We Think Flügger group's (CPH:FLUG B) Robust Earnings Are Conservative

Even though Flügger group A/S' (CPH:FLUG B) recent earnings release was robust, the market didn't seem to notice. Investors are probably missing some underlying factors which are encouraging for the future of the company.

See our latest analysis for Flügger group

Examining Cashflow Against Flügger group's Earnings

As finance nerds would already know, the accrual ratio from cashflow is a key measure for assessing how well a company's free cash flow (FCF) matches its profit. To get the accrual ratio we first subtract FCF from profit for a period, and then divide that number by the average operating assets for the period. This ratio tells us how much of a company's profit is not backed by free cashflow.

As a result, a negative accrual ratio is a positive for the company, and a positive accrual ratio is a negative. That is not intended to imply we should worry about a positive accrual ratio, but it's worth noting where the accrual ratio is rather high. To quote a 2014 paper by Lewellen and Resutek, "firms with higher accruals tend to be less profitable in the future".

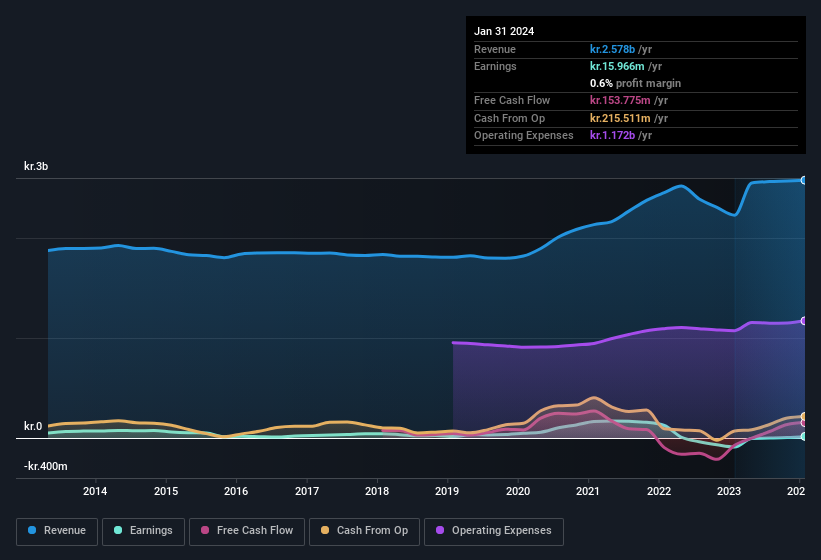

For the year to January 2024, Flügger group had an accrual ratio of -0.11. Therefore, its statutory earnings were quite a lot less than its free cashflow. Indeed, in the last twelve months it reported free cash flow of kr.154m, well over the kr.16.0m it reported in profit. Given that Flügger group had negative free cash flow in the prior corresponding period, the trailing twelve month resul of kr.154m would seem to be a step in the right direction.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Flügger group.

Our Take On Flügger group's Profit Performance

As we discussed above, Flügger group has perfectly satisfactory free cash flow relative to profit. Because of this, we think Flügger group's earnings potential is at least as good as it seems, and maybe even better! And one can definitely find a positive in the fact that it made a profit this year, despite losing money last year. Of course, we've only just scratched the surface when it comes to analysing its earnings; one could also consider margins, forecast growth, and return on investment, among other factors. If you'd like to know more about Flügger group as a business, it's important to be aware of any risks it's facing. At Simply Wall St, we found 1 warning sign for Flügger group and we think they deserve your attention.

Today we've zoomed in on a single data point to better understand the nature of Flügger group's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About CPSE:FLUG B

Flügger group

Designs, manufactures, and markets decorative paints, wood protection products, spackling pastes, and wallpaper and tools.

Excellent balance sheet, good value and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)