- Denmark

- /

- Transportation

- /

- CPSE:NTG

European Growth Companies With Up To 14% Insider Ownership

Reviewed by Simply Wall St

As European markets reach record highs, buoyed by a rally in technology stocks and expectations for lower U.S. borrowing costs, investors are keenly observing growth companies with substantial insider ownership. In such an environment, companies where insiders hold significant stakes can be particularly appealing as they often signal confidence in the company's future prospects and alignment of interests with shareholders.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| XTPL (WSE:XTP) | 23.3% | 107.3% |

| Xbrane Biopharma (OM:XBRANE) | 13% | 112.0% |

| Pharma Mar (BME:PHM) | 11.9% | 44.2% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 90.7% |

| KebNi (OM:KEBNI B) | 36.3% | 63.7% |

| Elliptic Laboratories (OB:ELABS) | 24.4% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 37.9% |

| Circus (XTRA:CA1) | 24.5% | 67.1% |

| CD Projekt (WSE:CDR) | 29.7% | 43.5% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 59.4% |

We're going to check out a few of the best picks from our screener tool.

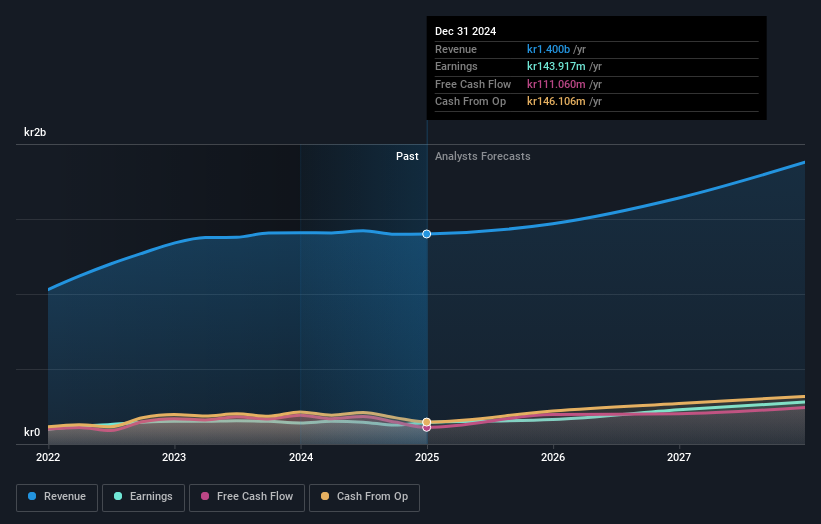

NTG Nordic Transport Group (CPSE:NTG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: NTG Nordic Transport Group A/S offers asset-light freight forwarding services across road, rail, air, and ocean in various countries including Denmark, Sweden, and the United States with a market cap of DKK4.05 billion.

Operations: NTG Nordic Transport Group's revenue is primarily derived from its Road & Logistics segment, which generated DKK7.66 billion, and its Air & Ocean segment, which contributed DKK2.83 billion.

Insider Ownership: 14.7%

NTG Nordic Transport Group, despite reporting a decline in net income and profit margins for the recent quarter, is trading at a substantial discount to its estimated fair value. Analysts anticipate significant earnings growth of 32.8% annually over the next three years, outperforming market expectations. However, NTG's revenue growth forecast of 6.3% per year lags behind high-growth benchmarks and it carries a high level of debt, which may warrant caution for potential investors.

- Click here and access our complete growth analysis report to understand the dynamics of NTG Nordic Transport Group.

- The analysis detailed in our NTG Nordic Transport Group valuation report hints at an deflated share price compared to its estimated value.

Absolent Air Care Group (OM:ABSO)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Absolent Air Care Group AB (publ) specializes in designing, developing, selling, installing, and maintaining air filtration units with a market capitalization of SEK2.89 billion.

Operations: The company's revenue is primarily derived from its Industrial segment, accounting for SEK1.07 billion, and its Commercial Kitchen segment, contributing SEK235.28 million.

Insider Ownership: 12.6%

Absolent Air Care Group faces challenges with declining sales and net income, yet it trades at a significant discount to its estimated fair value. Insider activity is positive, with substantial buying over the past three months. While profit margins have decreased from 10.3% to 6.6%, analysts forecast robust annual earnings growth of 40.2%, surpassing the Swedish market's expectations. The company's revenue growth is projected at 10.6% annually, outpacing the broader market rate of 5%.

- Delve into the full analysis future growth report here for a deeper understanding of Absolent Air Care Group.

- Upon reviewing our latest valuation report, Absolent Air Care Group's share price might be too pessimistic.

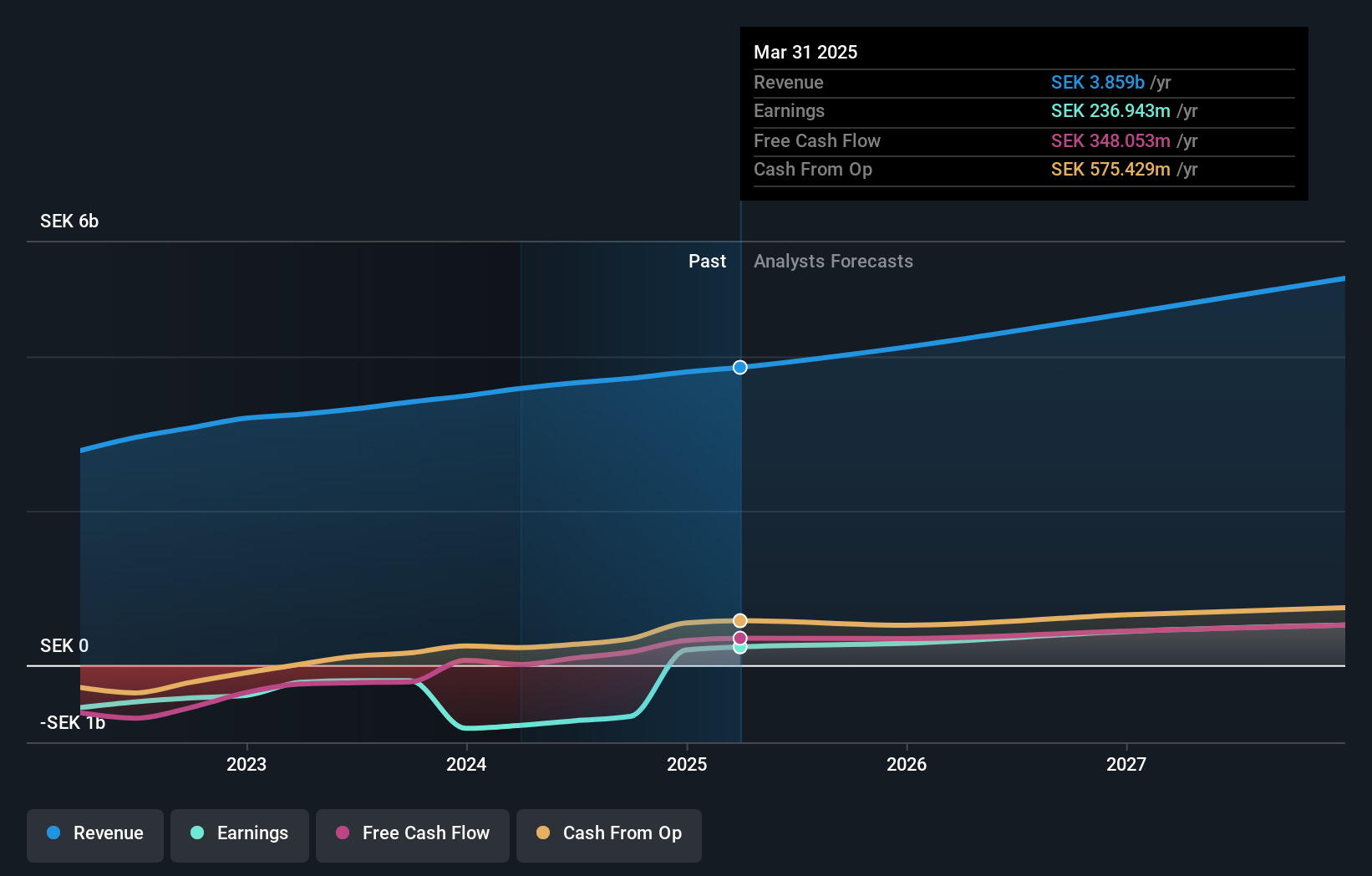

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Storytel AB (publ) offers streaming services for audiobooks and e-books, with a market cap of SEK6.05 billion.

Operations: The company generates revenue from two main segments: Streaming, which accounts for SEK3.45 billion, and Publishing, contributing SEK1.20 billion.

Insider Ownership: 12.7%

Storytel demonstrates potential as a growth company, with earnings forecasted to grow significantly at 24.13% annually, surpassing the Swedish market's average growth rate. Recent product innovations such as synced listening and Story Scan enhance user engagement, while expansion into Estonia marks strategic geographic growth. Despite a CFO transition, financial performance remains robust with increased net income and sales for the recent quarter. The stock trades substantially below its estimated fair value without recent insider trading activity.

- Take a closer look at Storytel's potential here in our earnings growth report.

- Our valuation report here indicates Storytel may be undervalued.

Where To Now?

- Embark on your investment journey to our 179 Fast Growing European Companies With High Insider Ownership selection here.

- Seeking Other Investments? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if NTG Nordic Transport Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NTG

NTG Nordic Transport Group

Provides asset-light freight forwarding services through road, rail, air, and ocean in Denmark, Sweden, the United States, Germany, Finland, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives