- Italy

- /

- Consumer Durables

- /

- BIT:DLG

European Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As European markets show mixed results, with the pan-European STOXX Europe 600 Index slightly up amid dovish signals from the U.S. Fed and easing trade tensions, investors are keenly watching economic indicators like industrial production and GDP growth for further direction. In such an environment, dividend stocks can offer a reliable income stream while potentially enhancing portfolio stability amidst market fluctuations.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.43% | ★★★★★★ |

| UNIQA Insurance Group (WBAG:UQA) | 4.86% | ★★★★★☆ |

| Telekom Austria (WBAG:TKA) | 4.32% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.84% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.70% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.18% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.23% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.72% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.02% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.43% | ★★★★★☆ |

Click here to see the full list of 230 stocks from our Top European Dividend Stocks screener.

We'll examine a selection from our screener results.

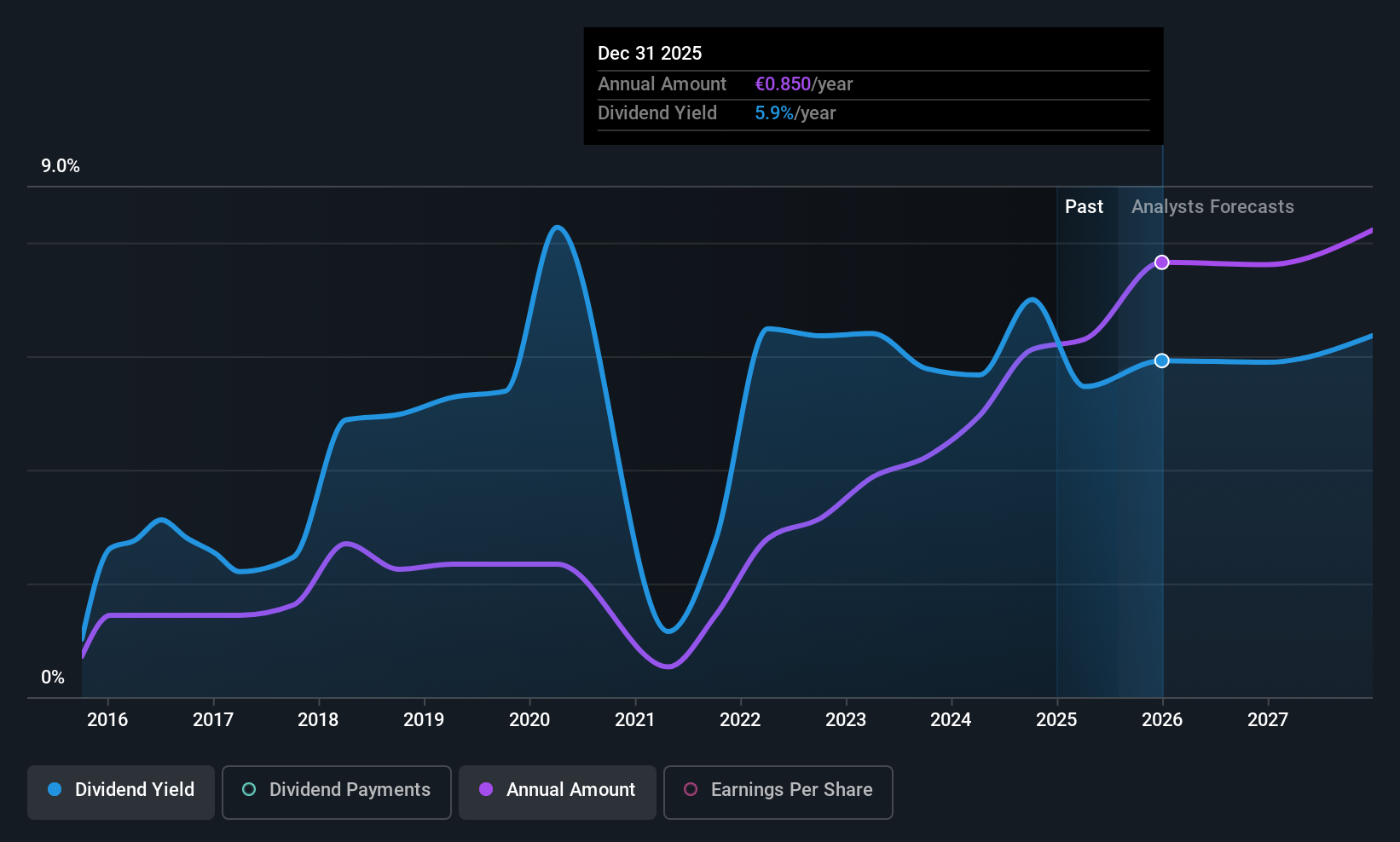

De'Longhi (BIT:DLG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: De'Longhi S.p.A. is a company that produces and distributes coffee machines, food preparation and cooking machines, air conditioning and heating systems, as well as domestic cleaning, ironing, and home care products, with a market cap of €4.55 billion.

Operations: De'Longhi S.p.A. generates its revenue from the production and distribution of coffee machines, food preparation and cooking machines, air conditioning and heating systems, along with domestic cleaning, ironing, and home care products.

Dividend Yield: 4.1%

De'Longhi's dividend payments are well-covered by both earnings and cash flows, with payout ratios of 58.5% and 56.5%, respectively. Despite a history of volatility in dividends, the company has increased its payouts over the past decade. Its current dividend yield is lower than the top tier in Italy but remains attractive given its value proposition, trading at a price-to-earnings ratio of 14.2x below the market average. Recent earnings growth supports future sustainability prospects.

- Navigate through the intricacies of De'Longhi with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, De'Longhi's share price might be too pessimistic.

Banco Bilbao Vizcaya Argentaria (BME:BBVA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Banco Bilbao Vizcaya Argentaria, S.A. offers retail banking, wholesale banking, and asset management services across various regions including Spain, Mexico, Turkey, South America, Europe, the United States, and Asia with a market cap of approximately €95.88 billion.

Operations: Banco Bilbao Vizcaya Argentaria, S.A. generates revenue from its operations in Mexico (€11.75 billion), Spain (€9.27 billion), South America (€4.34 billion), Turkey (€3.95 billion), and other regions within its business scope (€1.54 billion).

Dividend Yield: 4.2%

BBVA's dividends are well-covered by earnings with a current payout ratio of 23.3%, projected to rise to 48% in three years, indicating sustainability. However, the dividend track record is unstable and payments have been volatile over the past decade. Trading below estimated fair value by 32%, BBVA offers potential value despite its high bad loans ratio of 3.1% and low allowance for these loans at 82%. Recent dividend increase to €0.32 per share reflects ongoing commitment to shareholder returns amidst fluctuating yields in the Spanish market.

- Unlock comprehensive insights into our analysis of Banco Bilbao Vizcaya Argentaria stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Banco Bilbao Vizcaya Argentaria is priced lower than what may be justified by its financials.

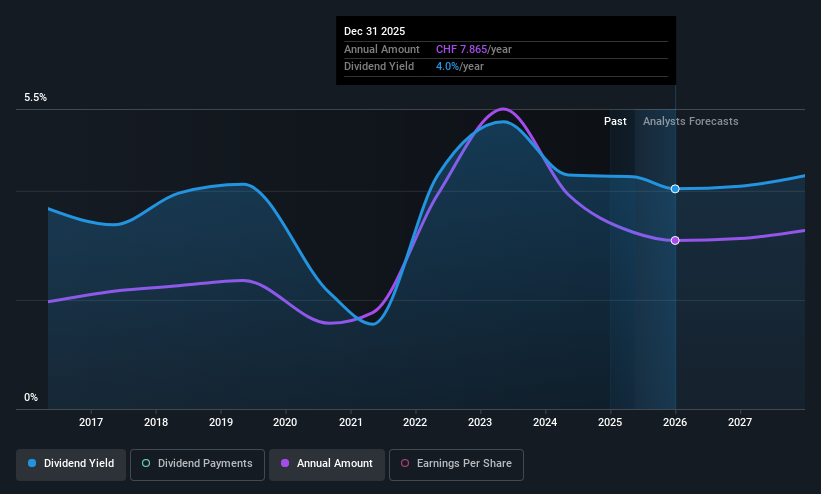

Kuehne + Nagel International (SWX:KNIN)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Kuehne + Nagel International AG, along with its subsidiaries, offers integrated logistics services across Europe, the Middle East, Africa, the Americas, and the Asia-Pacific region and has a market cap of CHF18.32 billion.

Operations: Kuehne + Nagel International AG generates revenue through its Air Logistics segment at CHF13.67 billion, Sea Logistics at CHF11.92 billion, Road Logistics at CHF4.86 billion, and Contract Logistics at CHF4.87 billion.

Dividend Yield: 5.3%

Kuehne + Nagel International's dividend yield of 5.35% places it among the top Swiss market payers, although its track record over the past decade has been volatile and unreliable. Despite this, dividends are covered by earnings (85% payout ratio) and cash flows (65.9%). Recent management changes aim to bolster strategic direction amidst stable earnings growth expectations. The company's shares trade at a significant discount to estimated fair value, offering potential appeal for value-focused investors.

- Click here to discover the nuances of Kuehne + Nagel International with our detailed analytical dividend report.

- Our valuation report here indicates Kuehne + Nagel International may be undervalued.

Next Steps

- Access the full spectrum of 230 Top European Dividend Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:DLG

De'Longhi

Produces and distributes coffee machines, food preparation and cooking machines, air conditioning and heating, domestic cleaning and ironing, and home care products.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)