Banco Bilbao Vizcaya Argentaria And 2 Other Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

In the midst of a busy earnings week, global markets have experienced some volatility, with major indexes like the Nasdaq Composite and S&P MidCap 400 reaching record highs before retreating. As investors navigate these dynamic market conditions, dividend stocks such as Banco Bilbao Vizcaya Argentaria can offer stability and income potential by providing regular payouts even when broader market trends fluctuate.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.31% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.12% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.83% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 5.03% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.48% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.93% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 5.00% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.97% | ★★★★★★ |

| James Latham (AIM:LTHM) | 5.83% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 5.10% | ★★★★★★ |

Click here to see the full list of 2032 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

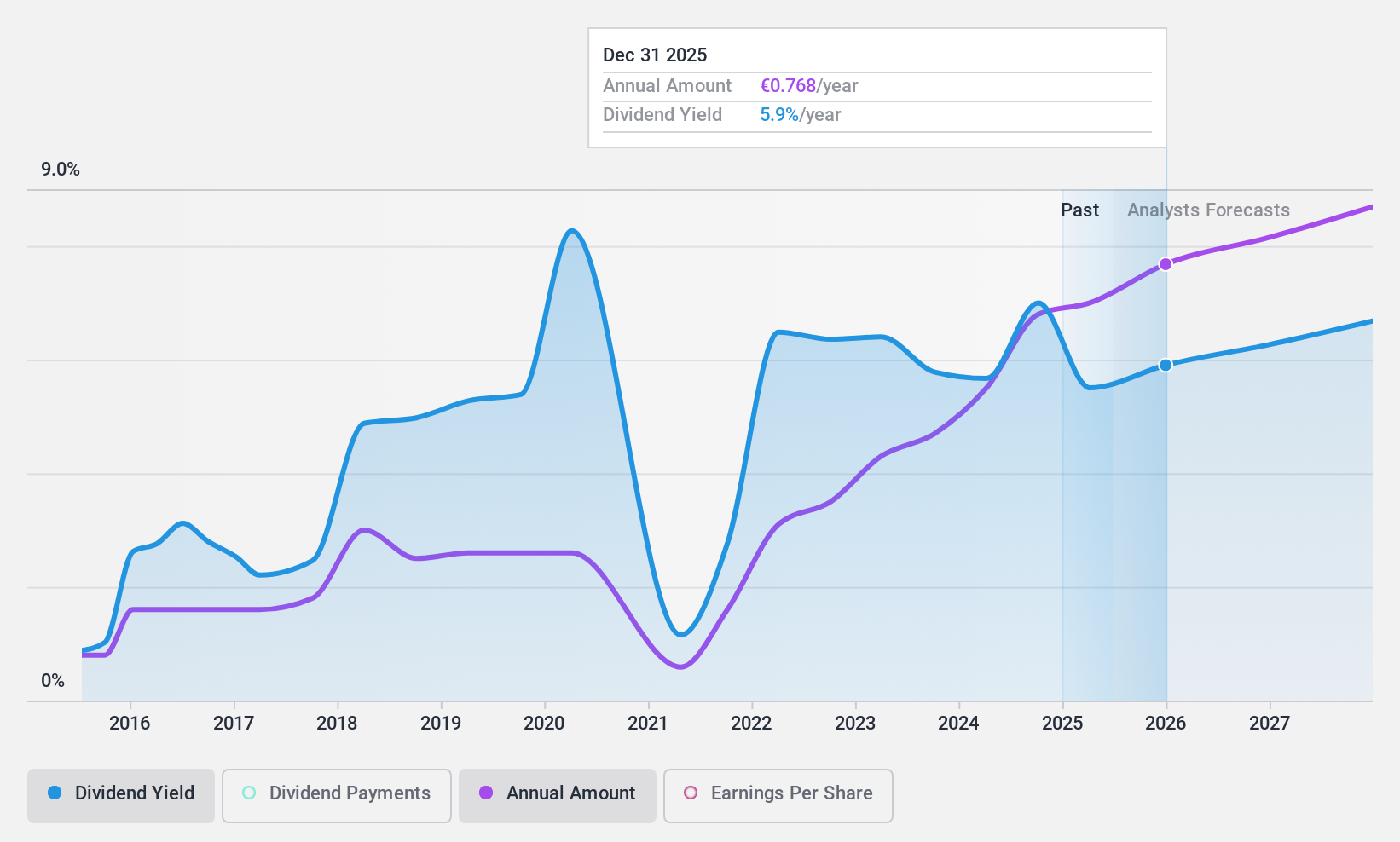

Banco Bilbao Vizcaya Argentaria (BME:BBVA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Banco Bilbao Vizcaya Argentaria, S.A. offers retail banking, wholesale banking, and asset management services across the United States, Spain, Mexico, Turkey, South America, and internationally with a market cap of approximately €54.27 billion.

Operations: Banco Bilbao Vizcaya Argentaria, S.A.'s revenue segments include €14.90 billion from Mexico, €3.26 billion from Turkey, €4.43 billion from South America, and €9.06 billion from Spain (including Non-Core Real Estate).

Dividend Yield: 7.2%

Banco Bilbao Vizcaya Argentaria offers a compelling dividend yield of 7.22%, placing it in the top tier within Spain, though its historical dividend stability has been volatile, with significant annual drops. Despite this, dividends are well-covered by earnings with a payout ratio of 42.2% and forecasted to remain sustainable at 51.6%. Recent earnings growth is strong, with net income rising to €7.62 billion for the first nine months of 2024 from €5.96 billion last year.

- Take a closer look at Banco Bilbao Vizcaya Argentaria's potential here in our dividend report.

- According our valuation report, there's an indication that Banco Bilbao Vizcaya Argentaria's share price might be on the cheaper side.

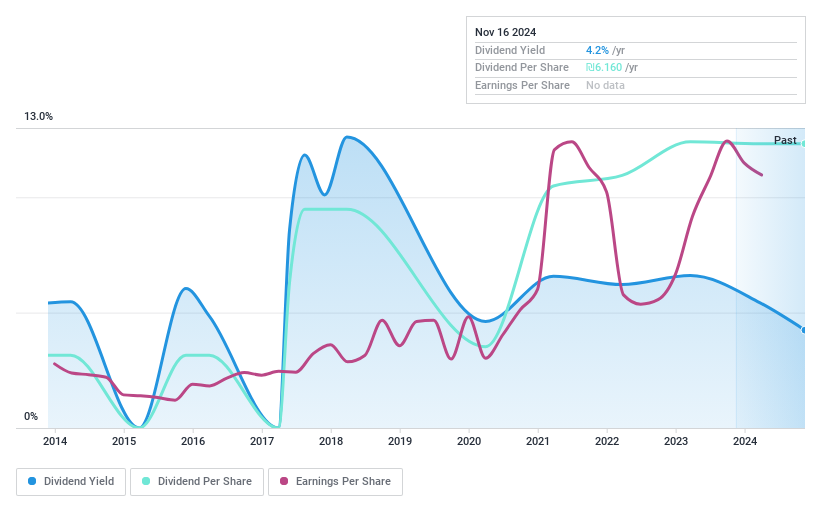

I.B.I. Investment House (TASE:IBI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: I.B.I Investment House Ltd. is a publicly owned holding investment firm with approximately NIS 11 billion ($2.63 billion) in assets under management and a market cap of ₪1.79 billion.

Operations: I.B.I. Investment House Ltd.'s revenue segments include asset management, investment banking, brokerage services, and mutual funds.

Dividend Yield: 4.4%

I.B.I. Investment House's dividend is well-covered by both earnings and cash flows, with payout ratios around 45%. Despite a decade of volatile payments, dividends have grown over time. The recent cash dividend of ILS 2.36 highlights ongoing returns to shareholders, though the yield at 4.39% is below top-tier market levels in Israel. Recent earnings show increased sales but decreased net income year-over-year, impacting overall financial stability for dividends.

- Navigate through the intricacies of I.B.I. Investment House with our comprehensive dividend report here.

- The analysis detailed in our I.B.I. Investment House valuation report hints at an deflated share price compared to its estimated value.

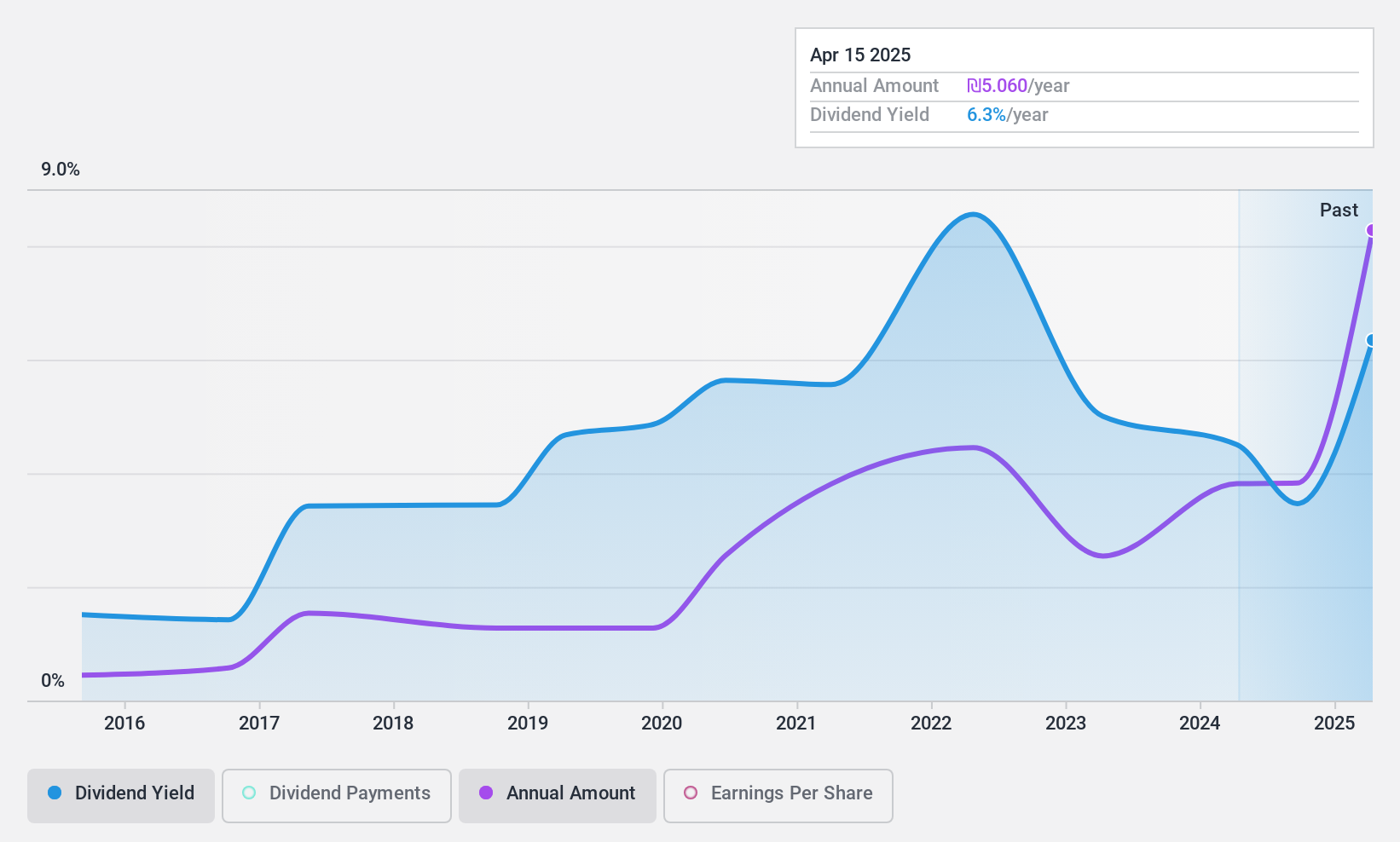

Palram Industries (1990) (TASE:PLRM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Palram Industries (1990) Ltd manufactures and sells thermoplastic sheets, panel systems, and finished products both in Israel and internationally, with a market cap of ₪1.81 billion.

Operations: Palram Industries generates its revenue from several segments, including the Polycarbonate Sector with ₪947.77 million, the PVC Sector with ₪420.95 million, the Canopia Sector (formerly Applications) with ₪259.90 million, and the Pur-U Sector contributing ₪185.04 million.

Dividend Yield: 3.3%

Palram Industries has seen earnings growth, with recent quarterly sales reaching ILS 494.37 million and net income at ILS 65.81 million. Despite a decade of volatile dividends, the current payout ratio of 40.2% indicates dividends are well-covered by earnings and cash flows (37.5%). While the dividend yield is lower than top-tier levels in Israel, Palram's valuation appears attractive as it trades significantly below estimated fair value.

- Click to explore a detailed breakdown of our findings in Palram Industries (1990)'s dividend report.

- Upon reviewing our latest valuation report, Palram Industries (1990)'s share price might be too pessimistic.

Turning Ideas Into Actions

- Gain an insight into the universe of 2032 Top Dividend Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Banco Bilbao Vizcaya Argentaria might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:BBVA

Banco Bilbao Vizcaya Argentaria

Provides retail banking, wholesale banking, and asset management services in the United States, Spain, Mexico, Turkey, South America, and internationally.

Very undervalued with solid track record and pays a dividend.