- Finland

- /

- Communications

- /

- HLSE:NOKIA

Nokia Oyj (HLSE:NOKIA) Expands U.S. Broadband Reach with Superior Fiber Win Is Its Strategy Gaining Traction?

Reviewed by Simply Wall St

- Earlier this week, the City of Superior announced it selected Nokia to provide fiber and IP solutions for its citywide ConnectSuperior broadband initiative, aiming to deliver wholesale open-access fiber infrastructure to 26,000 underserved residents and businesses.

- This project underscores Nokia's expanding involvement in U.S. broadband deployments, highlighting its key role in enabling modern network infrastructure for underserved American communities.

- We'll explore how Nokia's role in bringing fiber broadband to unserved U.S. households could reshape its growth outlook and investment narrative.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Nokia Oyj Investment Narrative Recap

To own Nokia, you need to believe in its ability to gain share in the next wave of broadband and cloud networking, as well as to overcome ongoing margin pressures in its core Mobile Networks business. The City of Superior broadband project supports Nokia’s presence in the US infrastructure space, but on its own is unlikely to materially shift the main short-term catalyst: improved profitability tied to a ramp in high-margin cloud and fixed network contracts. The greatest risk remains continued margin compression if market share losses and commoditization trends persist, especially in Mobile Networks, regardless of contract wins.

Among Nokia’s recent announcements, the partnership with Vortex Group to upgrade IP edge and transport networks in India stands out as most closely related. It reflects Nokia’s broader push into underserved regions and reinforces the relevance of fiber and IP solutions as margin contributors, but also highlights the importance of execution in high-potential but highly competitive markets.

Yet, investors should also be aware that, despite contract wins, ongoing pressure from flat revenue trends in key segments still looms as...

Read the full narrative on Nokia Oyj (it's free!)

Nokia Oyj's narrative projects €21.0 billion revenue and €1.7 billion earnings by 2028. This requires 3.0% yearly revenue growth and a €791 million increase in earnings from €909.0 million today.

Uncover how Nokia Oyj's forecasts yield a €4.45 fair value, a 15% upside to its current price.

Exploring Other Perspectives

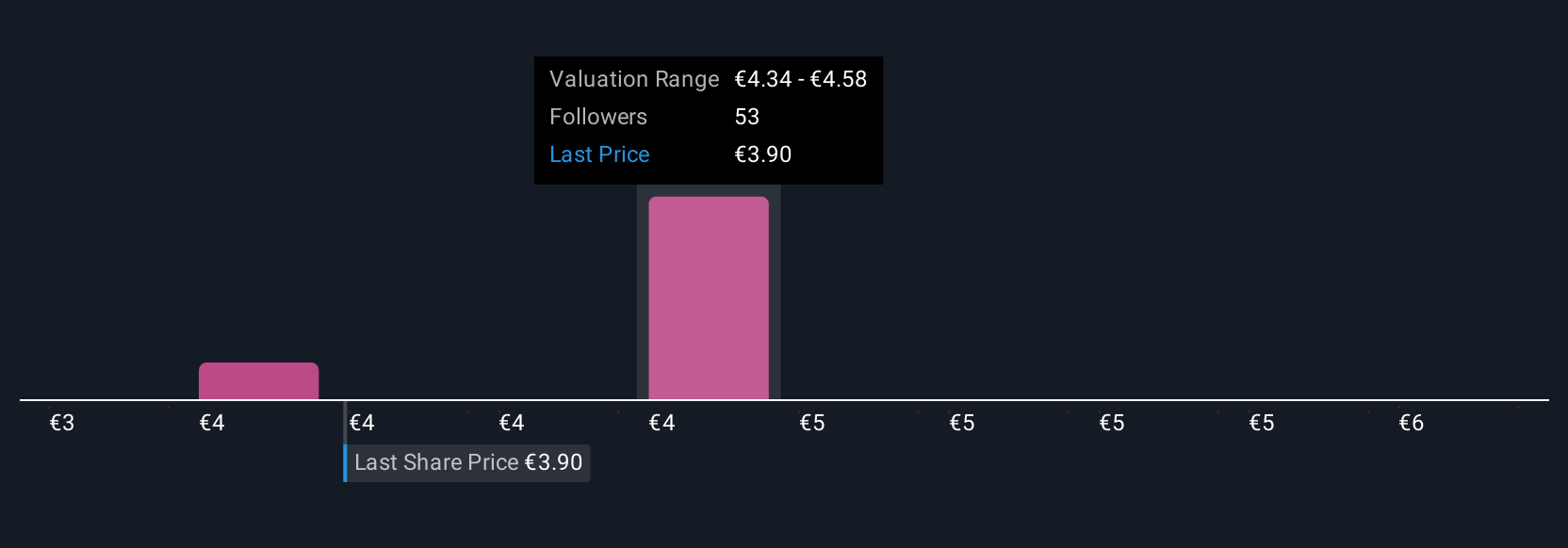

Four Simply Wall St Community members place their fair values for Nokia between €3.40 and €5.75, highlighting a wide range of independent analysis. With persistent pressure on Mobile Networks profit margins, these differing views invite you to explore how valuation perspectives can influence your investment decision.

Explore 4 other fair value estimates on Nokia Oyj - why the stock might be worth 12% less than the current price!

Build Your Own Nokia Oyj Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nokia Oyj research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Nokia Oyj research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nokia Oyj's overall financial health at a glance.

No Opportunity In Nokia Oyj?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are the new gold rush. Find out which 30 stocks are leading the charge.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nokia Oyj might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:NOKIA

Nokia Oyj

Provides mobile, fixed, and cloud network solutions in North and Latin America, Greater China, India, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives