- Spain

- /

- Paper and Forestry Products

- /

- BME:MCM

Exploring 3 Undiscovered Gems with Solid Financial Foundations

Reviewed by Simply Wall St

In a week marked by cautious Federal Reserve commentary and political uncertainty, U.S. stocks experienced declines, with smaller-cap indexes like the S&P 600 facing significant pressure. Despite strong economic data showcasing robust growth and consumer spending, investor sentiment remains wary amid potential government shutdowns and tempered expectations for future rate cuts. In this challenging environment, identifying stocks with solid financial foundations becomes crucial as they often provide resilience against market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Société Multinationale de Bitumes Société Anonyme | 54.45% | 24.68% | 23.10% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Conoil | 27.59% | 16.64% | 46.05% | ★★★★★★ |

| Akmerkez Gayrimenkul Yatirim Ortakligi | NA | 43.32% | 27.57% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 14.94% | 0.59% | 5.95% | ★★★★★☆ |

| First National Bank of Botswana | 24.77% | 10.64% | 15.30% | ★★★★★☆ |

| Yeni Gimat Gayrimenkul Yatirim Ortakligi | 0.18% | 50.86% | 65.05% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Kerevitas Gida Sanayi ve Ticaret | 48.40% | 45.75% | 37.51% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Miquel y Costas & Miquel (BME:MCM)

Simply Wall St Value Rating: ★★★★★★

Overview: Miquel y Costas & Miquel, S.A., along with its subsidiaries, specializes in the production and distribution of fine and specialty lightweight papers both domestically in Spain and internationally, with a market cap of €475.36 million.

Operations: Miquel y Costas & Miquel generates revenue through the manufacture, trading, and sale of fine and specialty lightweight papers. The company's financial performance is reflected in its market capitalization of €475.36 million.

Miquel y Costas & Miquel, a notable player in its sector, showcases a robust financial profile with earnings growth of 15.5% over the past year, outpacing the Forestry industry's -34.1%. The company reported net income of €26.82 million for the half-year ending June 2024, up from €24.26 million in the previous year. Its price-to-earnings ratio stands at 10x, undercutting the Spanish market's average of 19x, suggesting potential value for investors. With its debt to equity ratio reduced to 15.9% over five years and high-quality earnings reported, MCM appears well-positioned within its industry landscape.

- Unlock comprehensive insights into our analysis of Miquel y Costas & Miquel stock in this health report.

Learn about Miquel y Costas & Miquel's historical performance.

Sidetrade (ENXTPA:ALBFR)

Simply Wall St Value Rating: ★★★★★☆

Overview: Sidetrade SA offers an AI-powered order-to-cash software as a service platform, serving both France and international markets, with a market cap of €318.58 million.

Operations: Sidetrade's revenue is primarily generated from its software and programming segment, amounting to €47.82 million. The company focuses on delivering AI-powered solutions in the order-to-cash domain across various markets.

