentum hints at improving sentiment and shifting risk perceptions in the luxury sector.

If this renewed strength has you curious about where else opportunity is building, now is a great time to check out fast growing stocks with high insider ownership.

But after such a rapid price rally, is LVMH now trading below its true value? Alternatively, have investors already priced in the company’s future growth prospects, leaving little room for an overlooked buying opportunity?

Most Popular Narrative: 4.2% Overvalued

With the current share price above the narrative’s fair value estimate, the latest consensus points to a moderate overvaluation at today’s levels. This sets up an intriguing debate on what truly drives LVMH’s worth.

Continued investment in product innovation and portfolio diversification, including launches like Louis Vuitton beauty, new creative leadership at major brands, and luxury hospitality expansions, supports long-term growth and margin resilience by reinforcing brand desirability and tapping into the rising demand for luxury as a lifestyle among younger, affluent consumers.

Curious what bold forecasts are fueling that price target? This narrative hinges on a combination of game-changing brand strategies and future profits worthy of industry champions. The underlying assumptions might surprise even seasoned investors. Do you want to see the real numbers behind the valuation?

Result: Fair Value of €588.07 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent economic weakness in Asia and elevated cost pressures could still undercut LVMH’s forecasted growth and challenge the optimistic valuation narrative.

Another View: What Do Earnings Ratios Say?

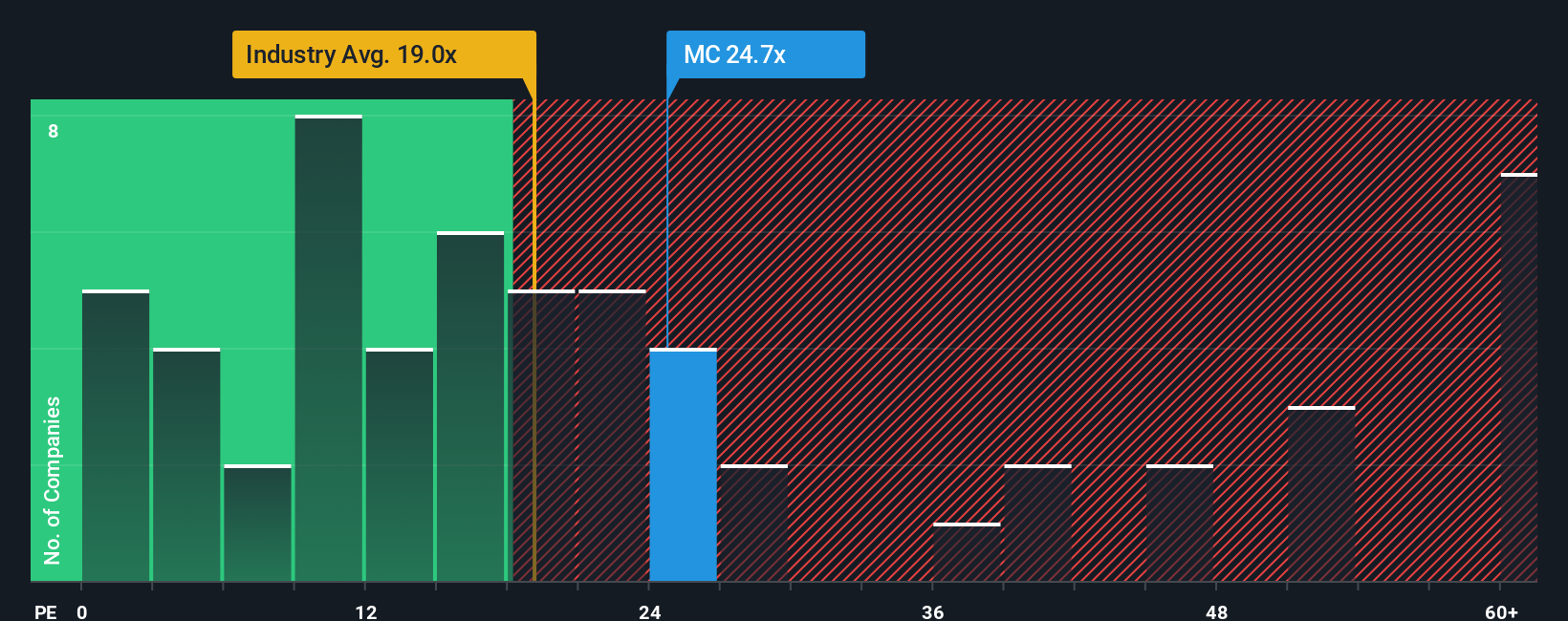

Looking at the company's price-to-earnings ratio of 27.7 times, LVMH sits well below the peer average of 39.2. However, it is noticeably above the European luxury industry average of 20.2. This creates a puzzling middle ground: investors see better value than rivals, but perhaps less safety than the sector as a whole. Could this gap widen or close as the market shifts?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own LVMH Moët Hennessy - Louis Vuitton Société Européenne Narrative

Keep in mind that if the current consensus does not match your perspective, you can dig into the data and develop your own outlook in just a few minutes. Do it your way.

A great starting point for your LVMH Moët Hennessy - Louis Vuitton Société Européenne research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Smart investors stay on top of trends and hidden gems before they become the next big story. Give your portfolio new possibilities by exploring these dynamic opportunities now. Missing out could mean leaving potential gains behind.

- Boost your passive income strategy with higher yields and discover your next dividend winner using these 17 dividend stocks with yields > 3%.

- Spot tomorrow’s market leaders by checking out these 27 AI penny stocks packed with companies powering the rise of artificial intelligence.

- Tap into breakthrough innovation finding its edge in finance and security with these 80 cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:MC

LVMH Moët Hennessy - Louis Vuitton Société Européenne

Operates as a luxury goods company worldwide.

Flawless balance sheet average dividend payer.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)