Did Societe Generale’s €1 Billion Buy-Back Just Shift Its Investment Narrative (ENXTPA:GLE)?

Reviewed by Sasha Jovanovic

- Societe Generale recently launched a €1 billion ordinary share buy-back program for shares cancellation, having received all necessary regulatory approvals and completing 79.4% of the planned repurchases as of early October 2025.

- The ongoing capital return initiative represents 1.8% of the company's share capital, signaling a significant commitment to enhancing shareholder value and drawing strong market interest as completion nears.

- We'll explore how progress on the €1 billion share buy-back may influence Société Générale's investment narrative and capital management outlook.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

Société Générale Société anonyme Investment Narrative Recap

To be a shareholder in Société Générale, you need confidence in the bank’s ability to drive operational leverage through digital transformation, cost control, and disciplined capital allocation. The latest €1 billion share buy-back, nearing completion, is a clear move to enhance returns in the short term, yet it does not materially shift the biggest immediate catalyst: further cost reductions. The principal near-term risk remains the possibility of weaker net interest income if rate pressures persist or cost discipline stalls, neither of which the buy-back directly addresses.

Of the recent announcements, the interim dividend set at €0.61 per share stands out as most relevant to the buy-back, reinforcing the emphasis on capital returns to shareholders. While these initiatives can strengthen shareholder sentiment, the underlying catalysts for sustainable progress are still anchored in ongoing efficiency measures, digital banking gains, and the ability to maintain earnings growth across market cycles.

However, investors should keep in mind that, despite rising distributions and share support, the risk of a prolonged low interest rate environment remains significant for Société Générale’s margins, especially if...

Read the full narrative on Société Générale Société anonyme (it's free!)

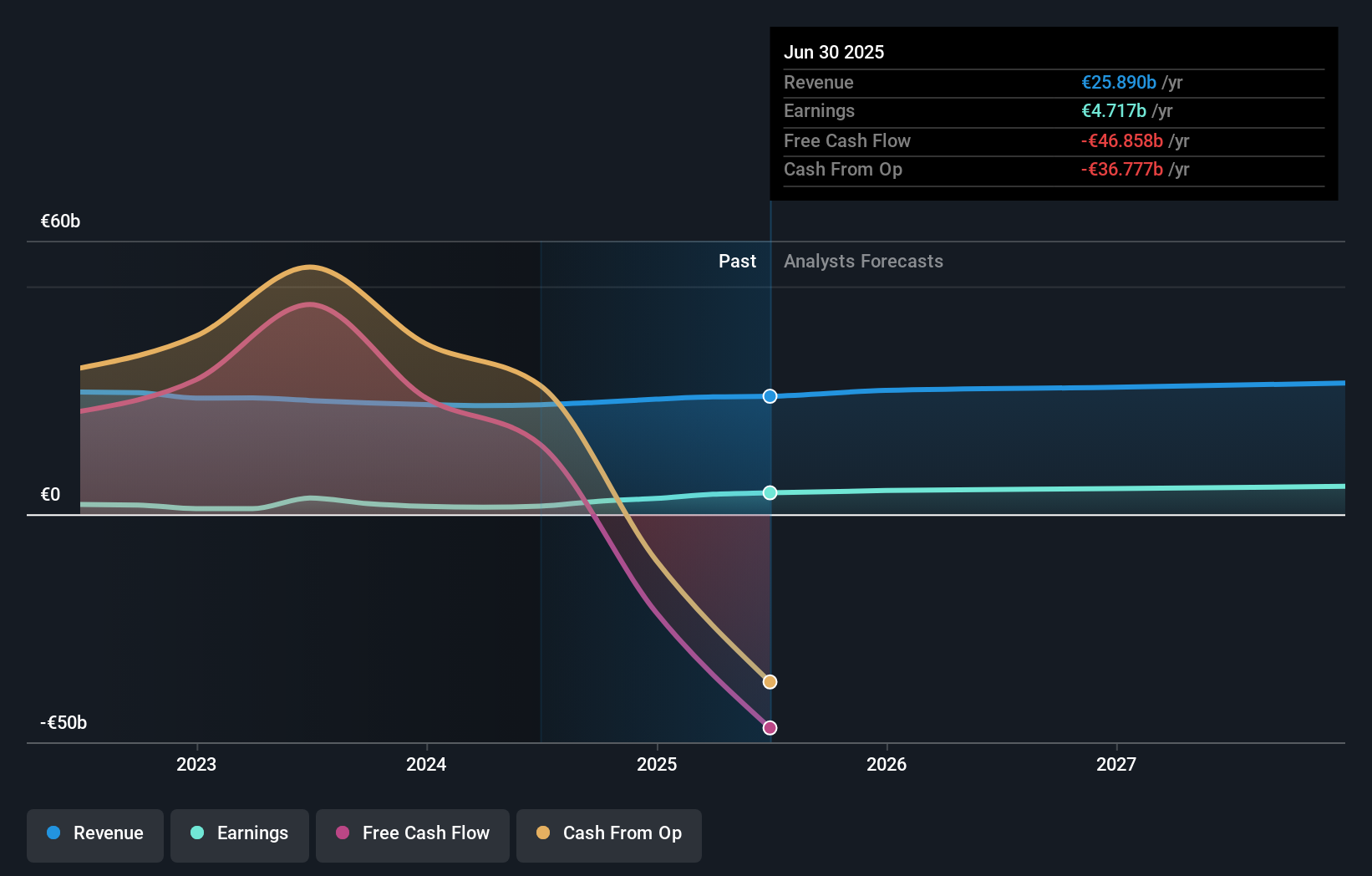

Société Générale Société anonyme's narrative projects €29.3 billion revenue and €5.9 billion earnings by 2028. This requires 4.2% yearly revenue growth and a €1.2 billion earnings increase from €4.7 billion.

Uncover how Société Générale Société anonyme's forecasts yield a €63.17 fair value, a 16% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided 5 fair value estimates for Société Générale ranging widely between €26.11 and €101.72. While buy-back progress supports sentiment, future earnings growth could face margin pressure if rates remain subdued, so it’s wise to compare multiple viewpoints before forming an opinion.

Explore 5 other fair value estimates on Société Générale Société anonyme - why the stock might be worth less than half the current price!

Build Your Own Société Générale Société anonyme Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Société Générale Société anonyme research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Société Générale Société anonyme research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Société Générale Société anonyme's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Rare earth metals are the new gold rush. Find out which 34 stocks are leading the charge.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:GLE

Société Générale Société anonyme

Provides banking and financial services to individuals, corporates, and institutional clients in Europe and internationally.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives