Flügger group (CPSE:FLUG B) Margin Slump to Loss Reinforces Bearish Profitability Narrative

Reviewed by Simply Wall St

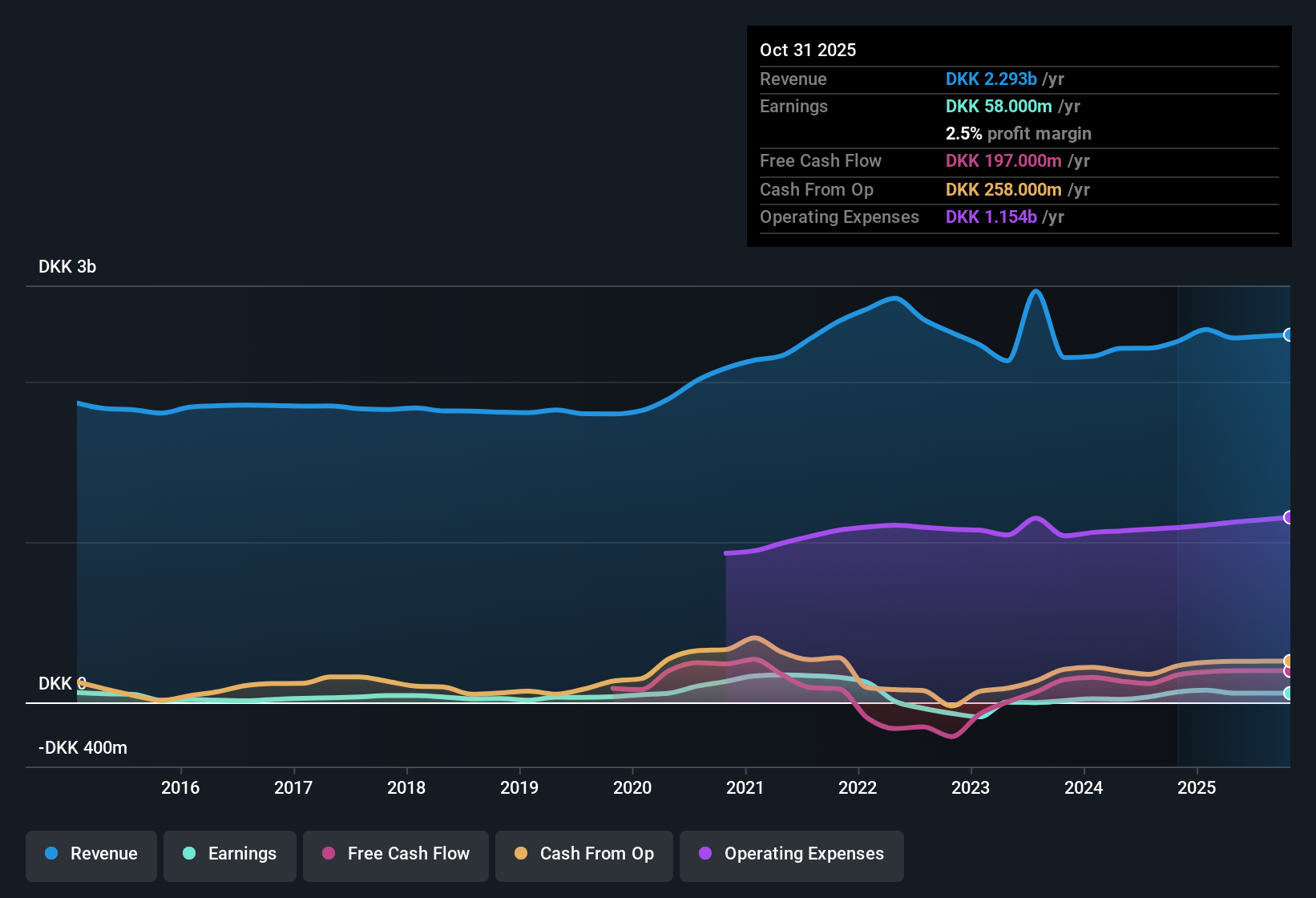

Flügger group (CPSE:FLUG B) has just posted its H1 2026 numbers, with revenue of DKK2.3 billion over the last twelve months and net income of DKK58 million setting the tone for a period where profitability has stayed modest. The company has seen revenue move from DKK1.2 billion in H1 2024 to DKK1.24 billion in H1 2025 and DKK1.03 billion in H2 2025, while EPS swung from DKK22.8 to DKK33.9 before dipping into negative territory at DKK-14.25 in the latest half, leaving investors focused on how quickly margins can rebuild from here.

See our full analysis for Flügger group.With the headline figures on the table, the next step is to compare these results with the dominant narratives around Flügger group, to see which stories the numbers actually support and which ones start to crack under closer inspection.

Curious how numbers become stories that shape markets? Explore Community Narratives

Net Margin Slips To 2.5%

- Over the last twelve months, Flügger group converted DKK2.3 billion of revenue into just DKK58 million of net income, giving a 2.5% net margin compared with 2.9% a year earlier.

- What stands out for the bearish narrative is that this thin 2.5% margin sits alongside a five year annualised earnings decline of 26.8%, which raises questions about how robust any recovery can be:

- Critics highlight that H2 2025 already showed a net loss of DKK43 million on DKK1.0 billion of revenue, so the modest trailing profit is being supported by earlier, stronger halves.

- They also point to the negative EPS of DKK-14.25 in H2 2025 after EPS of DKK33.9 in H1 2025 as evidence that profitability has been volatile rather than steadily improving.

Earnings Forecast To Grow 22.8%

- Forward looking models point to earnings growth of about 22.8% per year over the next three years, compared with the trailing five year earnings decline of 26.8% per year.

- Supporters of a bullish view argue that this pivot from long term earnings decline to double digit growth potential is the key part of the story, and the recent numbers give them some basis:

- They note that despite the weak H2 2025, trailing twelve month net income is still positive at DKK58 million, so the company is not starting its forecast recovery from a position of deep cumulative losses.

- They also point out that revenue on a trailing basis is holding around DKK2.3 billion, with forecasts suggesting about 4% annual revenue growth even if that is a touch slower than the wider Danish market at 4.7%.

Shares Cheaper Than Industry Peers

- At a share price of DKK326, Flügger group trades on a trailing P E of 16.8 times, below the European chemicals industry average of 17.2 times and well below peer levels of 23.7 times, and against a DCF fair value of about DKK1,112.14.

- From a bullish valuation angle, this combination of lower multiples and a large gap to DCF fair value looks like potential mispricing, but the recent operating record forces a more careful read:

- Consensus narrative notes that the stock appears about 70.7% below the DCF fair value despite only modest trailing profitability, which suggests the valuation case leans heavily on the 22.8% earnings growth forecast actually being delivered.

- At the same time, a 6.14% dividend yield that is not well covered by the last twelve months of earnings shows that cash returns are currently ahead of profit generation, which could influence how long investors are prepared to wait for that forecast growth.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Flügger group's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Flügger group’s thin margins, recent swing to losses and inconsistent earnings trend highlight how fragile its current growth and income profile appears.

If that volatility makes you uneasy, use our stable growth stocks screener (2107 results) to focus on businesses with steadier revenue and earnings so you are not relying on a turnaround story.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:FLUG B

Flügger group

Designs, manufactures, and markets decorative paints, wood protection products, spackling pastes, and wallpaper and tools.

Undervalued with excellent balance sheet and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)