How Investors May Respond To Bankinter (BME:BKT) Expanding Beyond Spain Amid Sector Optimism

Reviewed by Sasha Jovanovic

- In recent weeks, Bankinter has gained attention for outperforming many Spanish banking peers, amid a period of growing sector optimism and positive sentiment.

- The bank's ongoing expansion into Portugal and Ireland stands out as a significant step in diversifying its income streams and reducing reliance on the Spanish market.

- We’ll explore how Bankinter’s push into new markets could influence its investment narrative and outlook for recurring revenue growth.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

Bankinter Investment Narrative Recap

An investor considering Bankinter must be confident in its ability to diversify revenue beyond Spain, supported by ongoing expansion into Portugal and Ireland. While recent share price momentum may encourage optimism, the most important short term catalyst remains continued delivery of recurring revenue growth abroad, the main risk persists in Bankinter’s ongoing exposure to the Spanish economy. Currently, the news does not materially affect these core dynamics in the near term.

The most relevant recent announcement is Bankinter’s upcoming Q3 2025 earnings report, scheduled for October 23. This event will be closely watched as it offers a timely check-in on whether the bank’s international ventures are translating into meaningful revenue diversification and recurring income growth, which remains a central theme amid sector optimism.

Yet, despite growing geographic reach, investors should watch for signs the bank’s exposure to domestic Spanish risks may still lead to...

Read the full narrative on Bankinter (it's free!)

Bankinter's outlook projects €3.3 billion in revenue and €1.2 billion in earnings by 2028. This assumes a 7.7% annual revenue growth rate and a €217.8 million increase in earnings from the current €982.2 million.

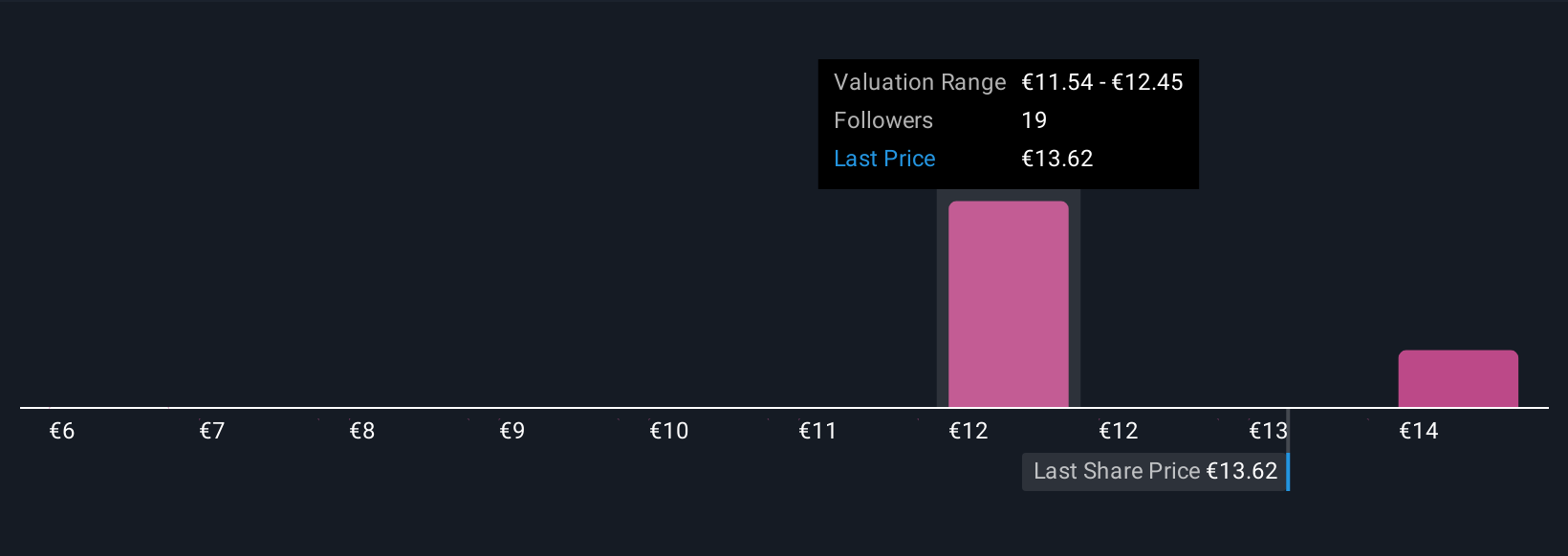

Uncover how Bankinter's forecasts yield a €12.17 fair value, a 10% downside to its current price.

Exploring Other Perspectives

Three retail investors from the Simply Wall St Community estimate Bankinter’s fair value ranges widely, from €6.09 to €15.21 per share. With international growth still a work in progress, this diversity of views highlights how broader risks to Spanish earnings continue to influence sentiment.

Explore 3 other fair value estimates on Bankinter - why the stock might be worth less than half the current price!

Build Your Own Bankinter Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Bankinter research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Bankinter research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Bankinter's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bankinter might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BKT

Bankinter

Provides various banking products and services to individuals and corporate customers, and small- and medium-sized enterprises in Spain.

Average dividend payer with moderate growth potential.

Similar Companies

Market Insights

Community Narratives