3 European Stocks Estimated To Be Trading Up To 33.8% Below Intrinsic Value

Reviewed by Simply Wall St

As European markets face headwinds from a disappointing trade framework with the U.S., major stock indexes such as France's CAC 40 and Germany's DAX have seen notable declines. Amidst this challenging environment, identifying undervalued stocks becomes crucial for investors seeking potential opportunities, especially those trading below their intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Sparebank 68° Nord (OB:SB68) | NOK178.50 | NOK352.47 | 49.4% |

| Rheinmetall (XTRA:RHM) | €1783.50 | €3480.42 | 48.8% |

| LEM Holding (SWX:LEHN) | CHF603.00 | CHF1202.14 | 49.8% |

| Kuros Biosciences (SWX:KURN) | CHF27.42 | CHF54.72 | 49.9% |

| Ion Beam Applications (ENXTBR:IBAB) | €11.86 | €23.21 | 48.9% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.381 | €0.75 | 49.4% |

| doValue (BIT:DOV) | €2.442 | €4.82 | 49.3% |

| Comet Holding (SWX:COTN) | CHF189.80 | CHF372.94 | 49.1% |

| Aquila Part Prod Com (BVB:AQ) | RON1.488 | RON2.93 | 49.2% |

| Alfio Bardolla Training Group (BIT:ABTG) | €1.875 | €3.64 | 48.5% |

Let's uncover some gems from our specialized screener.

Línea Directa Aseguradora Compañía de Seguros y Reaseguros (BME:LDA)

Overview: Línea Directa Aseguradora, S.A., Compañía de Seguros y Reaseguros operates in the insurance and reinsurance sectors in Spain and Portugal, with a market cap of €1.48 billion.

Operations: The company's revenue is primarily derived from its Auto segment at €866.19 million, followed by Home at €164.38 million and Health at €37.78 million.

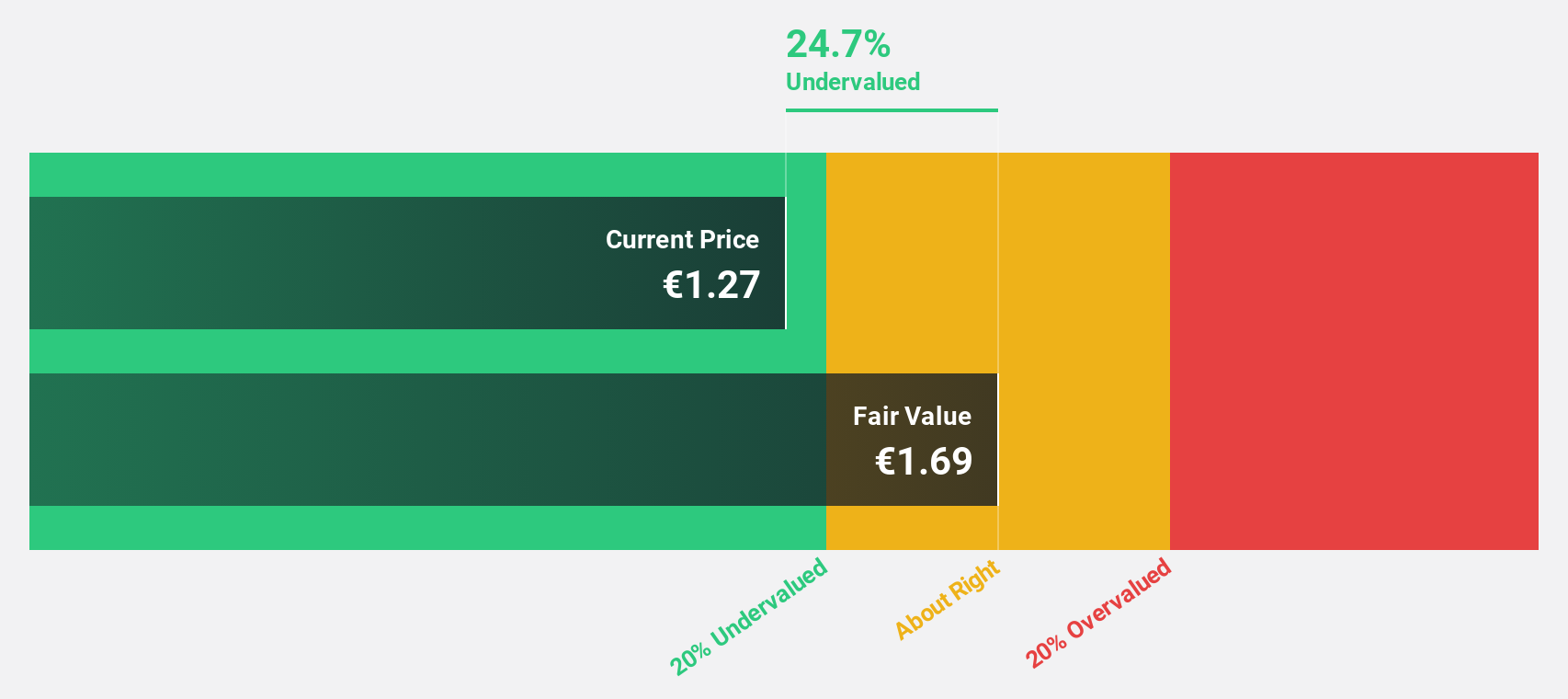

Estimated Discount To Fair Value: 19.2%

Línea Directa Aseguradora's recent earnings report for H1 2025 shows net income of €43.77 million, up from €25.42 million a year ago, with basic earnings per share doubling to €0.04. The stock trades at approximately 19% below its estimated fair value of €1.69, suggesting it is undervalued based on cash flows, despite an unstable dividend track record. Revenue growth is forecasted at 5.7% annually, outpacing the Spanish market average of 4.4%.

- Our comprehensive growth report raises the possibility that Línea Directa Aseguradora Compañía de Seguros y Reaseguros is poised for substantial financial growth.

- Take a closer look at Línea Directa Aseguradora Compañía de Seguros y Reaseguros' balance sheet health here in our report.

Thales (ENXTPA:HO)

Overview: Thales S.A. operates globally, offering solutions in defence and security, aerospace and space, as well as digital identity and security markets, with a market cap of €48.98 billion.

Operations: Thales generates revenue from its Aerospace segment (€5.81 billion), Cyber & Digital (€4.08 billion), and Defence excluding Digital Identity & Security (€11.96 billion).

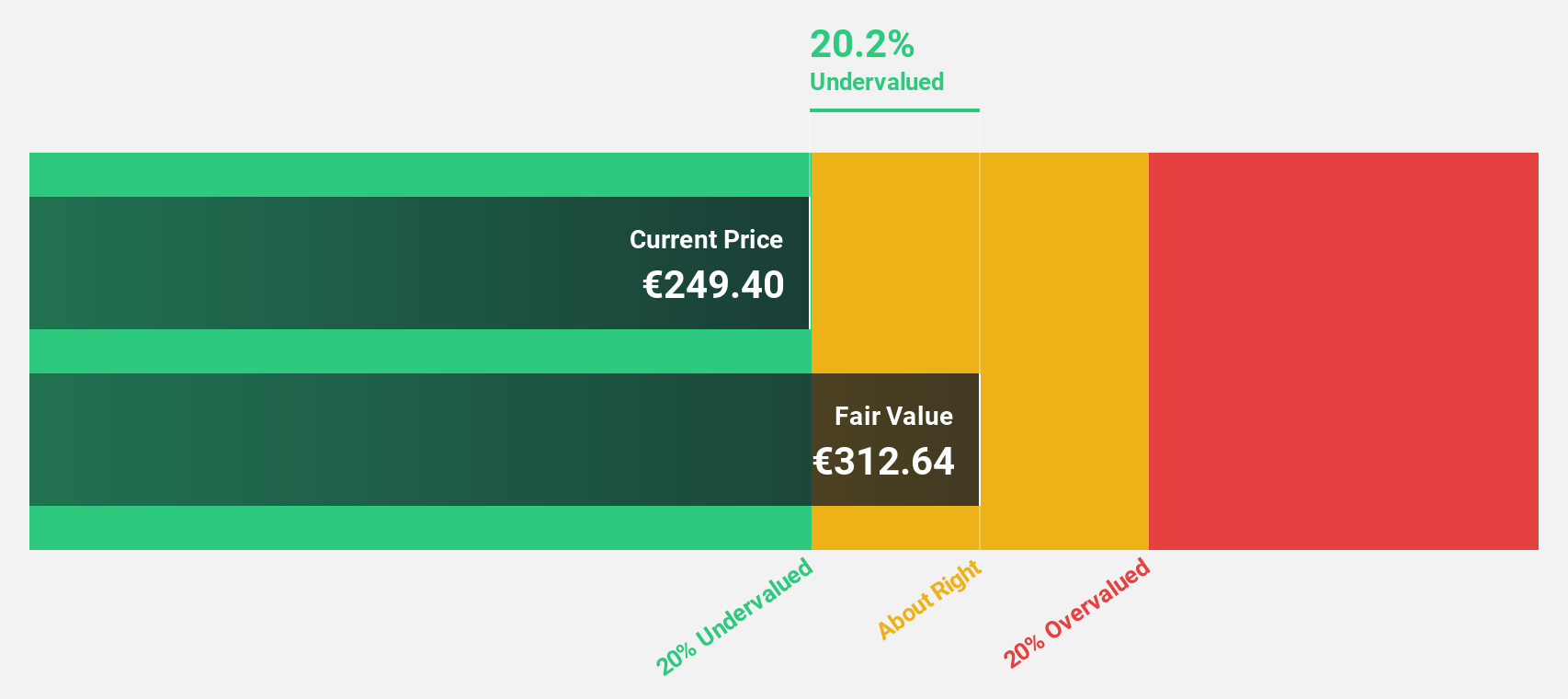

Estimated Discount To Fair Value: 33.8%

Thales S.A. is trading at approximately 33.8% below its estimated fair value of €360.45, positioning it as undervalued based on cash flows. The company recently raised its earnings guidance for 2025, forecasting organic sales growth between 6% and 7%, with expected revenues of €21.8 to €22 billion. Despite a dip in net income for H1 2025 compared to the previous year, Thales' earnings are forecasted to grow faster than the French market at an annual rate of around 16%.

- Our expertly prepared growth report on Thales implies its future financial outlook may be stronger than recent results.

- Click here and access our complete balance sheet health report to understand the dynamics of Thales.

Circus (XTRA:CA1)

Overview: Circus SE is a technology company that develops and delivers autonomous solutions for the food service market, with a market cap of €369.91 million.

Operations: The company's revenue segment includes Industrial Automation & Controls, generating €0.98 million.

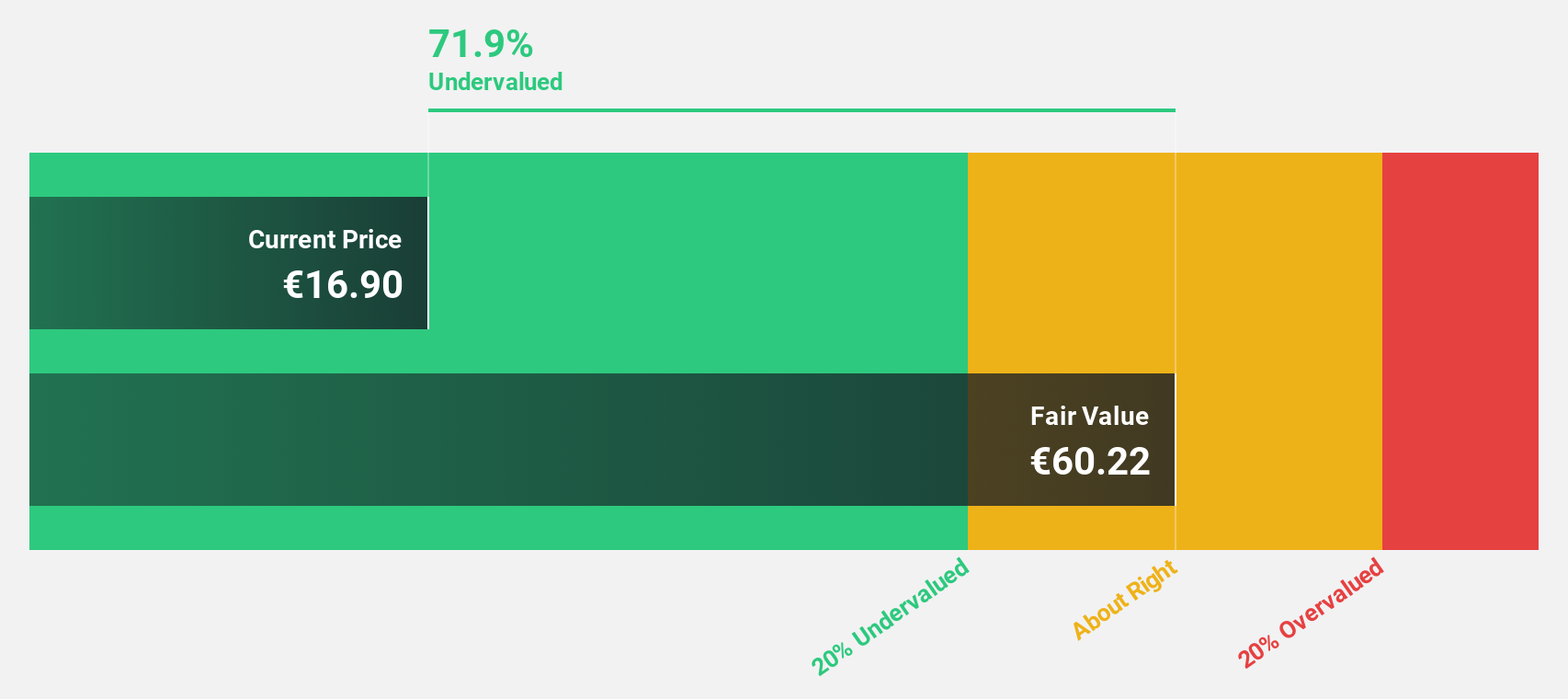

Estimated Discount To Fair Value: 15.5%

Circus SE is trading at 15.5% below its estimated fair value of €18.45, indicating potential undervaluation based on cash flows. The company forecasts significant revenue growth of 95% annually and anticipates profitability within three years, surpassing average market expectations. Recent strategic moves include securing Deutsche Tamoil as a client for its AI cooking robots and gaining U.S. government supplier approval, enhancing international expansion prospects and positioning Circus for long-term contracts in defense sectors.

- Our earnings growth report unveils the potential for significant increases in Circus' future results.

- Unlock comprehensive insights into our analysis of Circus stock in this financial health report.

Next Steps

- Click through to start exploring the rest of the 185 Undervalued European Stocks Based On Cash Flows now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:LDA

Línea Directa Aseguradora Compañía de Seguros y Reaseguros

Engages in insurance and reinsurance business in Spain and Portugal.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives