As global markets continue to navigate the complexities of rising inflation and shifting economic policies, U.S. stock indexes have climbed toward record highs, with growth stocks outpacing their value counterparts. For investors interested in smaller or newer companies, penny stocks—despite their somewhat outdated name—remain a relevant investment area offering potential for growth at lower price points. When these stocks are supported by strong financial health and solid fundamentals, they can present opportunities for upside while mitigating some of the risks typically associated with this segment of the market.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.515 | MYR2.56B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £4.05 | £327.19M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.94 | HK$45.23B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £448.86M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.942 | £150.13M | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.33 | MYR918.11M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.80 | A$146.79M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.07 | £305.33M | ★★★★☆☆ |

| Secure Trust Bank (LSE:STB) | £4.28 | £81.63M | ★★★★☆☆ |

Click here to see the full list of 5,678 stocks from our Penny Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

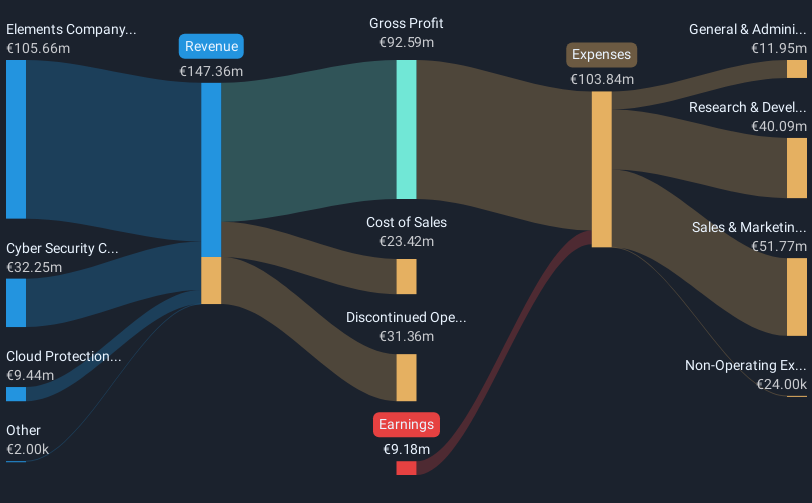

WithSecure Oyj (HLSE:WITH)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: WithSecure Oyj operates in the corporate security business globally and has a market capitalization of €175.14 million.

Operations: The company's revenue is primarily derived from its Elements Company segment (€105.66 million), Cyber Security Consulting (€32.25 million), and Cloud Protection for Salesforce (€9.44 million).

Market Cap: €175.14M

WithSecure Oyj, operating in the corporate security sector, has a market cap of €175.14 million and reported annual sales of €116 million for 2024. Despite being unprofitable with a net loss of €37.98 million, the company maintains more cash than its total debt and has reduced its debt-to-equity ratio significantly over five years. Its short-term assets exceed both short- and long-term liabilities, providing financial stability. While management is experienced with an average tenure of 2.1 years, the board is relatively new with less experience. The stock trades at a good value compared to peers and industry estimates.

- Jump into the full analysis health report here for a deeper understanding of WithSecure Oyj.

- Assess WithSecure Oyj's future earnings estimates with our detailed growth reports.

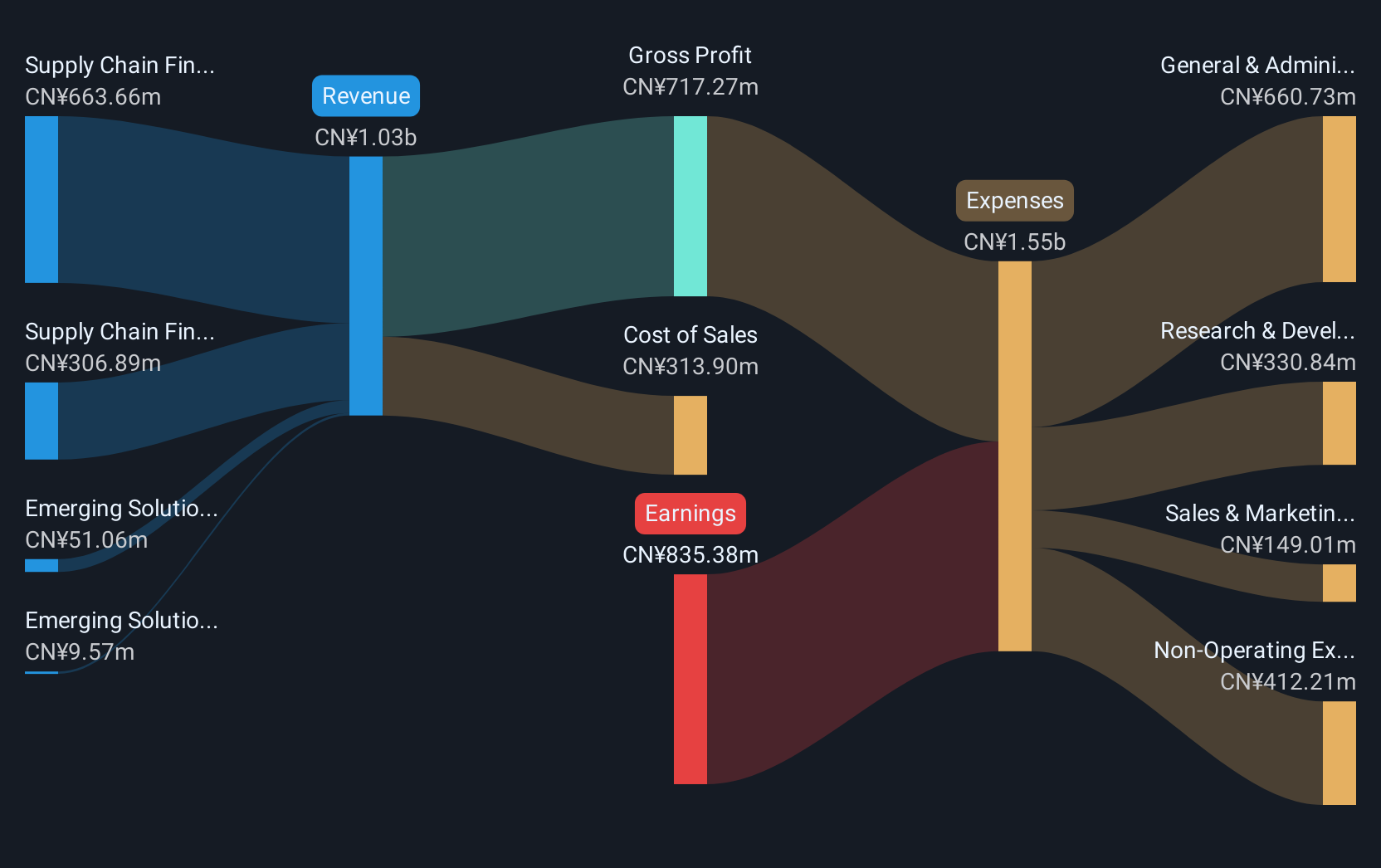

Linklogis (SEHK:9959)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Linklogis Inc. is an investment holding company that offers supply chain finance technology and data-driven solutions in Mainland China, with a market cap of HK$4.24 billion.

Operations: Linklogis generates revenue through its Supply Chain Finance Technology Solutions, comprising CN¥590.19 million from Anchor Cloud and CN¥255.31 million from FI Cloud, as well as Emerging Solutions, which include CN¥35.39 million from Cross-Border Cloud and CN¥8.96 million from SME Credit Tech Solutions.

Market Cap: HK$4.24B

Linklogis Inc., with a market cap of HK$4.24 billion, is unprofitable but maintains a positive free cash flow and sufficient cash runway for over three years. The company's short-term assets significantly exceed its liabilities, indicating solid financial health. Recent developments include the launch of the BeeFeather AI Document Check Platform, enhancing supply chain finance efficiency through AI-driven solutions. Despite high share price volatility and insider selling activity, Linklogis' strategic focus on AI technology positions it to capitalize on emerging market opportunities in supply chain finance innovation and operational optimization within financial institutions.

- Click here and access our complete financial health analysis report to understand the dynamics of Linklogis.

- Learn about Linklogis' future growth trajectory here.

AEM Holdings (SGX:AWX)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: AEM Holdings Ltd. offers application-specific intelligent system tests and handling solutions for semiconductor and electronics companies, with a market cap of SGD491.44 million.

Operations: The company has not reported any specific revenue segments.

Market Cap: SGD491.44M

AEM Holdings Ltd., with a market cap of SGD491.44 million, shows strong financial positioning as its short-term assets (SGD452.7M) exceed both short-term and long-term liabilities, suggesting robust liquidity. Despite being unprofitable with a negative return on equity (-1.01%), the company maintains satisfactory debt levels with net debt to equity at 8.4% and well-covered interest payments by EBIT (6.3x coverage). Recent executive changes include the appointment of Mr. Kwek You-Cheer as CFO, bringing over 20 years of strategic financial leadership to enhance AEM’s operational efficiency and financial strategy amidst its growth trajectory forecasted at 87.54% annually in earnings.

- Get an in-depth perspective on AEM Holdings' performance by reading our balance sheet health report here.

- Examine AEM Holdings' earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Unlock our comprehensive list of 5,678 Penny Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:9959

Linklogis

An investment holding company, provides supply chain finance technology and data-driven emerging solutions in Mainland China.

Flawless balance sheet low.

Market Insights

Community Narratives