- Finland

- /

- Communications

- /

- HLSE:NOKIA

Nokia Oyj (HLSE:NOKIA) Jumps 6.1% After Securing £2bn VodafoneThree UK 5G Network Contract—Has the Bull Case Changed?

Reviewed by Simply Wall St

- VodafoneThree, the newly formed UK mobile operator, recently announced a collaboration with Nokia and Ericsson, awarding contracts worth more than £2 billion to upgrade and expand its national network infrastructure over an eight-year period, with Nokia responsible for technology at 7,000 sites.

- This deal marks Nokia’s return as a supplier to Vodafone and Three in the UK, reinforcing its position as a significant player in next-generation 5G network deployments across Europe.

- We’ll now review how Nokia’s role in this substantial UK network contract may impact its growth outlook and long-term investment case.

AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Nokia Oyj Investment Narrative Recap

To be a Nokia shareholder, it helps to believe in the long-term growth potential of 5G and next-generation mobile networks, as well as sustained infrastructure investment in Europe and beyond. The £2 billion VodafoneThree contract signals renewed confidence in Nokia’s technical solutions and footprint in the UK, though the biggest short-term catalyst, market share recovery in Mobile Networks, relies on scale and execution beyond this single win. The most immediate risk remains stiff competition and pressure on margins within the global mobile equipment market, as downward pricing and open standards adoption continue.

One announcement closely tied to this catalyst is Nokia's September 2025 partnership with Datwyler IT Infra, Intel, and Switzerland Innovation Park Biel/Bienne to build a hub for private 5G and AI-powered solutions. This move supports industrial digitalization and highlights growing non-carrier demand for Nokia’s tech, which could add resilience to performance if telco spending slows. Yet, while these initiatives may broaden addressable opportunities, the impact on near-term revenue mix depends on scale and adoption rates.

By contrast, investors should also be mindful of Nokia’s ongoing reliance on large carrier capital spending cycles and the risk that...

Read the full narrative on Nokia Oyj (it's free!)

Nokia Oyj's narrative projects €21.0 billion in revenue and €1.7 billion in earnings by 2028. This requires 3.0% annual revenue growth and an increase of €791.0 million in earnings from €909.0 million today.

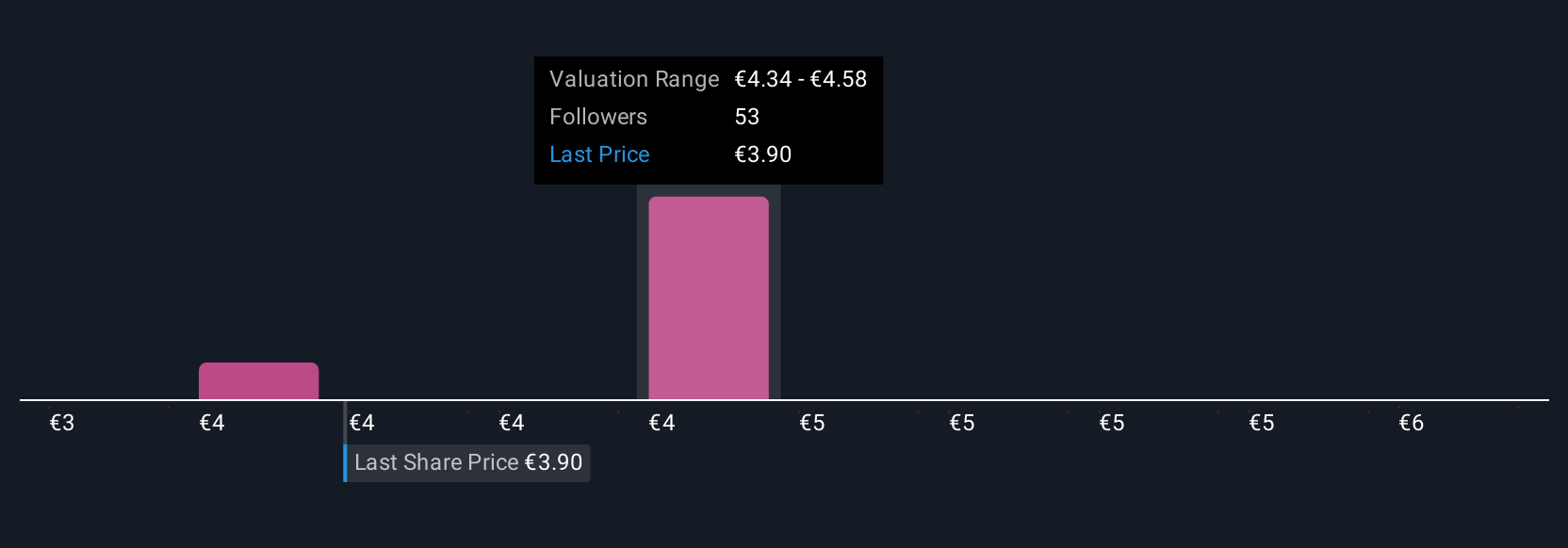

Uncover how Nokia Oyj's forecasts yield a €4.45 fair value, a 9% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members provided four fair value estimates for Nokia shares, ranging from €3.40 to €5.75. With opinions varying widely, some investors see untapped upside, while others focus on risks like limited revenue growth in Mobile Networks potentially capping further gains.

Explore 4 other fair value estimates on Nokia Oyj - why the stock might be worth as much as 41% more than the current price!

Build Your Own Nokia Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nokia Oyj research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nokia Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nokia Oyj's overall financial health at a glance.

Seeking Other Investments?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives