- Sweden

- /

- Interactive Media and Services

- /

- OM:BETCO

3 European Companies Estimated To Be Undervalued By Up To 46.6%

Reviewed by Simply Wall St

As European markets continue to navigate the complexities of mixed inflation data and economic contractions in major economies like Germany and France, the pan-European STOXX Europe 600 Index has managed to post its longest streak of weekly gains since 2012. In this environment, identifying undervalued stocks becomes crucial for investors looking to capitalize on potential market inefficiencies, particularly as encouraging company results offer a glimmer of optimism amidst broader uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sword Group (ENXTPA:SWP) | €33.20 | €64.46 | 48.5% |

| Laboratorios Farmaceuticos Rovi (BME:ROVI) | €53.65 | €107.22 | 50% |

| Novo Nordisk (CPSE:NOVO B) | DKK631.50 | DKK1234.68 | 48.9% |

| Schoeller-Bleckmann Oilfield Equipment (WBAG:SBO) | €32.60 | €63.35 | 48.5% |

| Hybrid Software Group (ENXTBR:HYSG) | €3.62 | €7.05 | 48.6% |

| Storytel (OM:STORY B) | SEK89.55 | SEK177.35 | 49.5% |

| Fnac Darty (ENXTPA:FNAC) | €28.00 | €55.38 | 49.4% |

| Star7 (BIT:STAR7) | €6.20 | €12.29 | 49.5% |

| Vestas Wind Systems (CPSE:VWS) | DKK103.35 | DKK201.53 | 48.7% |

| EKINOPS (ENXTPA:EKI) | €3.52 | €6.84 | 48.5% |

Let's explore several standout options from the results in the screener.

Puuilo Oyj (HLSE:PUUILO)

Overview: Puuilo Oyj operates a discount retail chain in Finland and has a market cap of €860.75 million.

Operations: The company's revenue primarily comes from its retail department stores, generating €364.50 million.

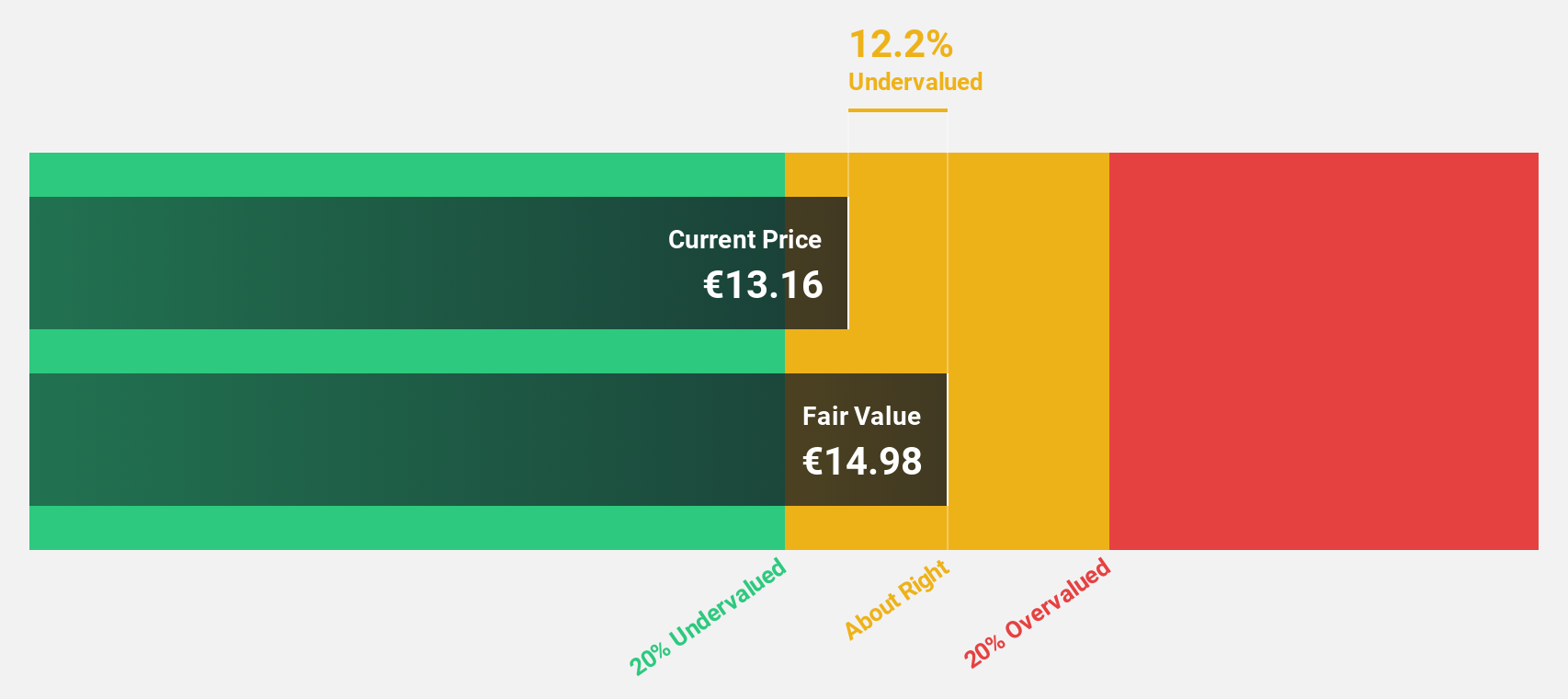

Estimated Discount To Fair Value: 31.8%

Puuilo Oyj is trading at €10.22, significantly below its estimated fair value of €14.98, representing a 31.8% discount. The company shows robust earnings growth potential with forecasts of 14.4% annually, outpacing the Finnish market's average of 11.4%. Despite slower revenue growth at 11.1%, it surpasses the Finnish market's projected rate of 3.2%. Furthermore, Puuilo's return on equity is expected to reach a very high level in three years, enhancing its appeal as an undervalued stock based on cash flows in Europe.

- Our earnings growth report unveils the potential for significant increases in Puuilo Oyj's future results.

- Dive into the specifics of Puuilo Oyj here with our thorough financial health report.

Better Collective (OM:BETCO)

Overview: Better Collective A/S operates as a digital sports media company in Europe, North America, and internationally, with a market cap of SEK7.01 billion.

Operations: The company generates revenue through two primary segments: Paid Media, which contributes €106.79 million, and Publishing, accounting for €264.70 million.

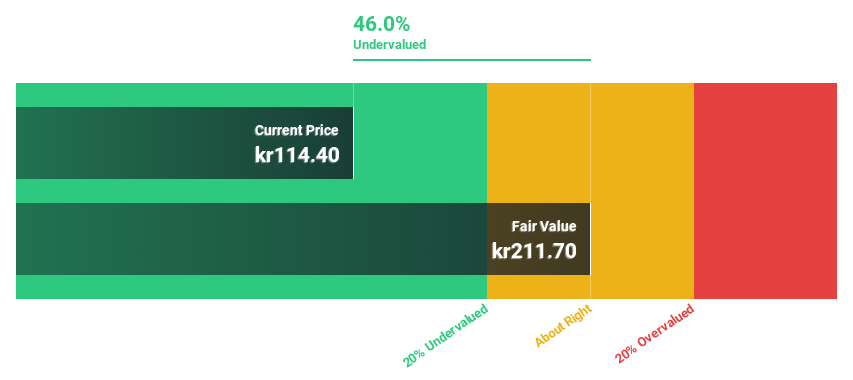

Estimated Discount To Fair Value: 46.6%

Better Collective is trading at SEK113.2, significantly below its estimated fair value of SEK212.04, offering a 46.6% discount. The company anticipates strong annual earnings growth of 23.5%, surpassing the Swedish market's average of 9.4%. However, revenue growth is expected to be modest at 4% per year and debt coverage by operating cash flow remains inadequate. Recent results showed an increase in Q4 sales to €96.18 million, with net income doubling compared to the previous year’s quarter.

- Our expertly prepared growth report on Better Collective implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of Better Collective with our comprehensive financial health report here.

DO & CO (WBAG:DOC)

Overview: DO & CO Aktiengesellschaft is a catering service provider operating in Austria, Turkey, Great Britain, the United States, Spain, Germany, and internationally with a market cap of €2.35 billion.

Operations: The company's revenue segments include Airline Catering (€1.75 billion), International Event Catering (€313.27 million), and Restaurants, Lounges & Hotels (€168.96 million).

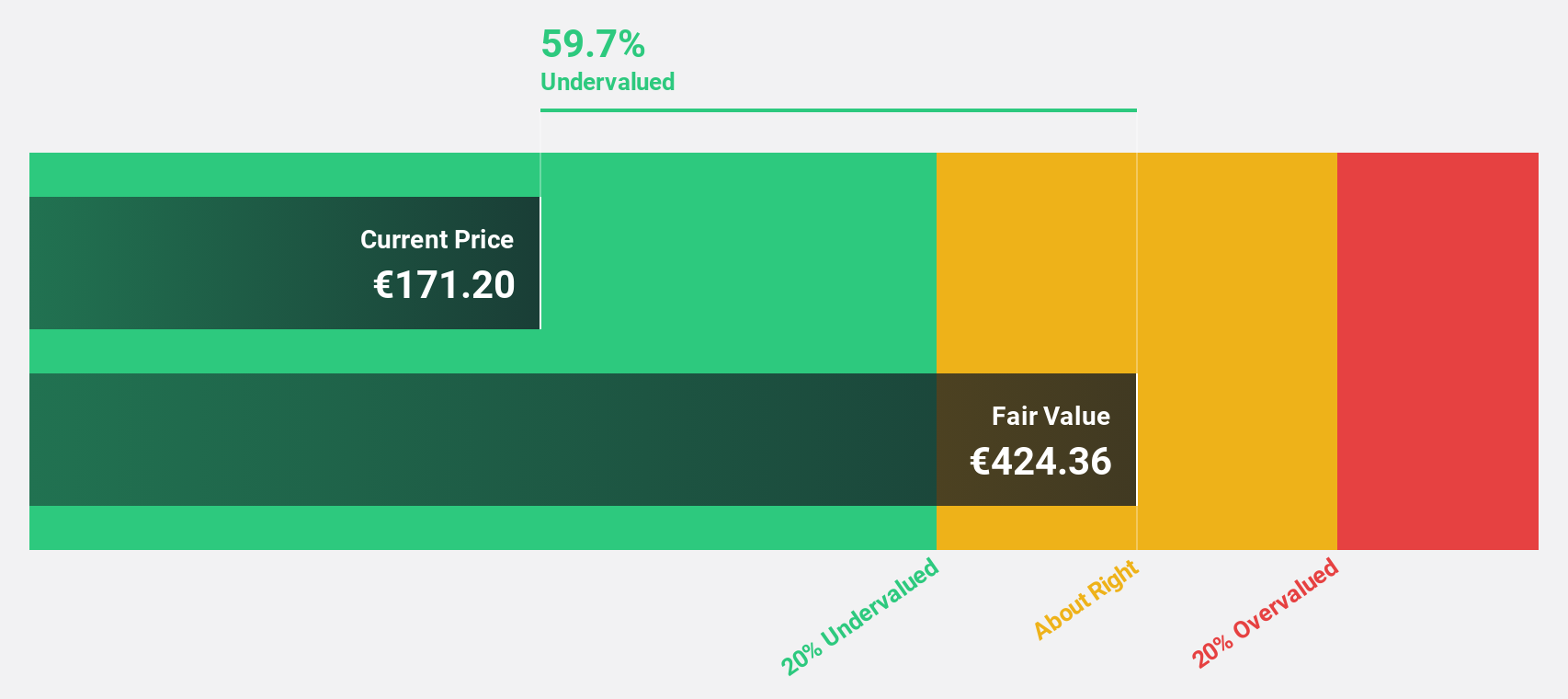

Estimated Discount To Fair Value: 37.8%

DO & CO Aktiengesellschaft is trading at €214, significantly below its estimated fair value of €343.95, representing a 37.8% discount. The company reported robust earnings growth of 41% over the past year and forecasts an annual profit increase of 17.5%, outpacing the Austrian market's average growth rate. With third-quarter sales rising to €642.97 million from €478.12 million a year ago, DO & CO demonstrates strong cash flow potential despite slower revenue growth projections at 5.3% annually.

- According our earnings growth report, there's an indication that DO & CO might be ready to expand.

- Unlock comprehensive insights into our analysis of DO & CO stock in this financial health report.

Turning Ideas Into Actions

- Delve into our full catalog of 202 Undervalued European Stocks Based On Cash Flows here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Better Collective might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:BETCO

Better Collective

Operates as a digital sports media company in Europe, North America, and internationally.

Good value with reasonable growth potential.