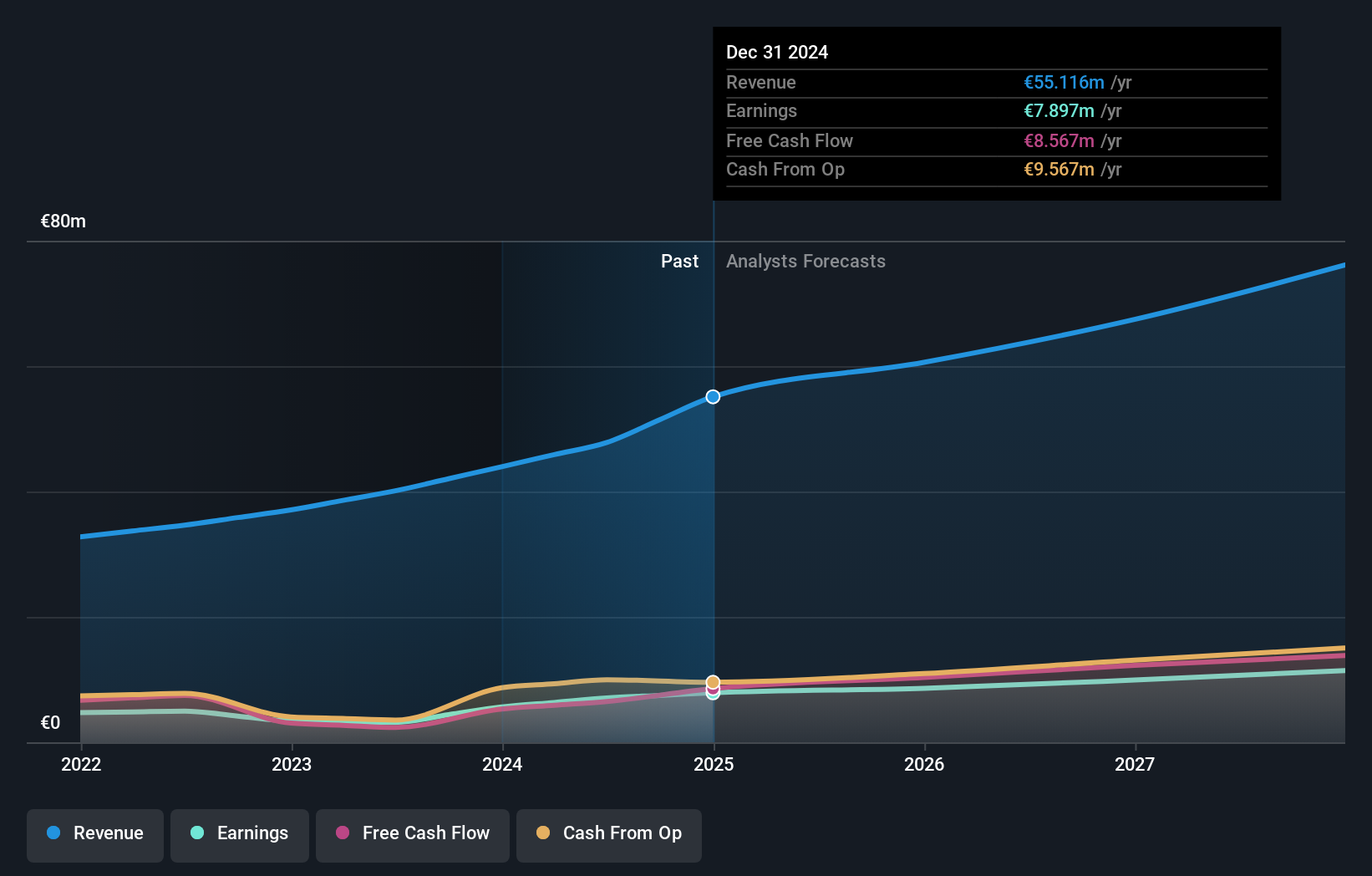

Sidetrade, a nimble player in the tech space, has shown impressive momentum with earnings growth of 122% over the past year, outpacing the broader software industry. The company's revenue reached €14.9 million in Q3 2024, marking a notable 33% increase. Its debt-to-equity ratio climbed from 2.1 to 25.6 over five years, yet interest payments are comfortably covered by EBIT at a robust multiple of 141x. Trading slightly below its estimated fair value by about 5%, Sidetrade seems well-positioned for continued growth with forecasted annual earnings expansion of nearly 16%.

- Click here and access our complete health analysis report to understand the dynamics of Sidetrade.

Understand Sidetrade's track record by examining our Past report.

Tsugami (TSE:6101)

Simply Wall St Value Rating: ★★★★★★

Overview: Tsugami Corporation, along with its subsidiaries, specializes in the manufacturing and sale of precision machine tools in Japan, with a market capitalization of ¥67.63 billion.

Operations: Tsugami generates revenue primarily from its operations in China, Japan, and India, with China contributing ¥75.84 billion and Japan ¥30.09 billion. The company faces a notable unallocated adjustment of -¥20.12 billion impacting its financials.

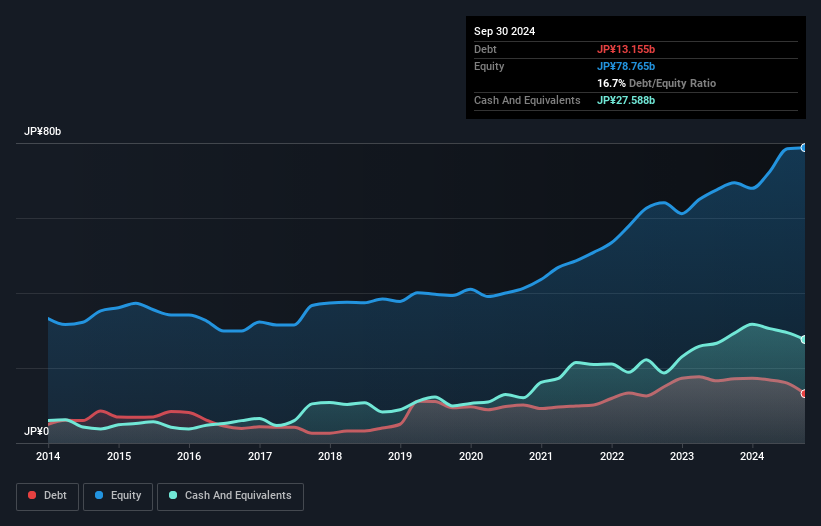

Tsugami, a noteworthy player in the machinery sector, has demonstrated robust financial health with its debt to equity ratio improving from 23.8% to 16.7% over five years. The firm boasts a price-to-earnings ratio of 8.5x, which is attractive compared to Japan's market average of 13.4x, indicating potential undervaluation. Impressively, Tsugami's earnings surged by 42%, outpacing the broader industry growth of just 0.8%. Recent strategic moves include repurchasing approximately 394,200 shares for ¥564 million since May 2024 and announcing further buybacks worth ¥400 million by May next year, reflecting proactive capital management strategies amidst evolving market conditions.

- Get an in-depth perspective on Tsugami's performance by reading our health report here.

Explore historical data to track Tsugami's performance over time in our Past section.

Seize The Opportunity

- Discover the full array of 4612 Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Miquel y Costas & Miquel, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:MCM

Miquel y Costas & Miquel

Engages in the manufacture, trading, and sale of fine and specialty lightweight papers in Spain and internationally.

Flawless balance sheet with proven track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives