As European markets experience a resurgence, buoyed by the European Central Bank's rate cuts and a delay in U.S. tariffs, investors are increasingly optimistic about the potential for growth within the region. With major indices like the STOXX Europe 600 Index gaining ground, this environment presents an opportune moment to explore lesser-known stocks that could thrive amid these favorable conditions. In such a climate, companies with robust fundamentals and innovative strategies can stand out as promising opportunities for those looking to diversify their portfolios with emerging European players.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Nederman Holding | 69.60% | 11.43% | 16.35% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| BAUER | 78.29% | 4.31% | nan | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Proeduca Altus (BME:PRO)

Simply Wall St Value Rating: ★★★★★☆

Overview: Proeduca Altus, S.A. is a company that specializes in delivering online education services and has a market capitalization of €1.49 billion.

Operations: Proeduca Altus generates its revenue primarily through the provision of services, amounting to €344.09 million, with a minor contribution from sales at €0.03 million. The company's net profit margin is a key financial metric to consider when evaluating its performance.

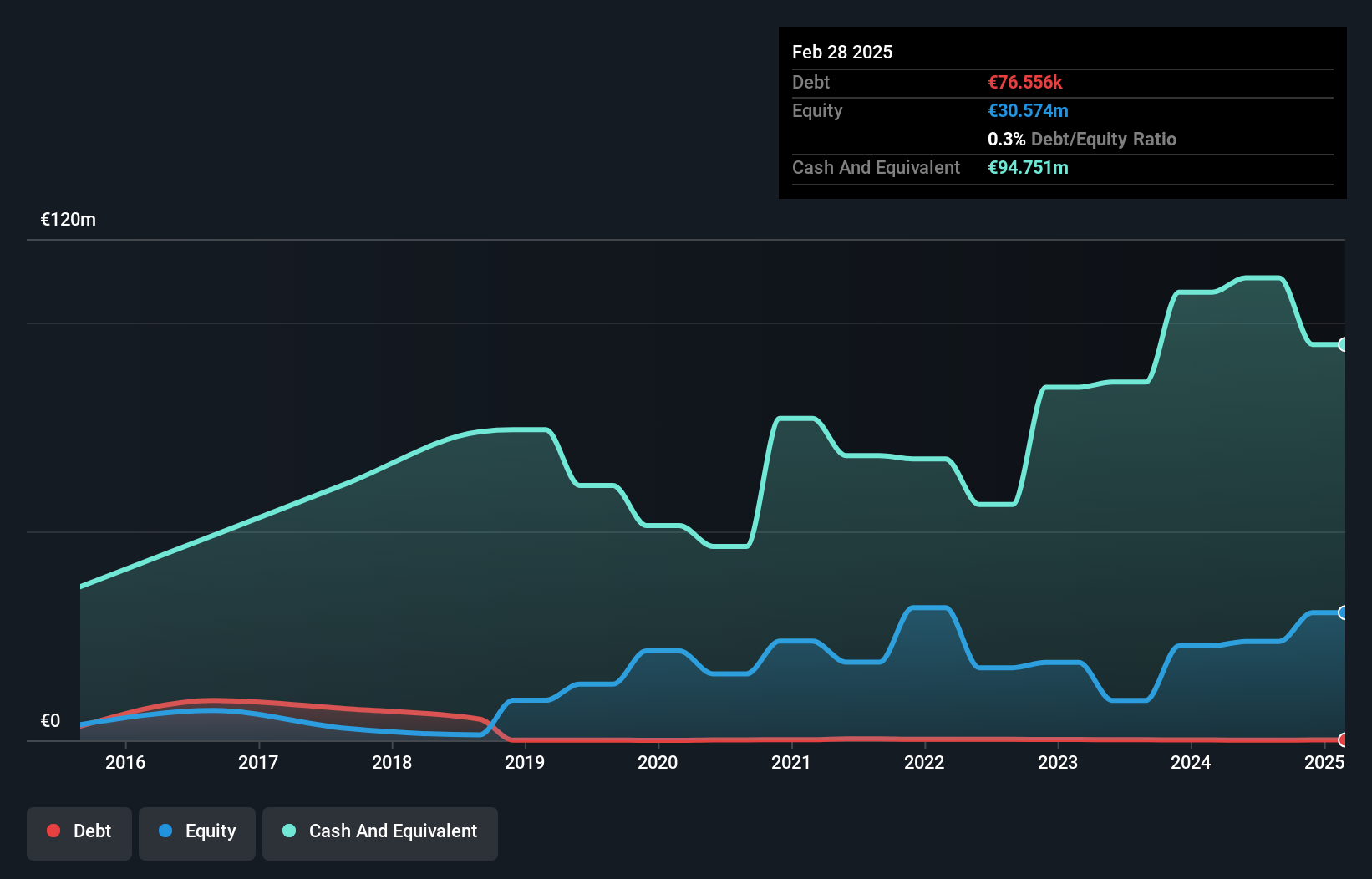

Proeduca Altus, a notable player in the online education sector, has shown impressive earnings growth of 20.8% over the past year, outpacing the Consumer Services industry average of 10.1%. With a debt-to-equity ratio reduction from 0.2 to 0.1 over five years and high-quality earnings, its financial health appears robust. Recent developments include a proposed acquisition by Proeduca Summa and partners for €110 million at €34 per share, valuing the company at approximately €1.54 billion. This move aligns with plans to delist from BME Growth as Portobello Capital and Sofina aim to increase their stakes significantly.

- Click here and access our complete health analysis report to understand the dynamics of Proeduca Altus.

Gain insights into Proeduca Altus' historical performance by reviewing our past performance report.

Ponsse Oyj (HLSE:PON1V)

Simply Wall St Value Rating: ★★★★★★

Overview: Ponsse Oyj is a manufacturer of cut-to-length forest machines with operations spanning the Nordic and Baltic countries, Central and Southern Europe, South America, North America, Asia, Australia, and Africa; it has a market capitalization of approximately €716.27 million.

Operations: Ponsse Oyj generates revenue primarily through the sale of cut-to-length forest machines across various global markets. The company's financial performance is influenced by its ability to manage production costs effectively, impacting its net profit margin.

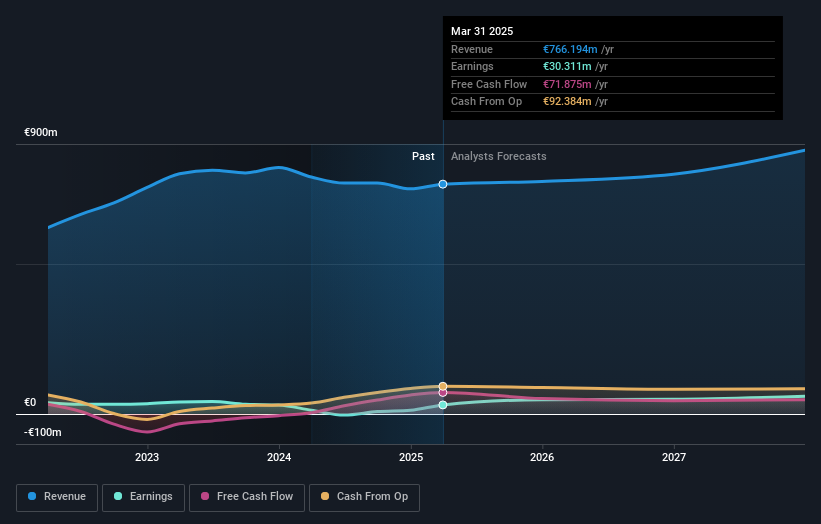

Ponsse Oyj, a notable player in the machinery sector, has shown impressive financial resilience with its debt to equity ratio falling from 71% to 21% over five years. The company boasts high-quality earnings and is trading at a significant discount of 32.6% below estimated fair value. Recent performance highlights include a remarkable earnings growth of 141.5%, outpacing the industry’s modest increase of 1.6%. In Q1 2025, Ponsse reported sales of €185.43 million and net income of €14.37 million, reversing last year’s loss, showcasing its robust recovery trajectory amidst market volatility.

- Take a closer look at Ponsse Oyj's potential here in our health report.

Assess Ponsse Oyj's past performance with our detailed historical performance reports.

Storytel (OM:STORY B)

Simply Wall St Value Rating: ★★★★★★

Overview: Storytel AB (publ) offers audiobooks and e-books streaming services, with a market capitalization of approximately SEK7.84 billion.

Operations: Storytel generates revenue primarily from its Streaming segment, which accounts for SEK3.38 billion, and its Publishing segment, contributing SEK1.13 billion.

