Rebl Group Oyj (HEL:REBL) Not Doing Enough For Some Investors As Its Shares Slump 25%

The Rebl Group Oyj (HEL:REBL) share price has fared very poorly over the last month, falling by a substantial 25%. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 58% loss during that time.

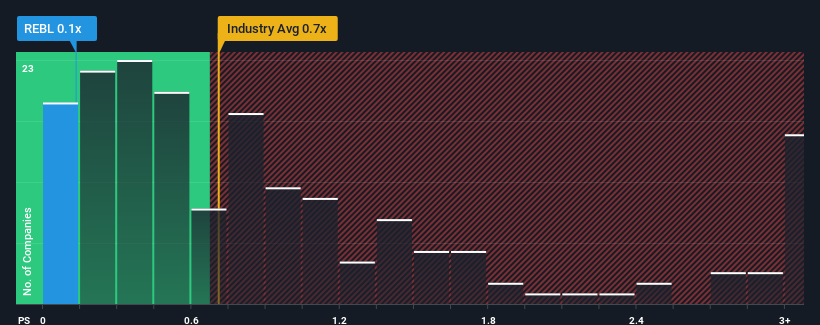

After such a large drop in price, given about half the companies operating in Finland's Media industry have price-to-sales ratios (or "P/S") above 0.8x, you may consider Rebl Group Oyj as an attractive investment with its 0.1x P/S ratio. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the reduced P/S.

Check out our latest analysis for Rebl Group Oyj

How Rebl Group Oyj Has Been Performing

Recent revenue growth for Rebl Group Oyj has been in line with the industry. Perhaps the market is expecting future revenue performance to dive, which has kept the P/S suppressed. Those who are bullish on Rebl Group Oyj will be hoping that this isn't the case.

Keen to find out how analysts think Rebl Group Oyj's future stacks up against the industry? In that case, our free report is a great place to start.How Is Rebl Group Oyj's Revenue Growth Trending?

The only time you'd be truly comfortable seeing a P/S as low as Rebl Group Oyj's is when the company's growth is on track to lag the industry.

Retrospectively, the last year delivered virtually the same number to the company's top line as the year before. Still, the latest three year period was better as it's delivered a decent 29% overall rise in revenue. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Turning to the outlook, the next three years should bring diminished returns, with revenue decreasing 7.4% each year as estimated by the one analyst watching the company. Meanwhile, the broader industry is forecast to expand by 0.7% each year, which paints a poor picture.

In light of this, it's understandable that Rebl Group Oyj's P/S would sit below the majority of other companies. However, shrinking revenues are unlikely to lead to a stable P/S over the longer term. Even just maintaining these prices could be difficult to achieve as the weak outlook is weighing down the shares.

What Does Rebl Group Oyj's P/S Mean For Investors?

Rebl Group Oyj's P/S has taken a dip along with its share price. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

With revenue forecasts that are inferior to the rest of the industry, it's no surprise that Rebl Group Oyj's P/S is on the lower end of the spectrum. Right now shareholders are accepting the low P/S as they concede future revenue probably won't provide any pleasant surprises. It's hard to see the share price rising strongly in the near future under these circumstances.

It is also worth noting that we have found 3 warning signs for Rebl Group Oyj (2 don't sit too well with us!) that you need to take into consideration.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:REBL

Rebl Group Oyj

Primarily engages in printing and designing of magazines and newspapers business in Finland.

Undervalued with mediocre balance sheet.

Market Insights

Community Narratives