This Is Why Topdanmark A/S' (CPH:TOP) CEO Compensation Looks Appropriate

Despite Topdanmark A/S' (CPH:TOP) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. The upcoming AGM on 25 March 2021 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for Topdanmark

Comparing Topdanmark A/S' CEO Compensation With the industry

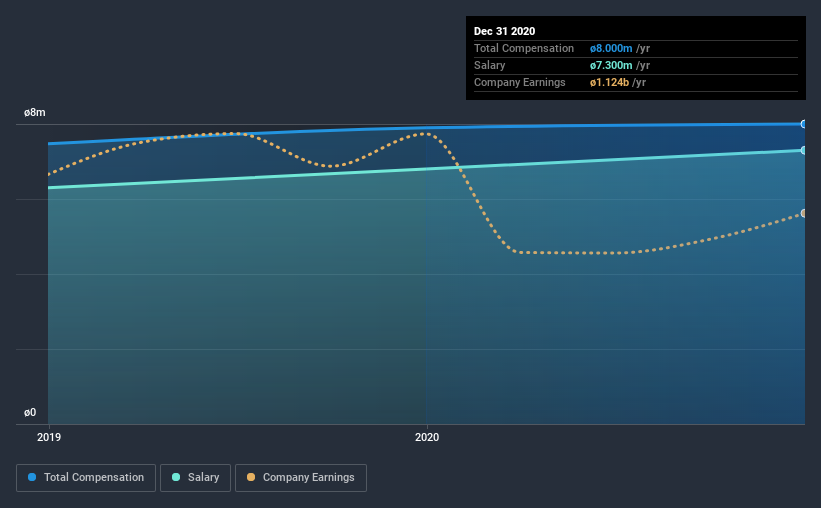

Our data indicates that Topdanmark A/S has a market capitalization of kr.26b, and total annual CEO compensation was reported as kr.8.0m for the year to December 2020. This means that the compensation hasn't changed much from last year. We note that the salary portion, which stands at kr.7.30m constitutes the majority of total compensation received by the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between kr.12b and kr.40b had a median total CEO compensation of kr.11m. From this we gather that Peter Hermann is paid around the median for CEOs in the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | kr.7.3m | kr.6.8m | 91% |

| Other | kr.700k | kr.1.1m | 9% |

| Total Compensation | kr.8.0m | kr.7.9m | 100% |

Speaking on an industry level, nearly 45% of total compensation represents salary, while the remainder of 55% is other remuneration. Topdanmark pays out 91% of remuneration in the form of a salary, significantly higher than the industry average. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at Topdanmark A/S' Growth Numbers

Over the last three years, Topdanmark A/S has shrunk its earnings per share by 14% per year. In the last year, its revenue is down 11%.

Few shareholders would be pleased to read that EPS have declined. And the fact that revenue is down year on year arguably paints an ugly picture. These factors suggest that the business performance wouldn't really justify a high pay packet for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Topdanmark A/S Been A Good Investment?

With a total shareholder return of 22% over three years, Topdanmark A/S shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

To Conclude...

Shareholder returns, while positive, should be looked at along with earnings, which have not grown at all recently. This makes us think the share price momentum may slow in the future. The upcoming AGM will provide shareholders the opportunity to revisit the company’s remuneration policies and evaluate if the board’s judgement and decision-making is aligned with that of the company’s shareholders.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. We did our research and spotted 2 warning signs for Topdanmark that investors should look into moving forward.

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies that have HIGH return on equity and low debt.

If you decide to trade Topdanmark, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Topdanmark might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About CPSE:TOP

Topdanmark

Offers life and non-life insurance products and services in Denmark.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives