- Denmark

- /

- Transportation

- /

- CPSE:NTG

European Growth Companies With High Insider Ownership December 2025

Reviewed by Simply Wall St

As the European markets continue to show resilience with the STOXX Europe 600 Index gaining 2.35% and major country indexes like Germany's DAX and France's CAC 40 also posting gains, investors are keeping a keen eye on growth companies that combine potential for expansion with high insider ownership. In a market where inflation remains subdued around the ECB’s target, these companies can be appealing as they often indicate strong management confidence and alignment of interests with shareholders, making them noteworthy in today's investment landscape.

Top 10 Growth Companies With High Insider Ownership In Europe

| Name | Insider Ownership | Earnings Growth |

| Redelfi (BIT:RDF) | 12.4% | 39.1% |

| Pharma Mar (BME:PHM) | 12% | 41.5% |

| MilDef Group (OM:MILDEF) | 13.7% | 83% |

| MedinCell (ENXTPA:MEDCL) | 12.5% | 96.3% |

| Magnora (OB:MGN) | 10.4% | 75.1% |

| KebNi (OM:KEBNI B) | 36.3% | 61.2% |

| DNO (OB:DNO) | 13.5% | 97.5% |

| CTT Systems (OM:CTT) | 17.5% | 52% |

| Circus (XTRA:CA1) | 24.1% | 65.8% |

| Bonesupport Holding (OM:BONEX) | 10.4% | 52% |

Here we highlight a subset of our preferred stocks from the screener.

Pharma Mar (BME:PHM)

Simply Wall St Growth Rating: ★★★★★★

Overview: Pharma Mar, S.A. is a biopharmaceutical company engaged in the research, development, production, and commercialization of bio-active principles for oncology across various international markets with a market cap of €1.27 billion.

Operations: The company's revenue primarily comes from its oncology segment, which generated €179.94 million.

Insider Ownership: 12%

Earnings Growth Forecast: 41.5% p.a.

Pharma Mar is poised for substantial growth, with revenue expected to grow 21.7% annually, outpacing the Spanish market's 4.6%. Earnings are projected to increase significantly by 41.5% per year, far exceeding the market average of 6.9%. The company's return on equity is forecasted to reach a high level of 32.2% in three years, though its share price has been highly volatile recently. No significant insider trading activity has been reported over the past three months.

- Unlock comprehensive insights into our analysis of Pharma Mar stock in this growth report.

- According our valuation report, there's an indication that Pharma Mar's share price might be on the expensive side.

NTG Nordic Transport Group (CPSE:NTG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NTG Nordic Transport Group A/S, with a market cap of DKK4.05 billion, offers asset-light freight forwarding services across road, rail, air, and ocean in Denmark, Sweden, the United States, Germany, Finland, and internationally through its subsidiaries.

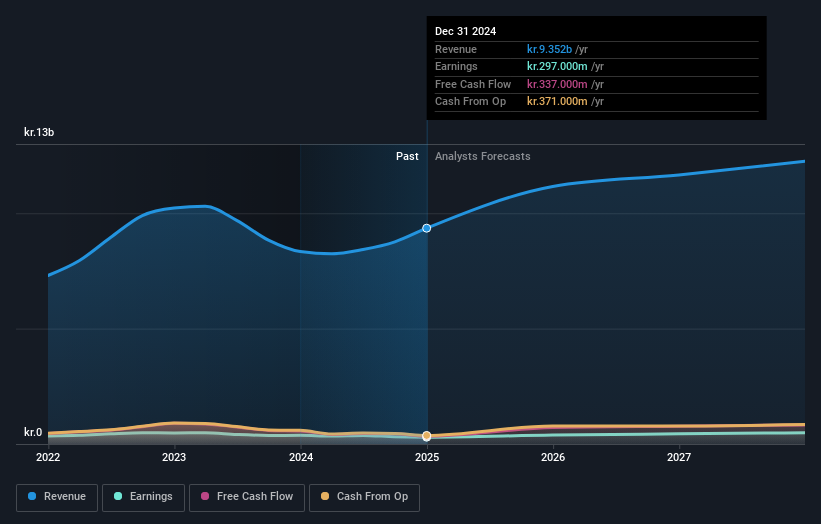

Operations: The company's revenue segments include Air & Ocean services generating DKK2.74 billion and Road & Logistics services contributing DKK8.40 billion.

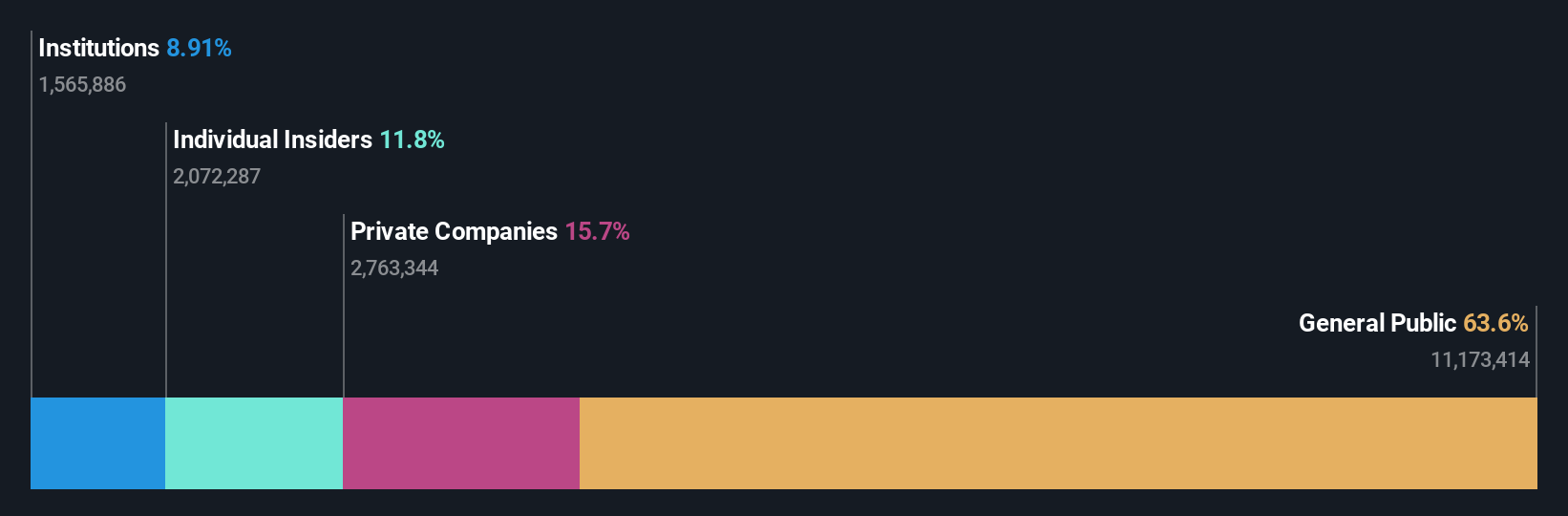

Insider Ownership: 14.5%

Earnings Growth Forecast: 32.9% p.a.

NTG Nordic Transport Group is positioned for strong earnings growth, with forecasts predicting a 32.9% annual increase, significantly outpacing the Danish market's 5%. Despite trading at a substantial discount to its estimated fair value and below analyst price targets, NTG's profit margins have declined from last year. Recent executive changes include the appointment of Tinneke Torpe as CFO, expected to enhance financial leadership. The company reported increased sales but lower net income for the nine months ended September 2025.

- Click to explore a detailed breakdown of our findings in NTG Nordic Transport Group's earnings growth report.

- Our valuation report unveils the possibility NTG Nordic Transport Group's shares may be trading at a discount.

Swedencare (OM:SECARE)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Swedencare AB (publ) develops, manufactures, markets, and sells animal healthcare products for cats, dogs, and horses across North America, Europe, and internationally with a market cap of SEK5.78 billion.

Operations: The company's revenue segments consist of SEK599.80 million from Europe, SEK682.50 million from Production, and SEK1.62 billion from North America.

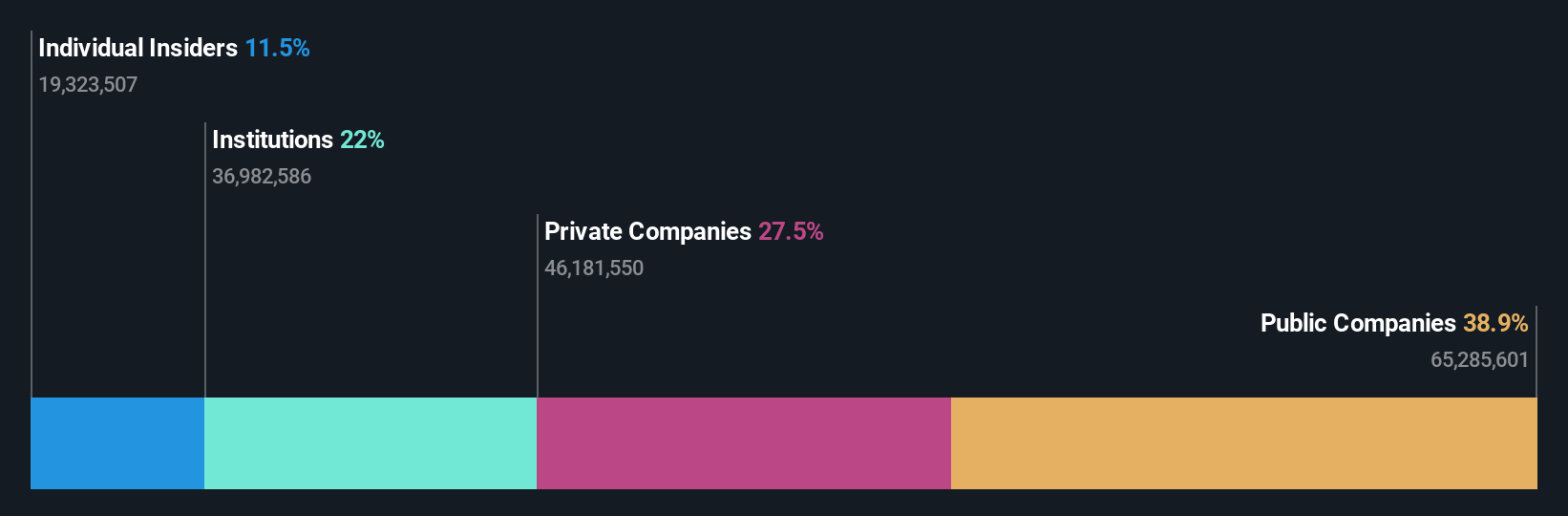

Insider Ownership: 11.6%

Earnings Growth Forecast: 69.7% p.a.

Swedencare is trading 67.6% below its estimated fair value, and analysts expect a 42.9% price increase. Despite slower revenue growth of 9.9% annually, earnings are forecast to grow significantly at 69.7%, surpassing the Swedish market's average growth rate. Insider activity shows more buying than selling over the past three months, though not substantial in volume. Recent earnings reports indicate increased sales but decreased net income for both the third quarter and nine-month periods ending September 2025.

- Click here to discover the nuances of Swedencare with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Swedencare is priced lower than what may be justified by its financials.

Seize The Opportunity

- Navigate through the entire inventory of 205 Fast Growing European Companies With High Insider Ownership here.

- Seeking Other Investments? Trump's oil boom is here — pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if NTG Nordic Transport Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:NTG

NTG Nordic Transport Group

Provides asset-light freight forwarding services through road, rail, air, and ocean in Denmark, Sweden, the United States, Germany, Finland, and internationally.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026