Investing in Bavarian Nordic (CPH:BAVA) a year ago would have delivered you a 53% gain

It might be of some concern to shareholders to see the Bavarian Nordic A/S (CPH:BAVA) share price down 13% in the last month. But that doesn't change the fact that the returns over the last year have been pleasing. In that time we've seen the stock easily surpass the market return, with a gain of 53%.

So let's assess the underlying fundamentals over the last 1 year and see if they've moved in lock-step with shareholder returns.

Check out our latest analysis for Bavarian Nordic

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the last year, Bavarian Nordic actually saw its earnings per share drop 38%.

So we don't think that investors are paying too much attention to EPS. Since the change in EPS doesn't seem to correlate with the change in share price, it's worth taking a look at other metrics.

We think that the revenue growth of 9.9% could have some investors interested. Many businesses do go through a phase where they have to forgo some profits to drive business development, and sometimes its for the best.

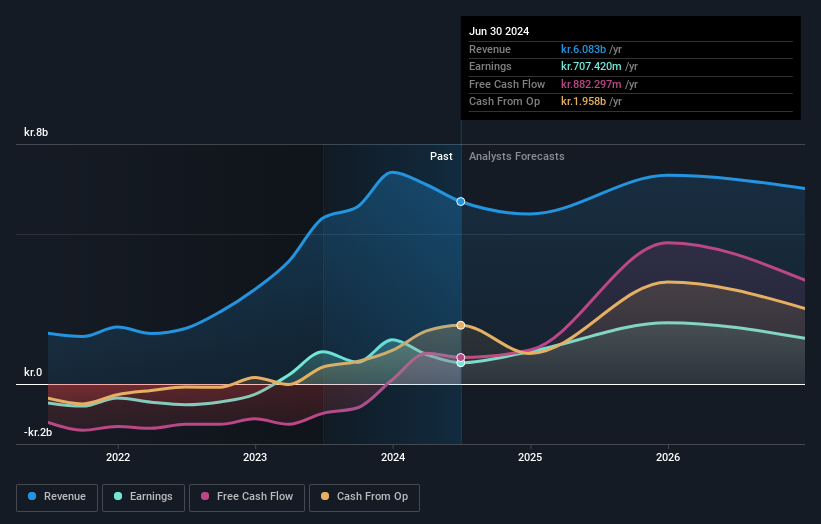

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It is of course excellent to see how Bavarian Nordic has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling Bavarian Nordic stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We're pleased to report that Bavarian Nordic shareholders have received a total shareholder return of 53% over one year. Since the one-year TSR is better than the five-year TSR (the latter coming in at 11% per year), it would seem that the stock's performance has improved in recent times. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Case in point: We've spotted 4 warning signs for Bavarian Nordic you should be aware of, and 1 of them makes us a bit uncomfortable.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Danish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bavarian Nordic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:BAVA

Bavarian Nordic

Develops, manufactures, and supplies life-saving vaccines.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives