As the pan-European STOXX Europe 600 Index remains steady amidst fluctuating interest rate policies and trade concerns, investors are keenly observing small-cap stocks that could benefit from these dynamics. In this landscape, identifying promising stocks involves looking for companies with strong fundamentals and growth potential that can navigate the current economic environment.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Inmocemento | 28.68% | 3.60% | 33.84% | ★★★★★☆ |

| Evergent Investments | 3.82% | 10.46% | 23.17% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Zespól Elektrocieplowni Wroclawskich KOGENERACJA | 13.23% | 20.22% | 17.99% | ★★★★★☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Fope (BIT:FPE)

Simply Wall St Value Rating: ★★★★★★

Overview: Fope S.p.A. is an Italian company that manufactures and sells jewelry products both domestically and internationally, with a market capitalization of €222.46 million.

Operations: Fope generates revenue primarily through the manufacture and sale of jewelry products in Italy and internationally. The company has a market capitalization of €222.46 million.

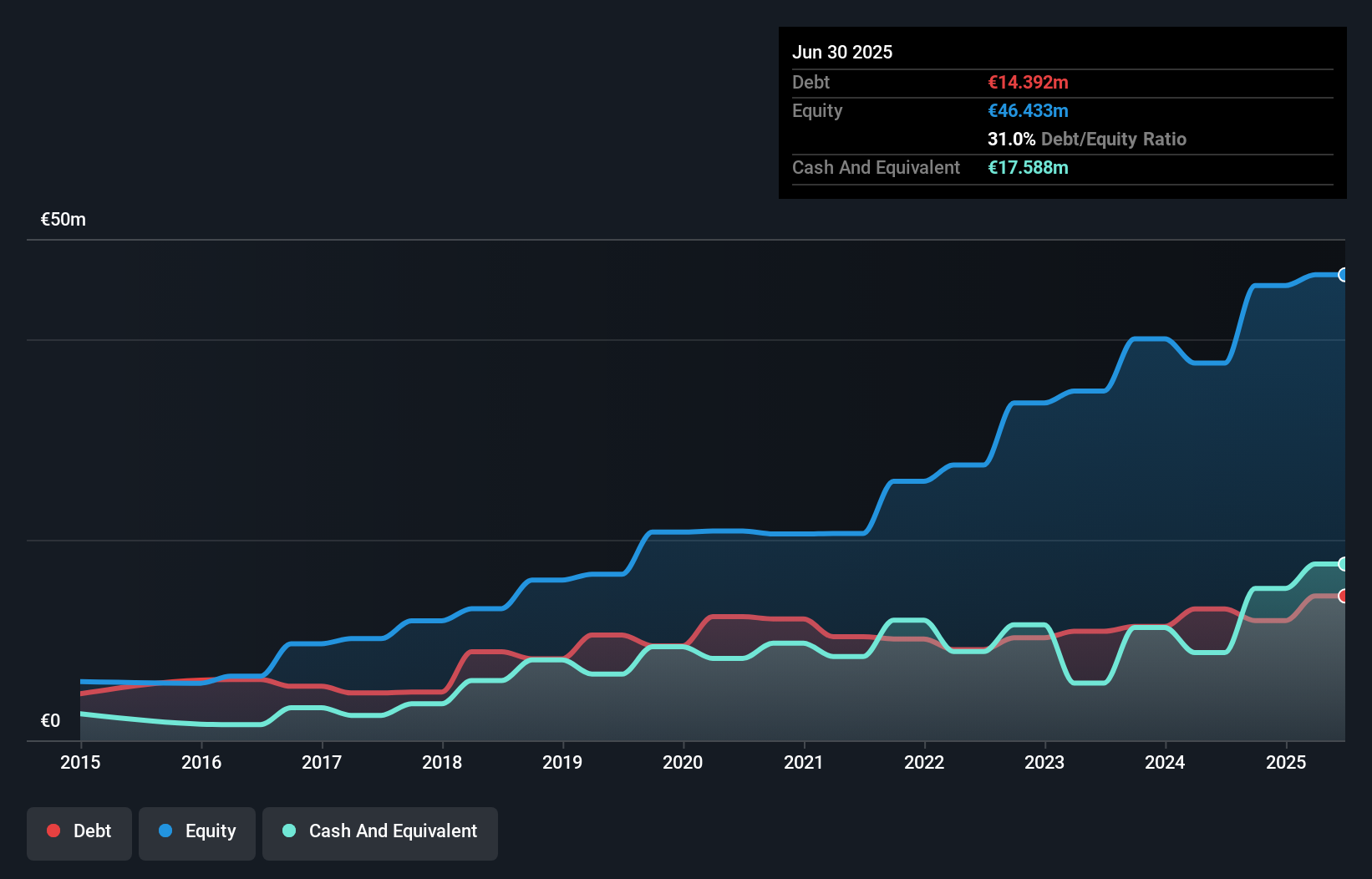

Fope, a luxury brand, showcases robust financial health with more cash than total debt and a debt-to-equity ratio reducing from 59.1% to 31% over five years. Its earnings growth of 104.2% outpaces the luxury industry’s -5.4%, highlighting its competitive edge. The company reported impressive half-year sales of €43.02 million, up from €29.64 million last year, with net income jumping to €5.61 million from €1.58 million previously. With an EBIT coverage of interest payments at 23x and a P/E ratio of 18x below the industry average, Fope seems well-positioned for continued success in its niche market.

- Dive into the specifics of Fope here with our thorough health report.

Examine Fope's past performance report to understand how it has performed in the past.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative offers diverse banking and financial services to various client segments in France, with a market cap of €1.47 billion.

Operations: The cooperative's primary revenue stream is retail banking, generating €662.31 million.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie, with total assets of €41.6B and equity of €5.7B, presents a compelling case in the European financial landscape. The company's earnings grew by 6.7% over the past year, outpacing the broader banks industry which saw a -0.3% change. It trades at 18.9% below its estimated fair value, suggesting potential upside for investors seeking undervalued opportunities. With customer deposits making up 91% of its liabilities, it relies on low-risk funding sources and maintains an appropriate bad loans ratio of 1.6%, supported by a sufficient allowance at 106%.

SpareBank 1 Helgeland (OB:HELG)

Simply Wall St Value Rating: ★★★★★☆

Overview: SpareBank 1 Helgeland is a Norwegian financial institution offering a range of products and services to retail customers, SMEs, municipal authorities, and institutions, with a market cap of NOK4.96 billion.

Operations: SpareBank 1 Helgeland generates revenue primarily through its financial services offered to retail customers, SMEs, municipal authorities, and institutions. The company has a market cap of NOK4.96 billion.

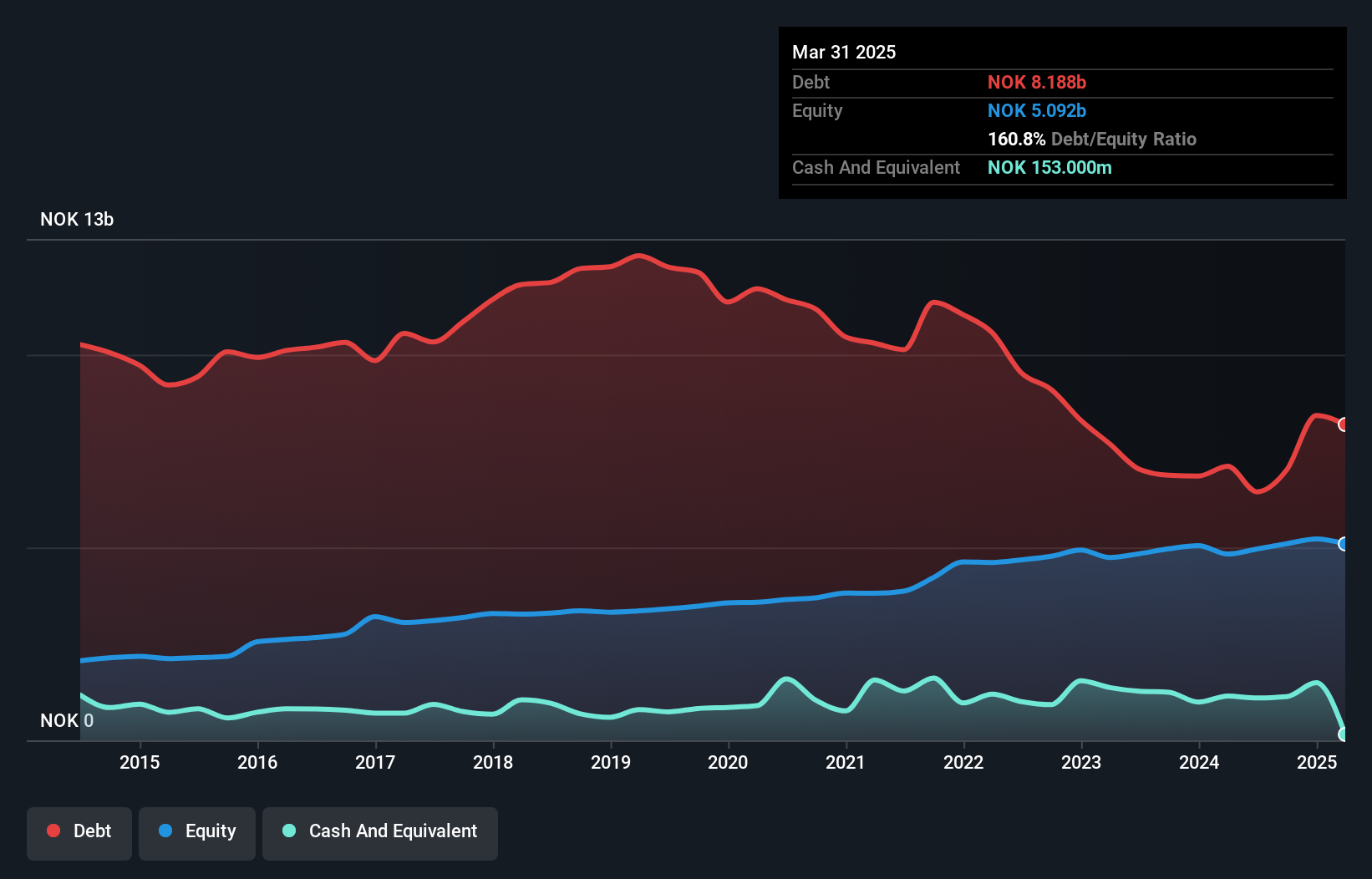

SpareBank 1 Helgeland, a compact financial player in Europe, showcases robust financial health with total assets of NOK40.7 billion and equity at NOK5.2 billion. Its loan portfolio stands at NOK32.1 billion, supported by deposits totaling NOK26 billion, reflecting a solid customer base that contributes to its low-risk funding structure. The bank's allowance for bad loans is notably low at 42%, while non-performing loans are kept in check at 1.9%. Recent earnings reveal stable performance with net income of NOK290 million for the first half of 2025 and consistent earnings per share from continuing operations at NOK8.1 compared to last year’s figures.

- Delve into the full analysis health report here for a deeper understanding of SpareBank 1 Helgeland.

Understand SpareBank 1 Helgeland's track record by examining our Past report.

Key Takeaways

- Take a closer look at our European Undiscovered Gems With Strong Fundamentals list of 336 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CRBP2

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative

Provides a range of banking and financial products and services to individuals, farmers, professionals, businesses, and public authorities in France.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives