- Finland

- /

- Paper and Forestry Products

- /

- HLSE:UPM

UPM-Kymmene (HLSE:UPM): Unlocking Value Beyond Sideways Share Price Movement

Reviewed by Kshitija Bhandaru

UPM-Kymmene Oyj (HLSE:UPM) continues to draw investor attention as its share price trends sideways, even though annual revenue growth has been modest. Recent trading suggests participants are weighing long-term prospects in the materials sector against short-term volatility.

See our latest analysis for UPM-Kymmene Oyj.

Despite muted momentum in 2024 so far, with the year-to-date share price return sitting at -13%, UPM-Kymmene’s longer-term story remains one of resilience in a cyclical sector. The five-year total shareholder return reaches 11%, suggesting patient investors have still been able to realize gains even as shorter-term sentiment fluctuates alongside commodity prices and economic signals.

If you’re keeping an eye on market resilience and want to uncover other interesting stories, this could be the perfect time to explore fast growing stocks with high insider ownership.

With UPM-Kymmene trading at a notable discount to analyst price targets, investors must consider whether the current valuation is an overlooked bargain or if the market is already reflecting all that future growth has to offer.

Most Popular Narrative: 13% Undervalued

UPM-Kymmene’s most widely followed narrative sets its fair value noticeably above the latest closing price, drawing attention to growth expectations and sector shifts. This perspective frames the current market price as a potential opportunity for those willing to look past short-term swings and consider the transformative trends underway.

The successful startup of the first core process at the Leuna biorefinery marks a crucial step toward new revenue streams in renewable chemicals, with full positive EBIT from this initiative expected by 2027 as global regulatory and consumer shifts drive demand for sustainable alternatives. (positive impact on future revenue and EBIT margins)

What exactly fuels the market optimism in this narrative? Underneath this bullish view are bold projections in profit margins, aggressive earnings targets, and a valuation multiple traditionally reserved for stronger growth industries. Craving the details behind these forecasts? Don’t just guess—see what makes this valuation so compelling.

Result: Fair Value of €27.13 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand for paper and high raw material costs could undermine optimistic forecasts and challenge UPM-Kymmene’s longer term earnings momentum.

Find out about the key risks to this UPM-Kymmene Oyj narrative.

Another View: Is the Market Overlooking Risks?

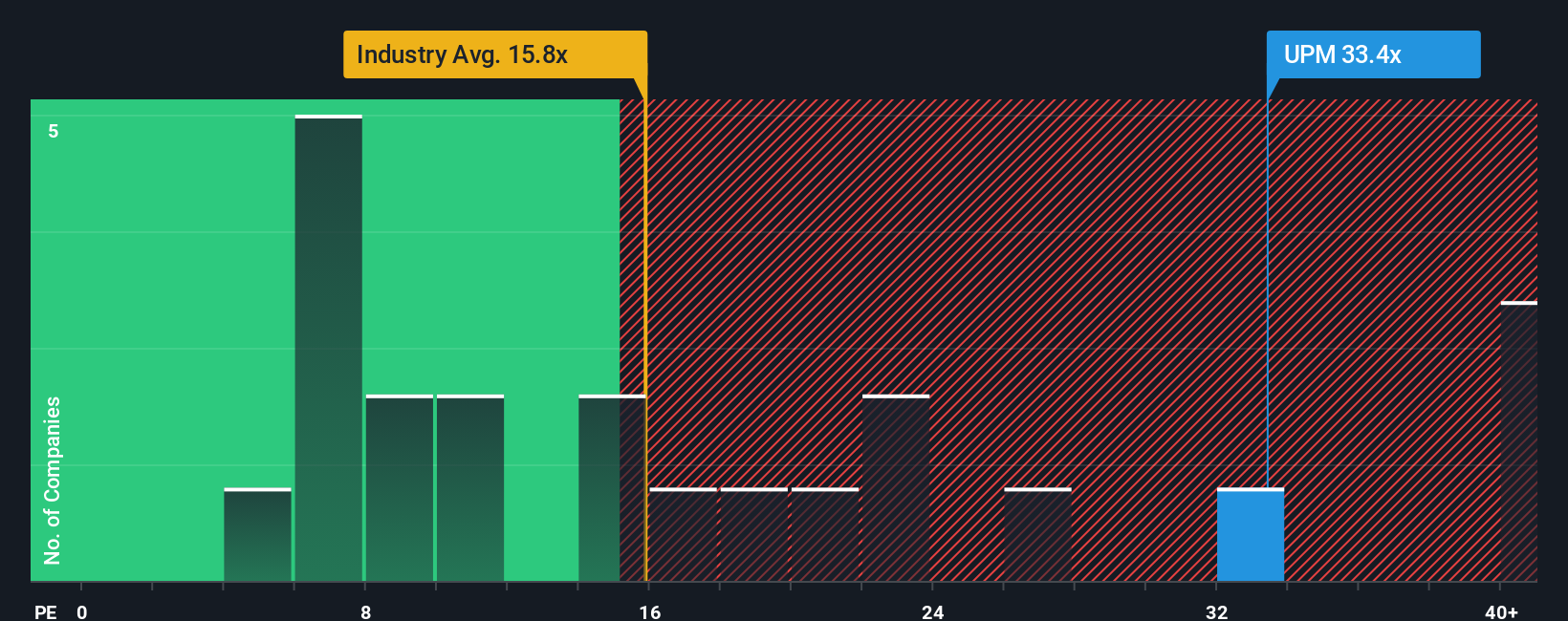

While our fair value analysis suggests UPM-Kymmene is deeply undervalued, the company’s current price-to-earnings ratio of 36.1× stands far above both its peer average of 16.1× and the European forestry industry’s 15.8×. Even when compared with the market’s fair ratio of 37.2×, UPM appears expensive on this metric. This raises questions about valuation risk if earnings growth does not meet expectations. Could the optimism priced in today be too ambitious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own UPM-Kymmene Oyj Narrative

If you see the story differently or like to chart your own course, you can easily build your take on UPM-Kymmene using our data in just a few minutes. Do it your way.

A great starting point for your UPM-Kymmene Oyj research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors know that staying ahead means acting fast on the best new stock opportunities. Don’t let your next big winner slip away. See what else stands out below.

- Capture the potential of rising digital currencies when you check out these 78 cryptocurrency and blockchain stocks shaping the future of finance and payment technologies.

- Amplify your portfolio’s income by reviewing these 19 dividend stocks with yields > 3% loaded with consistent, high-yield opportunities.

- Ride the AI trend and spot tomorrow’s leaders with these 24 AI penny stocks poised for breakthroughs in artificial intelligence and automation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About HLSE:UPM

UPM-Kymmene Oyj

Engages in the forest-based bioindustry in Europe, North America, Asia, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)