- France

- /

- Industrials

- /

- ENXTPA:CRI

Investors who have held Chargeurs (EPA:CRI) over the last three years have watched its earnings decline along with their investment

This week we saw the Chargeurs SA (EPA:CRI) share price climb by 11%. But that doesn't help the fact that the three year return is less impressive. In fact, the share price is down 43% in the last three years, falling well short of the market return.

While the last three years has been tough for Chargeurs shareholders, this past week has shown signs of promise. So let's look at the longer term fundamentals and see if they've been the driver of the negative returns.

See our latest analysis for Chargeurs

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

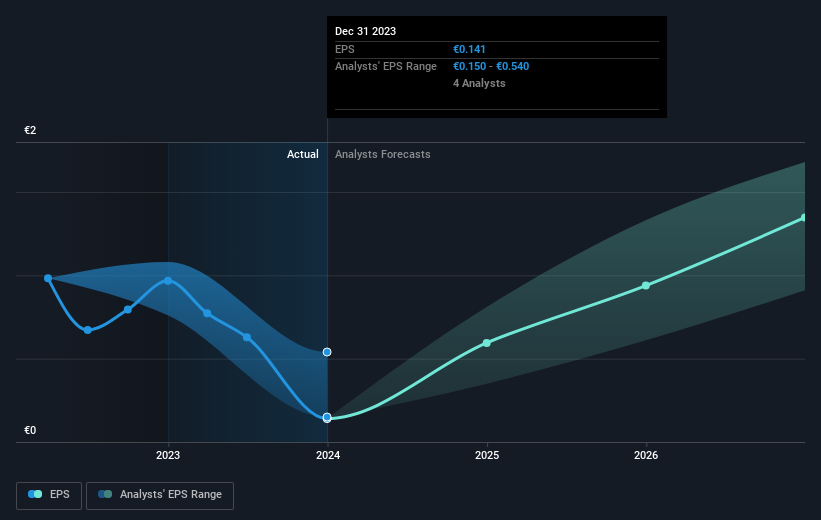

During the three years that the share price fell, Chargeurs' earnings per share (EPS) dropped by 57% each year. This fall in the EPS is worse than the 17% compound annual share price fall. So, despite the prior disappointment, shareholders must have some confidence the situation will improve, longer term. With a P/E ratio of 86.97, it's fair to say the market sees a brighter future for the business.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Chargeurs' total shareholder return (TSR) and its share price return. Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Its history of dividend payouts mean that Chargeurs' TSR, which was a 36% drop over the last 3 years, was not as bad as the share price return.

A Different Perspective

Investors in Chargeurs had a tough year, with a total loss of 15%, against a market gain of about 6.2%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.3% per year over five years. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 3 warning signs for Chargeurs (1 shouldn't be ignored!) that you should be aware of before investing here.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on French exchanges.

If you're looking to trade Compagnie Chargeurs Invest, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTPA:CRI

Compagnie Chargeurs Invest

Operates as an industrial and financial company in France, Italy, Germany, the United States, Mainland China, Hong Kong, the United Kingdom, and internationally.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives