Increases to CEO Compensation Might Be Put On Hold For Now at Raute Oyj (HEL:RAUTE)

Key Insights

- Raute Oyj will host its Annual General Meeting on 15th of April

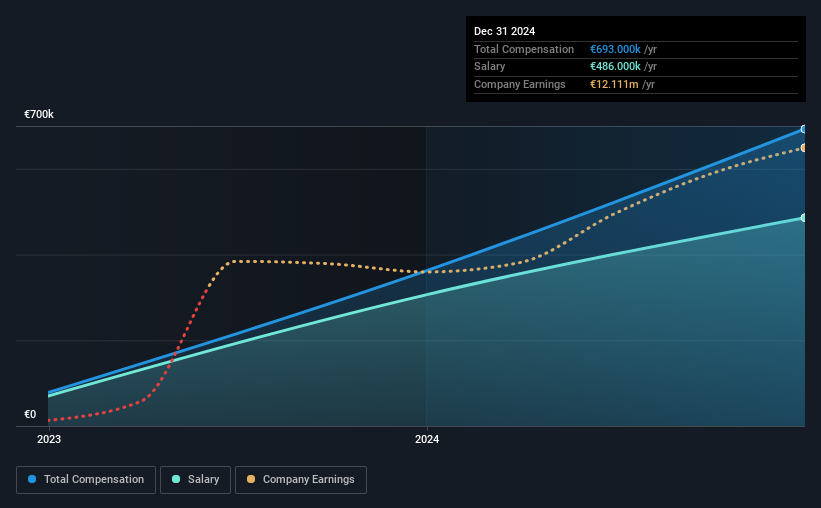

- CEO Mika Saariaho's total compensation includes salary of €486.0k

- Total compensation is 176% above industry average

- Raute Oyj's EPS grew by 94% over the past three years while total shareholder loss over the past three years was 7.0%

As many shareholders of Raute Oyj (HEL:RAUTE) will be aware, they have not made a gain on their investment in the past three years. Despite positive EPS growth in the past few years, the share price hasn't tracked the fundamental performance of the company. These are some of the concerns that shareholders may want to bring up at the next AGM held on 15th of April. Voting on resolutions such as executive remuneration and other matters could also be a way to influence management. We discuss below why we think shareholders should be cautious of approving a raise for the CEO at the moment.

View our latest analysis for Raute Oyj

Comparing Raute Oyj's CEO Compensation With The Industry

At the time of writing, our data shows that Raute Oyj has a market capitalization of €84m, and reported total annual CEO compensation of €693k for the year to December 2024. That's a notable increase of 91% on last year. We note that the salary portion, which stands at €486.0k constitutes the majority of total compensation received by the CEO.

On comparing similar-sized companies in the Finnish Machinery industry with market capitalizations below €183m, we found that the median total CEO compensation was €251k. Hence, we can conclude that Mika Saariaho is remunerated higher than the industry median. What's more, Mika Saariaho holds €234k worth of shares in the company in their own name.

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | €486k | €306k | 70% |

| Other | €207k | €56k | 30% |

| Total Compensation | €693k | €362k | 100% |

On an industry level, roughly 77% of total compensation represents salary and 23% is other remuneration. Although there is a difference in how total compensation is set, Raute Oyj more or less reflects the market in terms of setting the salary. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Raute Oyj's Growth Numbers

Raute Oyj's earnings per share (EPS) grew 94% per year over the last three years. In the last year, its revenue is up 41%.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business. Moving away from current form for a second, it could be important to check this free visual depiction of what analysts expect for the future .

Has Raute Oyj Been A Good Investment?

Since shareholders would have lost about 7.0% over three years, some Raute Oyj investors would surely be feeling negative emotions. So shareholders would probably want the company to be less generous with CEO compensation.

To Conclude...

Shareholders have not seen their shares grow in value, rather they have seen their shares decline. The stock's movement is disjointed with the company's earnings growth, which ideally should move in the same direction. Shareholders would be keen to know what's holding the stock back when earnings have grown. The upcoming AGM will be a chance for shareholders to question the board on key matters, such as CEO remuneration or any other issues they might have and revisit their investment thesis with regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. We did our research and spotted 2 warning signs for Raute Oyj that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About HLSE:RAUTE

Raute Oyj

Operates as a technology and service company that serves the wood products industry in Europe, Africa, Finland, North America, South America, Russia, and the Asia-Pacific.

Flawless balance sheet and undervalued.

Market Insights

Community Narratives