Bavarian Nordic (CPH:BAVA) shareholder returns have been , earning 13% in 3 years

It hasn't been the best quarter for Bavarian Nordic A/S (CPH:BAVA) shareholders, since the share price has fallen 21% in that time. But that shouldn't obscure the pleasing returns achieved by shareholders over the last three years. After all, the share price is up a market-beating 13% in that time.

The past week has proven to be lucrative for Bavarian Nordic investors, so let's see if fundamentals drove the company's three-year performance.

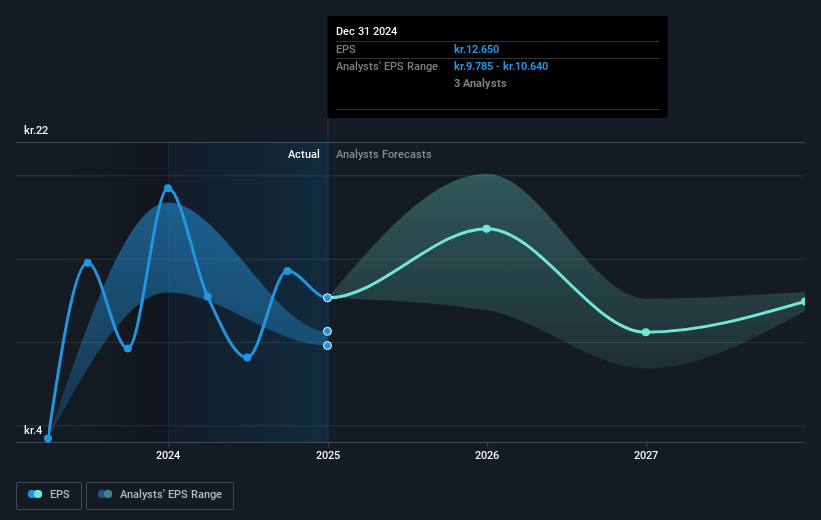

Our free stock report includes 1 warning sign investors should be aware of before investing in Bavarian Nordic. Read for free now.While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During three years of share price growth, Bavarian Nordic moved from a loss to profitability. So we would expect a higher share price over the period.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It is of course excellent to see how Bavarian Nordic has grown profits over the years, but the future is more important for shareholders. This free interactive report on Bavarian Nordic's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

It's nice to see that Bavarian Nordic shareholders have received a total shareholder return of 0.8% over the last year. Notably the five-year annualised TSR loss of 0.9% per year compares very unfavourably with the recent share price performance. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Bavarian Nordic better, we need to consider many other factors. For instance, we've identified 1 warning sign for Bavarian Nordic that you should be aware of.

But note: Bavarian Nordic may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Danish exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Bavarian Nordic might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:BAVA

Bavarian Nordic

Develops, manufactures, and supplies life-saving vaccines.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives