Does Wärtsilä Oyj Abp (HEL:WRT1V) Deserve A Spot On Your Watchlist?

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

In contrast to all that, many investors prefer to focus on companies like Wärtsilä Oyj Abp (HEL:WRT1V), which has not only revenues, but also profits. While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

See our latest analysis for Wärtsilä Oyj Abp

How Fast Is Wärtsilä Oyj Abp Growing?

Generally, companies experiencing growth in earnings per share (EPS) should see similar trends in share price. That makes EPS growth an attractive quality for any company. Wärtsilä Oyj Abp's shareholders have have plenty to be happy about as their annual EPS growth for the last 3 years was 37%. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

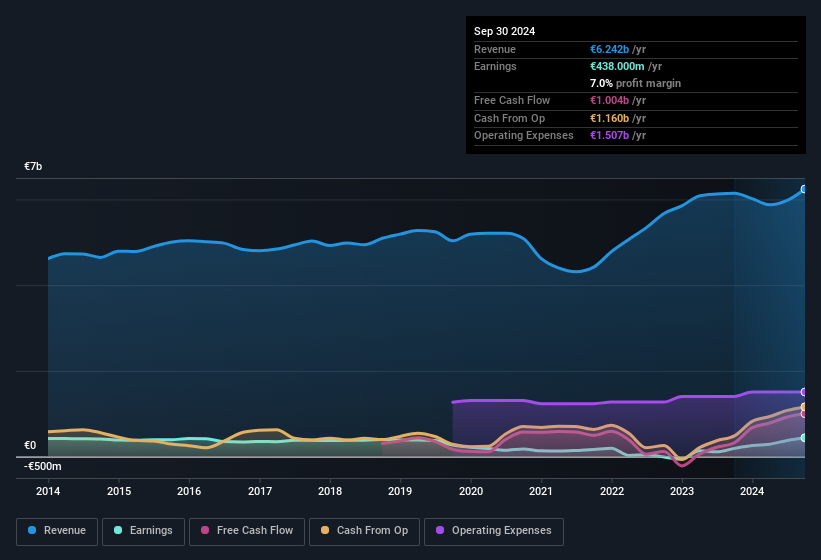

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While revenue is looking a bit flat, the good news is EBIT margins improved by 4.3 percentage points to 9.2%, in the last twelve months. That's something to smile about.

In the chart below, you can see how the company has grown earnings and revenue, over time. For finer detail, click on the image.

Fortunately, we've got access to analyst forecasts of Wärtsilä Oyj Abp's future profits. You can do your own forecasts without looking, or you can take a peek at what the professionals are predicting.

Are Wärtsilä Oyj Abp Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

Shareholders in Wärtsilä Oyj Abp will be more than happy to see insiders committing themselves to the company, spending €314k on shares in just twelve months. This, combined with the lack of sales from insiders, should be a great signal for shareholders in what's to come. Zooming in, we can see that the biggest insider purchase was by Independent Chairman of the Board Thomas Johnstone for €80k worth of shares, at about €17.88 per share.

On top of the insider buying, it's good to see that Wärtsilä Oyj Abp insiders have a valuable investment in the business. We note that their impressive stake in the company is worth €136m. Investors will appreciate management having this amount of skin in the game as it shows their commitment to the company's future.

Does Wärtsilä Oyj Abp Deserve A Spot On Your Watchlist?

Wärtsilä Oyj Abp's earnings have taken off in quite an impressive fashion. Just as heartening; insiders both own and are buying more stock. This quick rundown suggests that the business may be of good quality, and also at an inflection point, so maybe Wärtsilä Oyj Abp deserves timely attention. Still, you should learn about the 1 warning sign we've spotted with Wärtsilä Oyj Abp.

Keen growth investors love to see insider activity. Thankfully, Wärtsilä Oyj Abp isn't the only one. You can see a a curated list of Finnish companies which have exhibited consistent growth accompanied by high insider ownership.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Valuation is complex, but we're here to simplify it.

Discover if Wärtsilä Oyj Abp might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:WRT1V

Wärtsilä Oyj Abp

Offers technologies and lifecycle solutions for the marine and energy markets worldwide.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives