Did Alstom's (ENXTPA:ALO) CEO Transition Set the Stage for a New Strategic Direction?

Reviewed by Sasha Jovanovic

- Alstom SA recently announced that Martin Sion will take over as Group Chief Executive Officer from April 2026, succeeding long-serving CEO Henri Poupart-Lafarge, with continuity ensured through a planned leadership transition period.

- Martin Sion brings decades of engineering and executive experience from the aerospace and defense sectors, which could introduce new perspectives to Alstom's leadership during a period of operational transformation.

- We will explore how the appointment of Martin Sion as Alstom’s future CEO may influence the company's prospects and current investment case.

Outshine the giants: these 24 early-stage AI stocks could fund your retirement.

Alstom Investment Narrative Recap

To back Alstom as a shareholder, you need conviction that its restructuring and focus on higher-margin orders can overcome operational and supply chain challenges while capturing growth from global rail demand. The recent appointment of Martin Sion as future CEO signals leadership continuity, but the transition is unlikely to immediately shift the key short-term driver, resolving production delays and supply chain bottlenecks. As such, the most significant risk and catalyst remain unchanged right now.

The October 8 announcement of a contract for electric multiple-unit trains supports Alstom’s move toward sustainable mobility, reinforcing optimism about future orders. However, the project's execution will be closely watched, especially given ongoing concerns about supply chain reliability and timely delivery volumes.

Yet, in contrast to the optimism about growth, investors should be aware of potential penalties and financial strain if production delays or supply disruptions persist...

Read the full narrative on Alstom (it's free!)

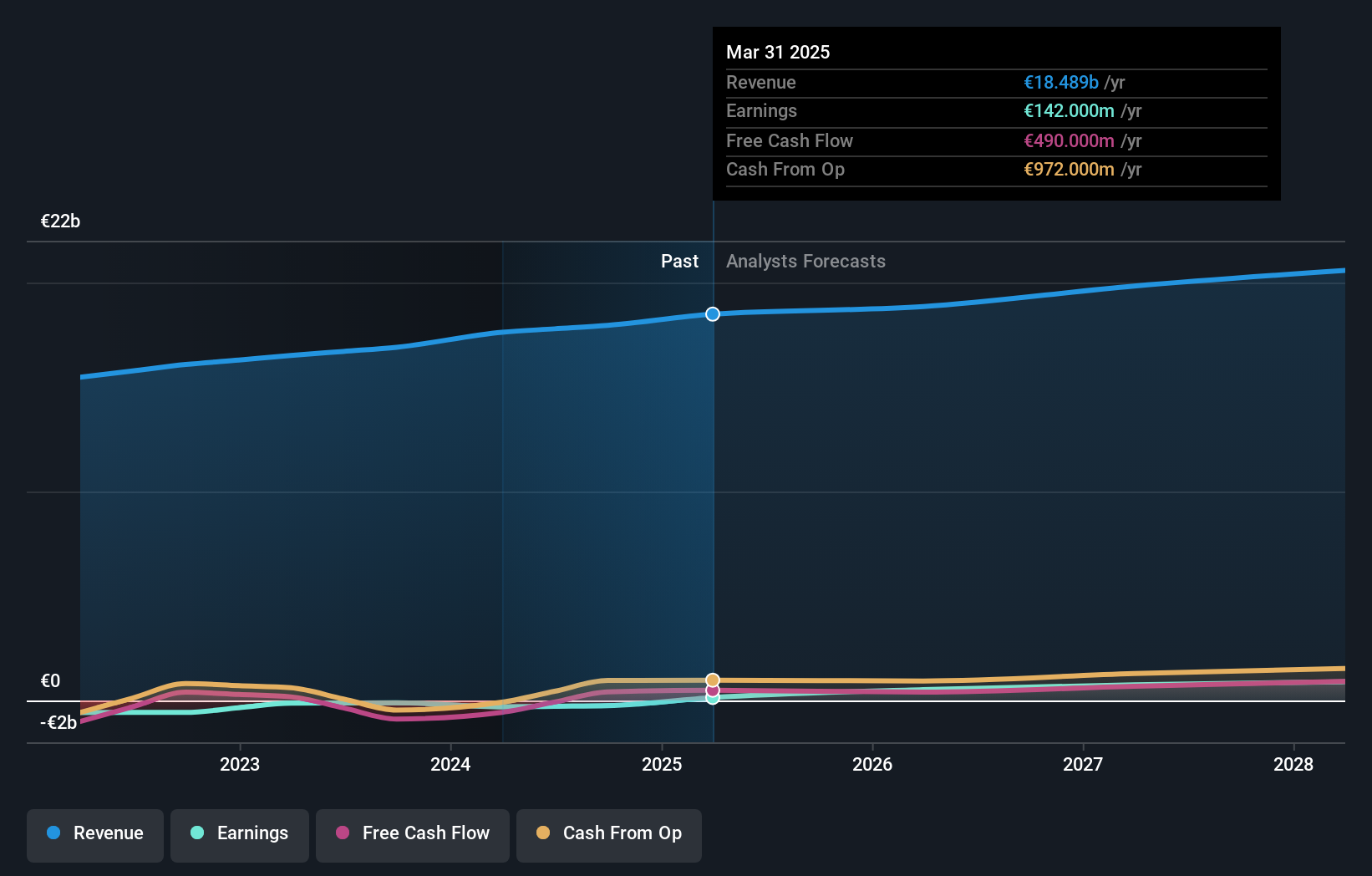

Alstom's narrative projects €20.6 billion revenue and €899.9 million earnings by 2028. This requires 3.6% yearly revenue growth and a €757.9 million earnings increase from €142.0 million today.

Uncover how Alstom's forecasts yield a €23.06 fair value, a 6% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members currently estimate Alstom's fair value between €18.02 and €23.06, reflecting a spread of three distinct viewpoints. Alongside this range, the urgent need to resolve supply chain delays highlights just how much execution risk could influence whether these expectations become reality, consider how views among investors can differ and find more perspectives below.

Explore 3 other fair value estimates on Alstom - why the stock might be worth 17% less than the current price!

Build Your Own Alstom Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- Our free Alstom research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Alstom's overall financial health at a glance.

No Opportunity In Alstom?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:ALO

Alstom

Provides solutions for rail transport industry in Europe, the Americas, the Asia Pacific, the Middle East, Central Asia, and Africa.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)