- Spain

- /

- Capital Markets

- /

- BME:R4

Discovering Undiscovered Gems on None Exchange December 2024

Reviewed by Simply Wall St

In the current global market landscape, investor sentiment has been influenced by a mix of cautious Federal Reserve commentary and political uncertainties, with small-cap indexes experiencing notable declines. Despite strong economic data such as robust GDP growth and retail sales in the U.S., concerns about future interest rate cuts and potential government shutdowns have added layers of complexity to investment decisions. Amidst these challenges, identifying promising stocks requires a keen eye for companies that demonstrate resilience and potential for growth even when broader market conditions are volatile.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Brillian Network & Automation Integrated System | 8.39% | 20.15% | 19.93% | ★★★★★★ |

| C&D Property Management Group | 1.32% | 37.15% | 41.55% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Saison Technology | NA | 0.66% | -13.83% | ★★★★★★ |

| IFE Elevators | NA | 12.67% | 17.10% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Moury Construct | 2.93% | 10.28% | 30.93% | ★★★★★☆ |

| Nanjing Well Pharmaceutical GroupLtd | 25.29% | 10.45% | 0.43% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

Caltagirone (BIT:CALT)

Simply Wall St Value Rating: ★★★★★★

Overview: Caltagirone SpA operates through its subsidiaries in media, real estate, and publishing activities, with a market capitalization of €780.78 million.

Operations: Caltagirone SpA generates revenue primarily from its Cement, Concrete and Aggregates segment at €1.64 billion, followed by Other Assets at €244.51 million and Constructions at €186.77 million. The Publishing segment contributes €112.65 million, while Management of Properties adds €35.27 million to the total revenue stream.

Caltagirone, a relatively small player in its field, has shown promising financial health over the past five years. The debt-to-equity ratio significantly improved from 35.8% to 9.9%, indicating effective debt management. Trading at 91% below its estimated fair value suggests potential undervaluation in the market. Earnings have grown by 10.5% this year, outpacing the Basic Materials industry, which experienced an -11.5%. With more cash than total debt and positive free cash flow of US$329 million recently recorded, Caltagirone seems well-positioned financially and could be considered a hidden opportunity for those looking beyond mainstream options.

- Click here and access our complete health analysis report to understand the dynamics of Caltagirone.

Renta 4 Banco (BME:R4)

Simply Wall St Value Rating: ★★★★★☆

Overview: Renta 4 Banco, S.A., along with its subsidiaries, offers wealth management, brokerage, and corporate advisory services both in Spain and internationally, with a market cap of €500.53 million.

Operations: Renta 4 Banco generates revenue primarily through wealth management, brokerage, and corporate advisory services. The company's net profit margin has shown interesting fluctuations over recent periods.

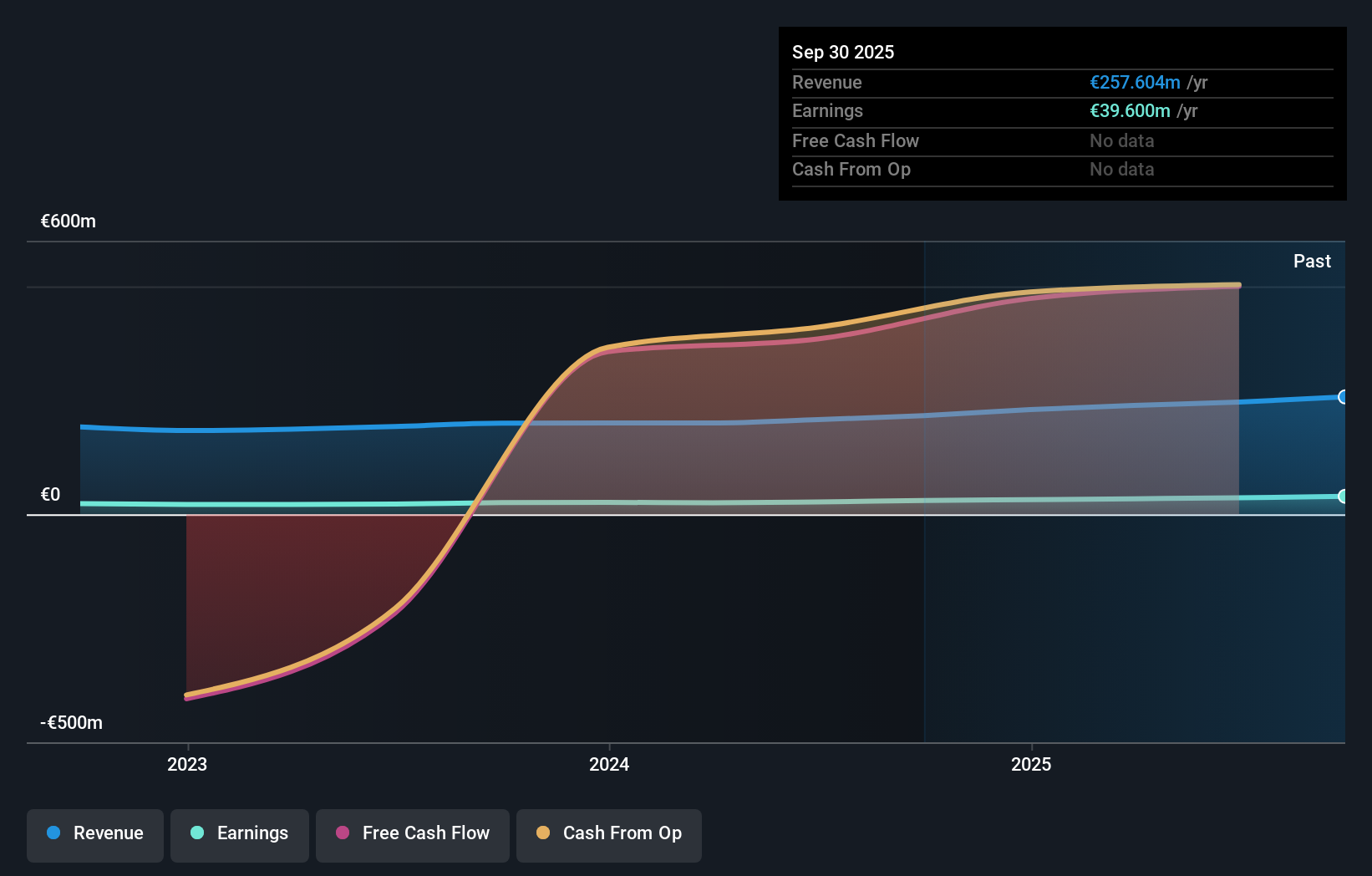

Renta 4 Banco, a notable player in Spain's financial sector, has demonstrated robust earnings growth of 18.1% over the past year, surpassing the industry average of 12.9%. Its price-to-earnings ratio stands at an attractive 16.6x, below the Spanish market average of 19x, indicating potential value for investors. The bank remains debt-free and reported high-quality earnings with net income rising to €8.04 million in Q3 from €5.15 million last year and €23.22 million over nine months compared to €19.24 million previously, showcasing its strong performance amidst industry challenges without leveraging debt dependency.

- Unlock comprehensive insights into our analysis of Renta 4 Banco stock in this health report.

Evaluate Renta 4 Banco's historical performance by accessing our past performance report.

Beijing China Sciences Runyu Environmental Technology (SZSE:301175)

Simply Wall St Value Rating: ★★★★★☆

Overview: Beijing China Sciences Runyu Environmental Technology Co., Ltd. specializes in providing environmental protection solutions and technologies, with a market cap of CN¥8.15 billion.

Operations: Beijing China Sciences Runyu Environmental Technology's revenue streams are not detailed in the provided text. However, the company has a market capitalization of CN¥8.15 billion, which reflects its valuation in the financial markets.

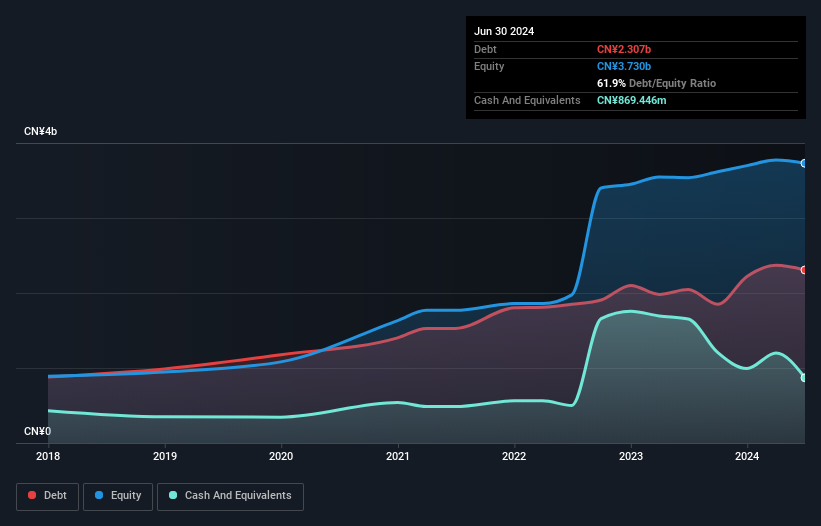

Beijing China Sciences Runyu Environmental Technology, a promising name in the environmental tech space, has shown robust financial performance. Over the past year, earnings grew by 33.7%, outpacing the industry average of 0.9%. The company reported net income of CNY 263.67 million for the first nine months of 2024, up from CNY 206.72 million last year, with basic earnings per share rising to CNY 0.1791 from CNY 0.1404 previously. Despite not being free cash flow positive, its net debt to equity ratio stands at a satisfactory 35.8%, and interest payments are well covered by EBIT at a ratio of 6.3x coverage.

Next Steps

- Dive into all 4612 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BME:R4

Renta 4 Banco

Engages in the provision of wealth management, brokerage, and corporate advisory services in Spain and internationally.

Outstanding track record with excellent balance sheet and pays a dividend.