- Netherlands

- /

- Banks

- /

- ENXTAM:ABN

3 Compelling Dividend Stocks To Consider

Reviewed by Simply Wall St

In a week marked by tariff uncertainties and mixed economic signals, global markets have shown varied performances, with U.S. stocks ending lower and European indices defying trade concerns to edge higher. Amidst this backdrop of fluctuating market conditions, dividend stocks continue to attract attention for their potential to provide steady income streams and a measure of stability in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.30% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

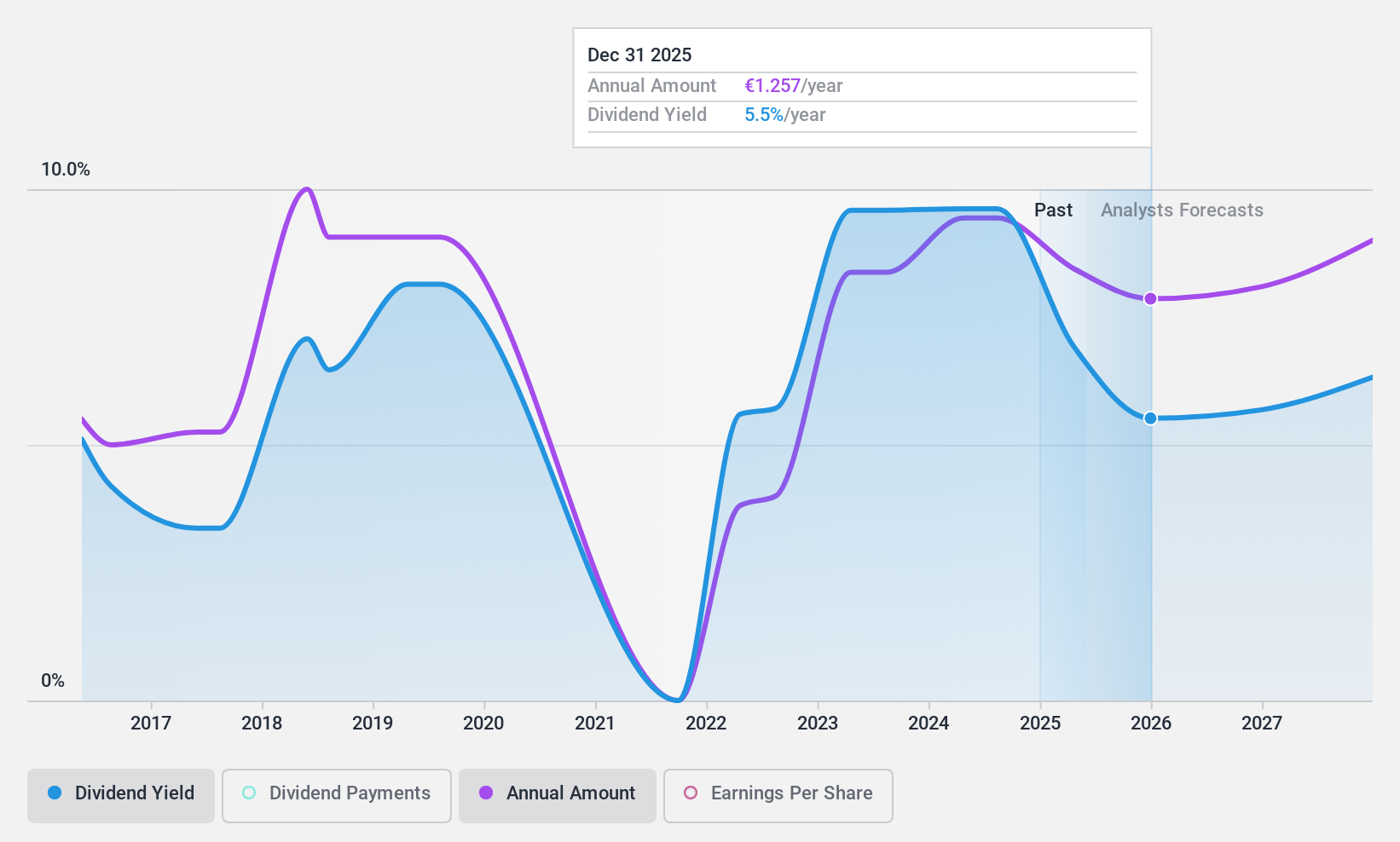

ABN AMRO Bank (ENXTAM:ABN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ABN AMRO Bank N.V. offers a range of banking products and financial services to retail, private, and business clients both in the Netherlands and internationally, with a market cap of €13.60 billion.

Operations: ABN AMRO Bank N.V.'s revenue is primarily generated through its Personal & Business Banking segment (€4.08 billion), Corporate Banking (€3.40 billion), and Wealth Management (€1.55 billion).

Dividend Yield: 9.1%

ABN AMRO Bank offers a compelling dividend yield of 9.15%, placing it in the top 25% of Dutch dividend payers. Its dividends are currently covered by earnings with a payout ratio of 72.8%, expected to improve to 50.3% in three years, suggesting sustainability despite an unstable track record and forecasted earnings decline. Recent fixed-income offerings totaling €2.25 billion may impact financial flexibility, but they underline strategic capital management efforts amidst fluctuating net income figures.

- Navigate through the intricacies of ABN AMRO Bank with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that ABN AMRO Bank is trading behind its estimated value.

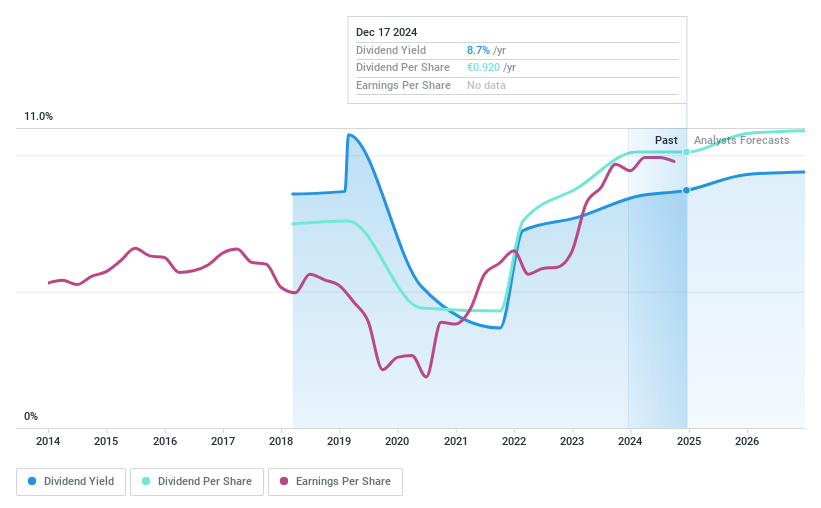

Nordea Bank Abp (HLSE:NDA FI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nordea Bank Abp provides banking products and services across Sweden, Finland, Norway, Denmark, and internationally with a market cap of €40.40 billion.

Operations: Nordea Bank Abp's revenue segments include Business Banking (€3.41 billion), Personal Banking (€4.67 billion), Asset and Wealth Management (€1.44 billion), and Large Corporates & Institutions (€2.32 billion).

Dividend Yield: 8%

Nordea Bank Abp's dividend yield of 7.98% ranks it among the top 25% of Finnish dividend payers, with payouts covered by earnings at a 65.3% ratio, expected to remain stable in three years. Despite recent increases, its seven-year dividend history is marked by volatility and unreliability. The proposed €0.94 per share dividend for 2024 represents a modest increase amidst declining earnings forecasts, highlighting potential challenges in maintaining consistent growth in shareholder returns.

- Dive into the specifics of Nordea Bank Abp here with our thorough dividend report.

- Our expertly prepared valuation report Nordea Bank Abp implies its share price may be lower than expected.

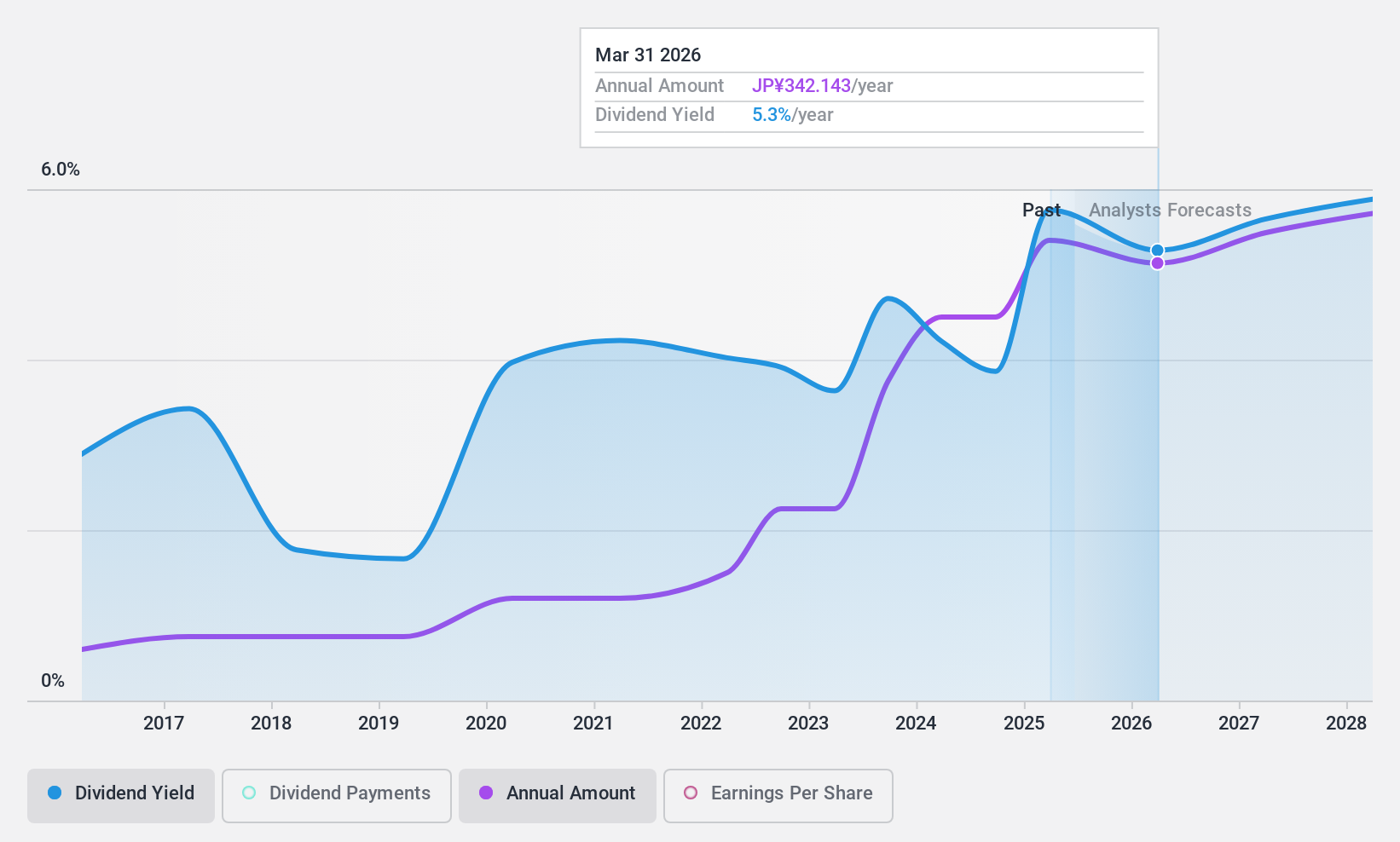

Cosmo Energy Holdings (TSE:5021)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cosmo Energy Holdings Co., Ltd. operates in the oil industry both in Japan and internationally through its subsidiaries, with a market cap of ¥578.55 billion.

Operations: Cosmo Energy Holdings Co., Ltd. generates revenue primarily from its Petroleum segment at ¥2.47 billion, followed by the Petrochemical Business at ¥349.02 million, and Oil Exploration and Production at ¥139.86 million, with additional contributions from its Renewable Energy Business totaling ¥13.29 million.

Dividend Yield: 5.3%

Cosmo Energy Holdings offers a compelling dividend yield of 5.28%, placing it in the top 25% of Japanese dividend payers. The company's dividends have been stable over the past decade, with recent increases reflecting a revised guidance to ¥180 per share for fiscal year-end 2025. However, dividends are not covered by free cash flows, posing sustainability concerns despite a low payout ratio of 38.2%. A share repurchase program aims to enhance shareholder returns further.

- Unlock comprehensive insights into our analysis of Cosmo Energy Holdings stock in this dividend report.

- Our valuation report unveils the possibility Cosmo Energy Holdings' shares may be trading at a discount.

Next Steps

- Click this link to deep-dive into the 1960 companies within our Top Dividend Stocks screener.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:ABN

ABN AMRO Bank

Provides various banking products and financial services to retail, private, and business clients in the Netherlands, rest of Europe, the United States, Asia, and internationally.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives