- Finland

- /

- Paper and Forestry Products

- /

- HLSE:UPM

Don't Buy UPM-Kymmene Oyj (HEL:UPM) For Its Next Dividend Without Doing These Checks

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see UPM-Kymmene Oyj (HEL:UPM) is about to trade ex-dividend in the next three days. The ex-dividend date occurs one day before the record date which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is an important date to be aware of as any purchase of the stock made on or after this date might mean a late settlement that doesn't show on the record date. Thus, you can purchase UPM-Kymmene Oyj's shares before the 5th of April in order to receive the dividend, which the company will pay on the 15th of April.

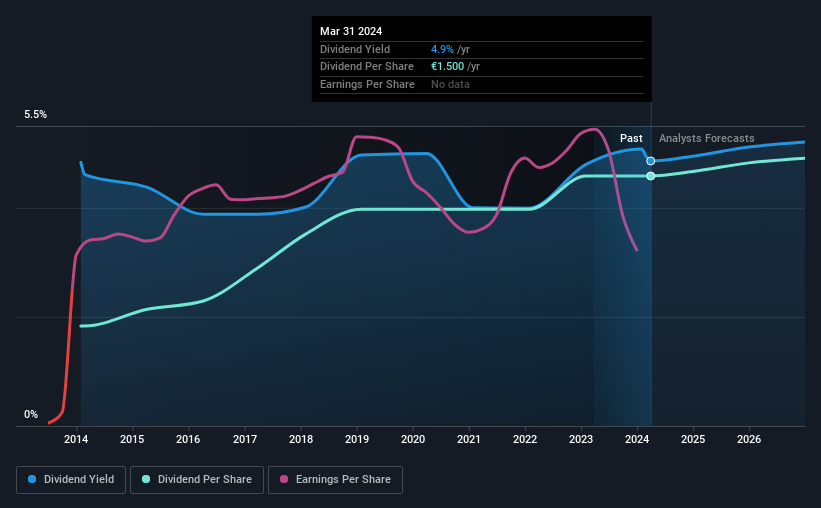

The company's upcoming dividend is €0.75 a share, following on from the last 12 months, when the company distributed a total of €1.50 per share to shareholders. Looking at the last 12 months of distributions, UPM-Kymmene Oyj has a trailing yield of approximately 4.9% on its current stock price of €30.87. If you buy this business for its dividend, you should have an idea of whether UPM-Kymmene Oyj's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

Check out our latest analysis for UPM-Kymmene Oyj

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. An unusually high payout ratio of 206% of its profit suggests something is happening other than the usual distribution of profits to shareholders. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. Dividends consumed 67% of the company's free cash flow last year, which is within a normal range for most dividend-paying organisations.

It's disappointing to see that the dividend was not covered by profits, but cash is more important from a dividend sustainability perspective, and UPM-Kymmene Oyj fortunately did generate enough cash to fund its dividend. Still, if the company repeatedly paid a dividend greater than its profits, we'd be concerned. Extraordinarily few companies are capable of persistently paying a dividend that is greater than their profits.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're discomforted by UPM-Kymmene Oyj's 24% per annum decline in earnings in the past five years. Such a sharp decline casts doubt on the future sustainability of the dividend.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. UPM-Kymmene Oyj has delivered 9.6% dividend growth per year on average over the past 10 years. That's intriguing, but the combination of growing dividends despite declining earnings can typically only be achieved by paying out a larger percentage of profits. UPM-Kymmene Oyj is already paying out 206% of its profits, and with shrinking earnings we think it's unlikely that this dividend will grow quickly in the future.

Final Takeaway

Should investors buy UPM-Kymmene Oyj for the upcoming dividend? It's never fun to see a company's earnings per share in retreat. Additionally, UPM-Kymmene Oyj is paying out quite a high percentage of its earnings, and more than half its cash flow, so it's hard to evaluate whether the company is reinvesting enough in its business to improve its situation. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

Although, if you're still interested in UPM-Kymmene Oyj and want to know more, you'll find it very useful to know what risks this stock faces. For example - UPM-Kymmene Oyj has 3 warning signs we think you should be aware of.

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:UPM

UPM-Kymmene Oyj

Engages in the forest-based bioindustry in Europe, North America, Asia, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)