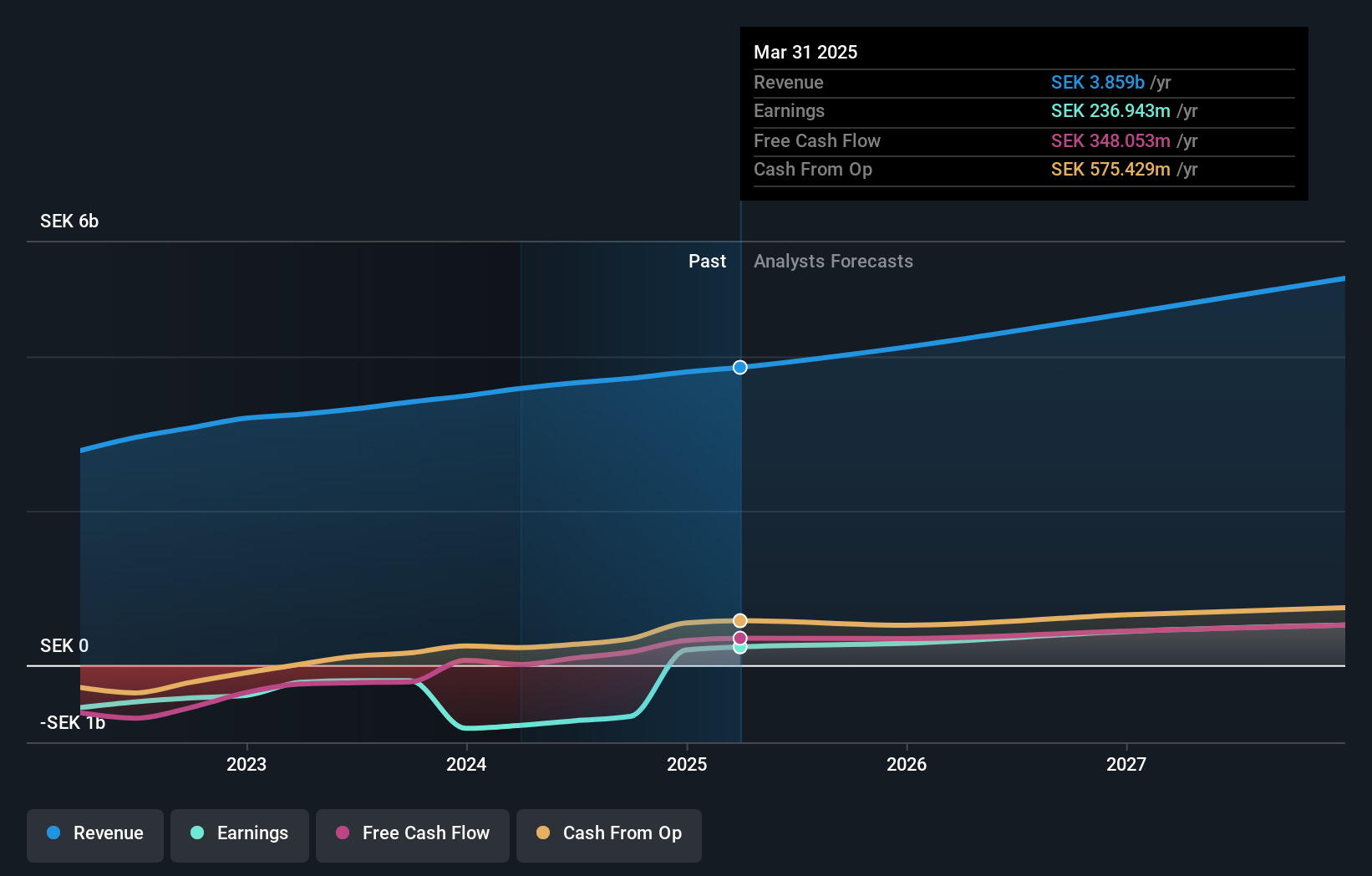

Storytel, a nimble player in the media sector, has shown impressive financial resilience and growth. The company reported sales of SEK 3.8 billion for 2024, up from SEK 3.5 billion the previous year, with net income swinging to SEK 196.71 million from a loss of SEK 819.19 million. Its debt management is commendable; the debt to equity ratio improved significantly from 116.9% to just 41.9% over five years, while interest coverage by EBIT stands strong at nine times interest payments. Trading at an attractive valuation—52% below estimated fair value—Storytel's profitability trajectory seems promising as it celebrates its anniversary with a proposed dividend payout of SEK 77.2 million.

- Click to explore a detailed breakdown of our findings in Storytel's health report.

Gain insights into Storytel's past trends and performance with our Past report.

Where To Now?

- Navigate through the entire inventory of 359 European Undiscovered Gems With Strong Fundamentals here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:STORY B

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Community Narratives