- Finland

- /

- Healthcare Services

- /

- HLSE:ORIOLA

Discover European Penny Stocks: Groupe OKwind Société anonyme Leads Our Trio

Reviewed by Simply Wall St

The European market recently experienced a slight downturn, with the pan-European STOXX Europe 600 Index ending lower amid concerns over U.S. trade policies and mixed performances among major stock indices. Despite these challenges, opportunities remain for investors seeking value in lesser-known areas of the market. Penny stocks, while often seen as a nod to past trading eras, continue to offer potential through their affordability and growth prospects when supported by strong financials. In this article, we explore three European penny stocks that stand out for their financial strength and promise of hidden value.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.75 | SEK281.19M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.16 | SEK208.63M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.954 | €31.95M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK4.00 | SEK243.36M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.61 | €51.27M | ★★★★★★ |

| Deceuninck (ENXTBR:DECB) | €2.24 | €310.01M | ★★★★★★ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.40 | €24.25M | ★★★★★☆ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK1.998 | SEK1.91B | ★★★★☆☆ |

| TTS (Transport Trade Services) (BVB:TTS) | RON4.69 | RON844.44M | ★★★★★★ |

| IMS (WSE:IMS) | PLN3.63 | PLN123.04M | ★★★★☆☆ |

Click here to see the full list of 434 stocks from our European Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Groupe OKwind Société anonyme (ENXTPA:ALOKW)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Groupe OKwind Société anonyme designs, manufactures, sells, and installs green energy solutions in France with a market cap of €18.42 million.

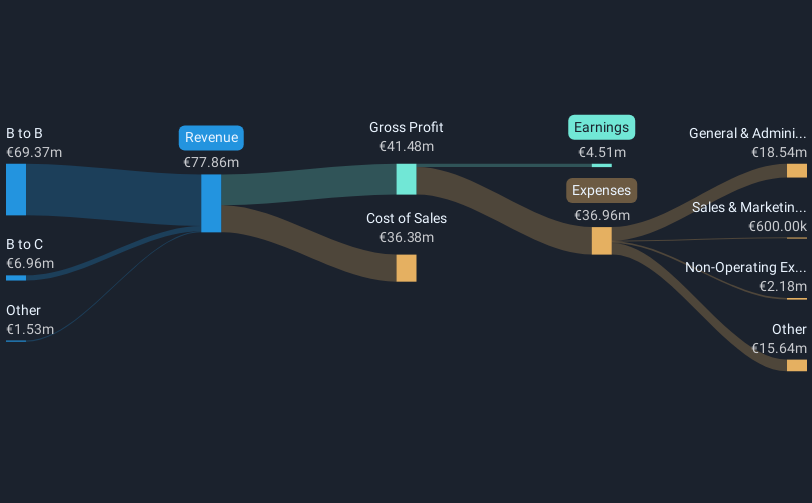

Operations: The company generates revenue primarily from its B to B segment, accounting for €69.37 million, and a smaller portion from the B to C segment at €6.96 million.

Market Cap: €18.42M

Groupe OKwind Société anonyme, with a market cap of €18.42 million, is expanding its industrial capacity through a new production site in Brittany, enhancing its green energy solutions. Despite recent earnings decline and volatile share price, the company maintains solid financial health with satisfactory debt levels and strong interest coverage. Its short-term assets significantly exceed liabilities, providing liquidity assurance. The stock trades at a lower P/E ratio compared to the French market, suggesting good relative value despite lower profit margins this year. The management team is experienced but faces challenges in accelerating profit growth amid industry competition.

- Take a closer look at Groupe OKwind Société anonyme's potential here in our financial health report.

- Understand Groupe OKwind Société anonyme's earnings outlook by examining our growth report.

Oriola Oyj (HLSE:OKDBV)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oriola Oyj operates in the healthcare and wellbeing sector, supplying products mainly in Sweden and Finland, with a market cap of €211.61 million.

Operations: Oriola Oyj has not reported any specific revenue segments.

Market Cap: €211.61M

Oriola Oyj, with a market cap of €211.61 million, operates in the healthcare sector across Sweden and Finland. Despite reporting a net loss of €20.1 million for 2024, Oriola's sales increased to €1.68 billion from the previous year, indicating potential revenue growth amidst financial challenges. The company has reduced its debt to equity ratio over five years and maintains sufficient cash flow coverage for its debt obligations. Recent management changes aim to bolster sales growth and streamline operations as it consolidates share classes to simplify governance structures while continuing dividend payouts despite earnings losses.

- Unlock comprehensive insights into our analysis of Oriola Oyj stock in this financial health report.

- Learn about Oriola Oyj's future growth trajectory here.

Scana (OB:SCANA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Scana ASA operates in the offshore, energy, and maritime sectors across Norway and various international markets with a market cap of NOK1.09 billion.

Operations: The company generates revenue primarily from its Energy segment with NOK824.6 million and its Offshore Segment with NOK1.20 billion.

Market Cap: NOK1.09B

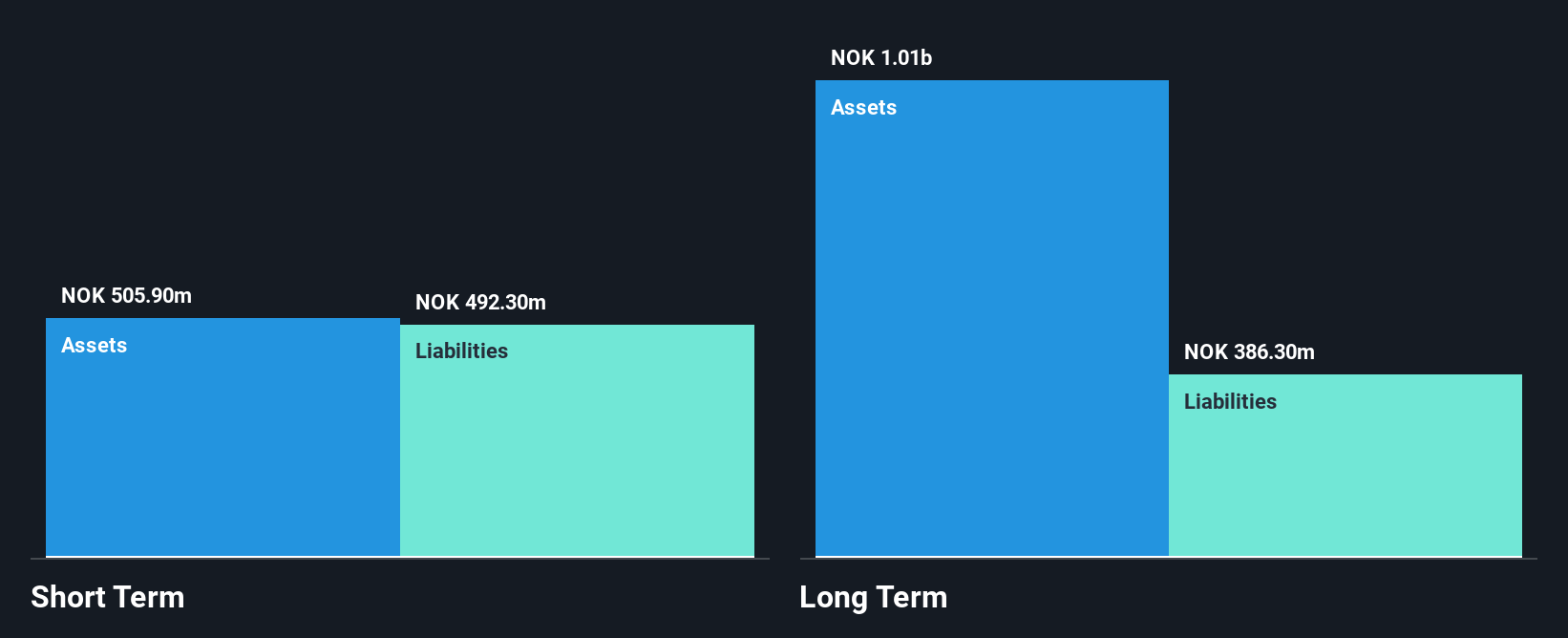

Scana ASA, with a market cap of NOK1.09 billion, operates in the offshore and energy sectors. Recently reporting full-year sales of NOK1.97 billion, Scana's earnings grew by 16.3% last year, surpassing industry averages despite a net loss in Q4 2024. The company maintains strong financial health with operating cash flow well covering its debt and short-term assets exceeding liabilities. However, profit margins slightly declined from the previous year to 4.2%. While trading at a significant discount to estimated fair value and peers, Scana's board lacks experience with an average tenure of just one year.

- Get an in-depth perspective on Scana's performance by reading our balance sheet health report here.

- Examine Scana's earnings growth report to understand how analysts expect it to perform.

Taking Advantage

- Jump into our full catalog of 434 European Penny Stocks here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Oriola Oyj, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:ORIOLA

Oriola Oyj

Engages in the wholesale of pharmaceuticals and health products in Sweden, Finland, and internationally.

Undervalued with excellent balance sheet.

Market Insights

Community Narratives