In a week marked by cautious Federal Reserve commentary and heightened political uncertainty, global markets experienced notable declines, with U.S. stocks seeing broad-based losses despite a late-week rally. Amid this volatility and the ongoing adjustments in interest rate expectations, dividend stocks can offer stability through consistent income streams, making them an attractive option for investors seeking reliable returns in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.09% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.56% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.88% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.76% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.62% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1951 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

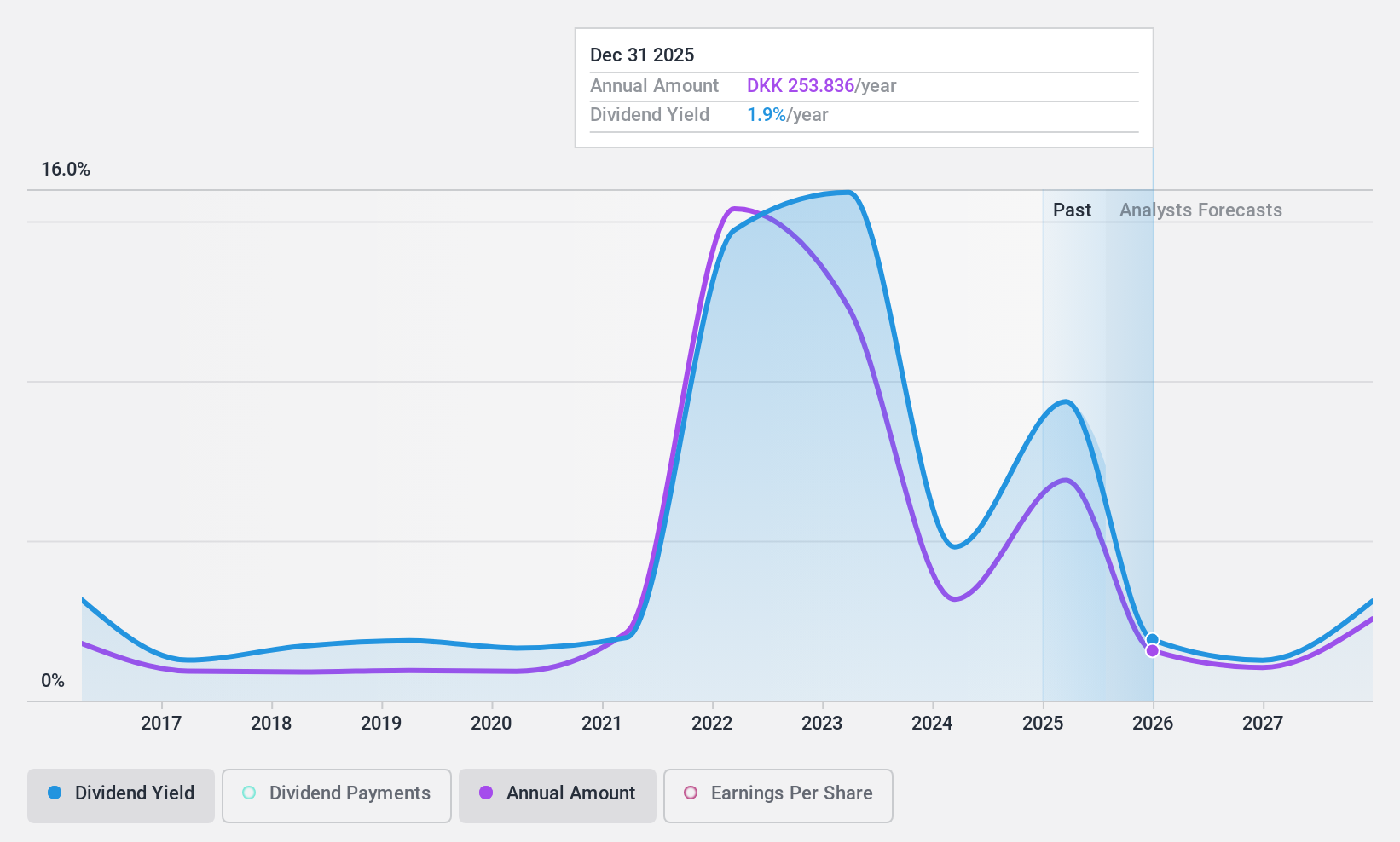

A.P. Møller - Mærsk (CPSE:MAERSK B)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: A.P. Møller - Mærsk A/S, along with its subsidiaries, operates in the ocean transport and logistics sector both in Denmark and globally, with a market cap of DKK182.69 billion.

Operations: A.P. Møller - Mærsk's revenue segments include Ocean at $34.67 billion, Terminals at $4.29 billion, and Logistics & Services at $14.57 billion.

Dividend Yield: 4.3%

A.P. Møller - Mærsk's dividend is well-covered by earnings and cash flows, with a payout ratio of 33.9% and a cash payout ratio of 33.6%. However, its dividend yield of 4.33% is lower than the top Danish market payers, and the track record has been volatile over the past decade despite some growth. Recent earnings showed significant sales growth to US$15.76 billion in Q3 2024, with net income rising to US$3.05 billion from US$521 million year-on-year.

- Click here to discover the nuances of A.P. Møller - Mærsk with our detailed analytical dividend report.

- The analysis detailed in our A.P. Møller - Mærsk valuation report hints at an inflated share price compared to its estimated value.

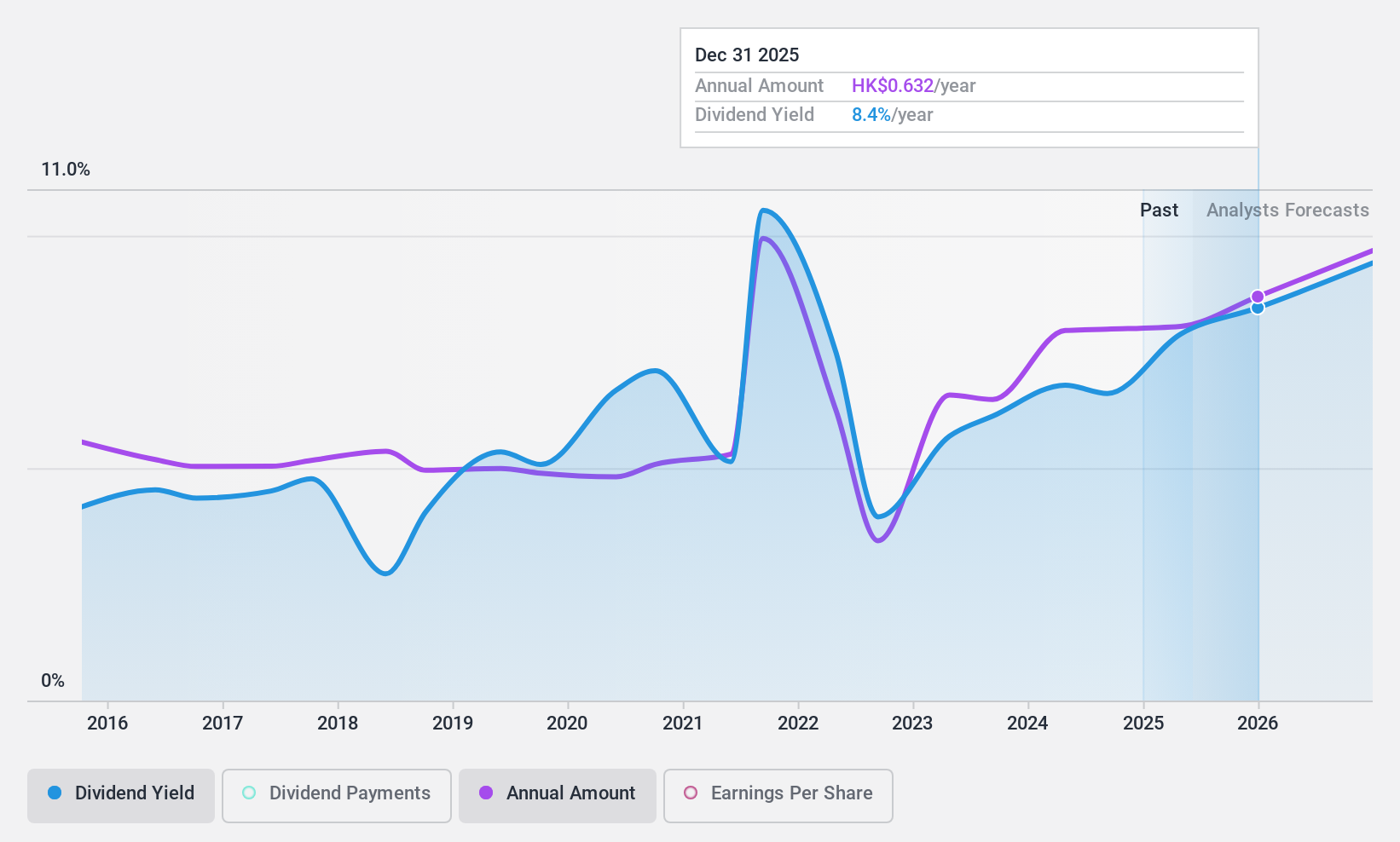

China Shineway Pharmaceutical Group (SEHK:2877)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: China Shineway Pharmaceutical Group Limited is an investment holding company involved in the research, development, manufacture, and trade of Chinese medicines in the People's Republic of China and Hong Kong, with a market cap of HK$7.36 billion.

Operations: The company's revenue primarily comes from its Chinese Pharmaceutical Products segment, generating CN¥4.20 billion.

Dividend Yield: 5.6%

China Shineway Pharmaceutical Group's dividend payments are well-covered by earnings and cash flows, with a payout ratio of 36.9%. Despite this, the dividend yield of 5.61% is below the top quartile in Hong Kong. The company trades at a significant discount to its estimated fair value and peers. However, its dividend track record has been volatile over the last decade, despite some growth in payments. Recent earnings grew by 25.1% over the past year.

- Click here and access our complete dividend analysis report to understand the dynamics of China Shineway Pharmaceutical Group.

- In light of our recent valuation report, it seems possible that China Shineway Pharmaceutical Group is trading behind its estimated value.

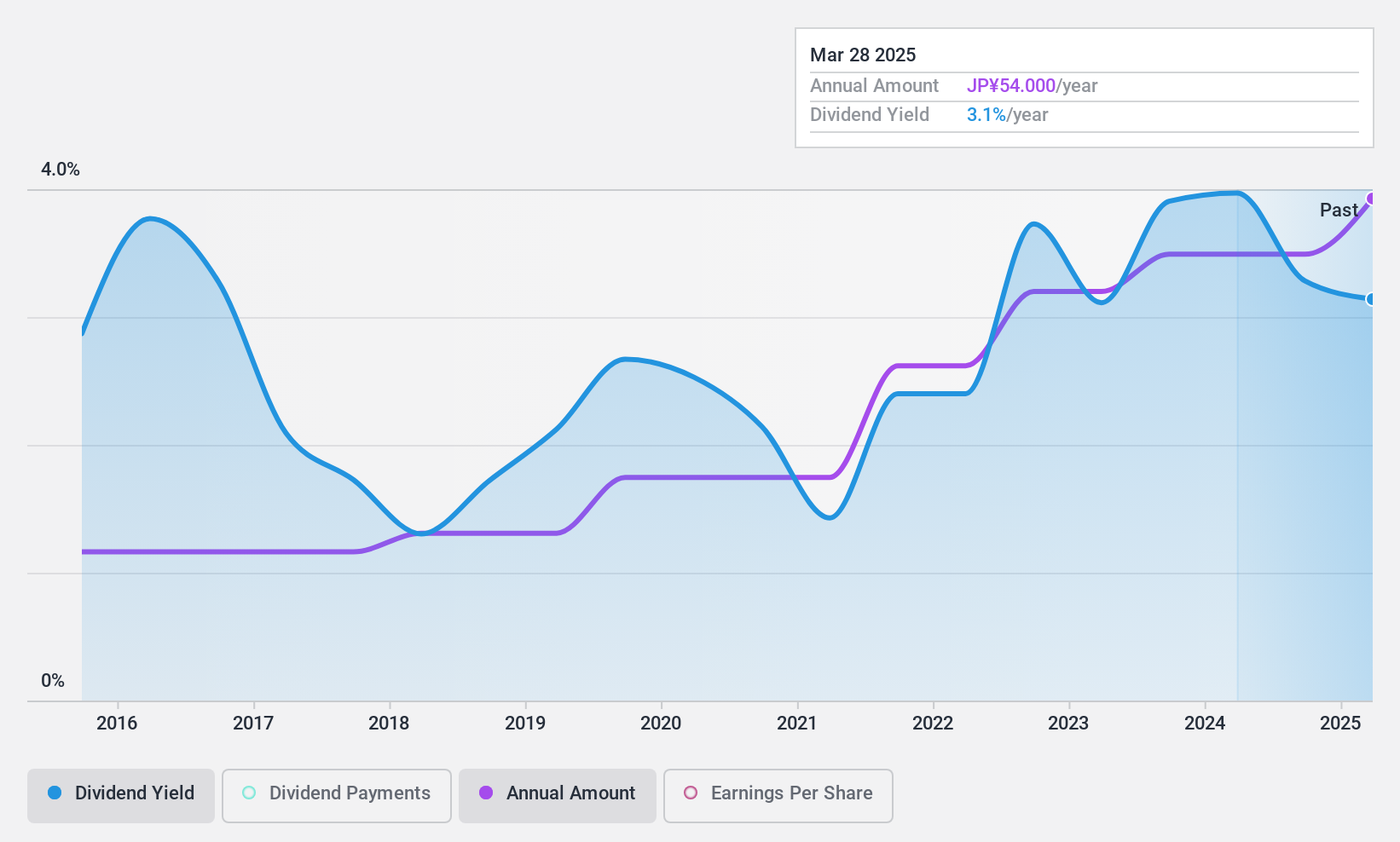

Tsugami (TSE:6101)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Tsugami Corporation, along with its subsidiaries, manufactures and sells precision machine tools in Japan and has a market capitalization of approximately ¥68.01 billion.

Operations: Tsugami Corporation generates revenue from several key regions, with ¥75.84 billion from China, ¥5.22 billion from India, ¥30.09 billion from Japan, and ¥1.88 billion from Korea.

Dividend Yield: 3.8%

Tsugami offers a stable dividend profile with payments reliably increasing over the past decade, supported by a low payout ratio of 30.2% and a cash payout ratio of 51.2%. The current yield is 3.78%, slightly below the top quartile in Japan. Its price-to-earnings ratio of 8.5x suggests good value compared to the market average of 13.5x, while earnings grew by 42.4% last year, enhancing its dividend sustainability further bolstered by recent share buybacks totaling ¥564.53 million.

- Take a closer look at Tsugami's potential here in our dividend report.

- Upon reviewing our latest valuation report, Tsugami's share price might be too optimistic.

Next Steps

- Unlock our comprehensive list of 1951 Top Dividend Stocks by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2877

China Shineway Pharmaceutical Group

An investment holding company, engages in the research and development, manufacture, and trade of Chinese pharmaceutical products in the People’s Republic of China and Hong Kong.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives